Key insights:

New congestion at Hamburg and Rotterdam is being blamed on ships missing their scheduled arrival times – a result of delays elsewhere like those caused by the Suez closure and now the outbreak in Yantian.

China-US rates:

Analysis

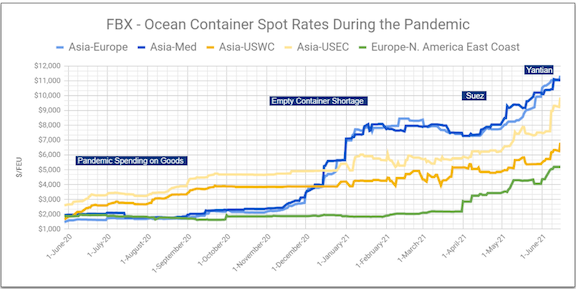

- Asia-US West Coast prices (FBX01 Daily) increased 4% to $6,861/FEU. This rate is 178% higher than the same time last year.

- Asia-US East Coast prices (FBX03 Daily) climbed just 1% to $10,002/FEU, and are 215% higher than rates for this week last year.

As the Port of Yantian begins the process of clearing backlogged ships and containers, carriers are also contending with growing congestion in the major European ports of Hamburg and Rotterdam.

Port officials point to late and unpredictable arrival times as the culprit for the congestion, providing another sign of how interconnected ocean freight is: delays elsewhere from other causes – like the Suez and now Yantian – throw off operations at other ports leading to further delays and disruptions as they have done for the past year.

With no extra capacity to throw at the problem, delays tie up supply and continue to put pressure on rates.

Though container prices were stable this week, importers and exporters often continue to pay thousands above spot rates in premiums now necessary to secure space on some lanes. Even enterprise shippers with new long term ocean contracts – signed at often double last year’s rates – are unable to move all their containers without paying more, if at all.

And though signs point to an increase in consumer spending on services, there is still no foreseen let up in ocean demand as some carriers have already announced significant transpacific peak season surcharges for mid-July.

Freightos.com marketplace data indicate that Asia-US air cargo rates declined by about 5% since last week on a relative lull in demand, though prices are still two to three times their typical level this time of year. With capacity still restricted by struggling passenger travel, expectations are that air cargo peak season, normally in October and November, could start in September as importers try to ensure that holiday inventories arrive in time.