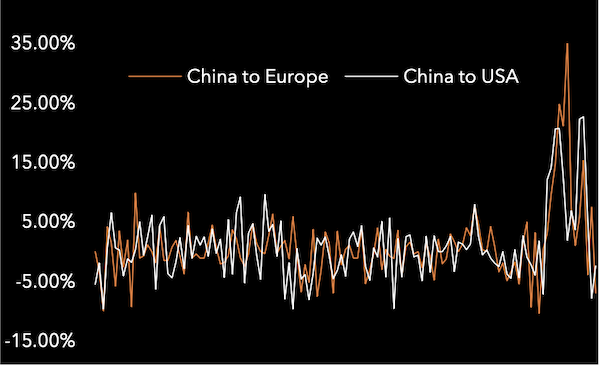

China to Europe and China to USA continues to slide, however, the rate of descent is in sharp contrast to its previous climb, noted by the near-neutral position of our rate change oscillator. Europe is down 59 cents, USA down 23 cents.

Rate drops would have been sharper if it wasn't for supportive price action in Hong Kong (particularly from Hong Kong to USA, up $1.14). Shanghai drags down the baskets, down $1.37 in Europe and down $1.60 in USA.

Market Comment

Whilst core trade lanes start to slip in terms of price, the near future of this market remains uncertain as ever. Much is being touted about an on-coming C-Check of freighter equipment (a 1-2 week inspection of individual aircraft). The interval for B747-400 typically occurs after 6,000 flight hours or 18 months. In other words, 200 to 220 round-trip flights from Europe to China and back.

The implication is that the time frames for this check have been expedited, threatening to take capacity out of the market in the coming months. This isn't really known or guaranteed and ignores the impacts of phased checks or even oncoming D checks (Heavy Maintenance) that are due for a number of B747-8Fs currently flying in the market.

The second unknown is the scale of passenger demand, and thus the availability of belly capacity. The reluctance of governments to engage in open air-bridges, and the asymmetry of quarantine measures, fix the stopper on passenger travel for the near future.

The third unknown, is the impact and size of consumer demand as 'non-essential' economies start to return from mid-June onwards. Inventories will either have to react to high demand, thus causing a sharp, high-speed volume spike. Or, demand will slump in line with a recession, and cargo will move on slower transport modes (container, rail), or not at all.

Diversification and Just-in-Case supply chain developments increase the volatility of prices in the future, something that shippers will have to factor when trying to establish 'traditional' long term contracts.

| Basket | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| CHINA - EUR | 7.89 | -0.59 | -6.96% | 8.12 | 83.81% |

| CHINA - USA | 9.18 | -0.23 | -2.44% | 9.62 | 71.39% |

| Blended | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| PVG/EUR | 9.81 | -1.37 | -12.25% | 10.36 | 108.62% |

| HKG/EUR | 5.96 | 0.19 | 3.29% | 5.88 | 68.93% |

| PVG/US | 10.82 | -1.60 | -12.88% | 11.37 | 91.71% |

| HKG/US | 7.54 | 1.14 | 17.81% | 7.88 | 90.84% |

| Global | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| Air Index | 5.60 | -0.23 | -1.76% | 2.27 | 49.63% |

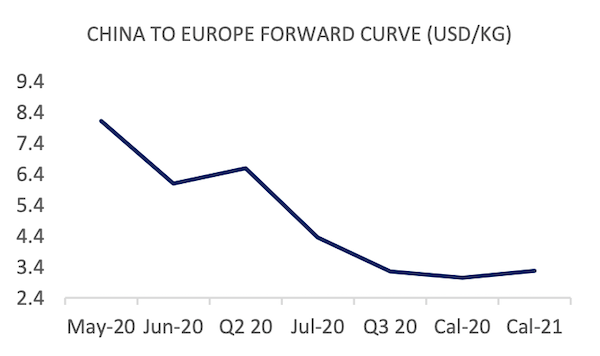

Forward Curve - Indicative Update

| FIS AFFA, CHINA - EUROPE | USD/KG | ||||

| BID | ASK | MID | CHANGE | |

| May-20 | 8.12 | 8.12 | 8.12 | 0.62 |

| Jun-20 | 4.00 | 8.20 | 6.10 | 0.32 |

| Q2 20 | 5.00 | 8.18 | 6.59 | -0.01 |

| Jul-20 | 3.20 | 5.50 | 4.35 | 0.10 |

| Q3 20 | 2.50 | 4.00 | 3.25 | 0.00 |

| Cal-20 | 2.60 | 3.50 | 3.05 | 0.00 |

| Cal-21 | 2.50 | 4.05 | 3.28 | 0.00 |

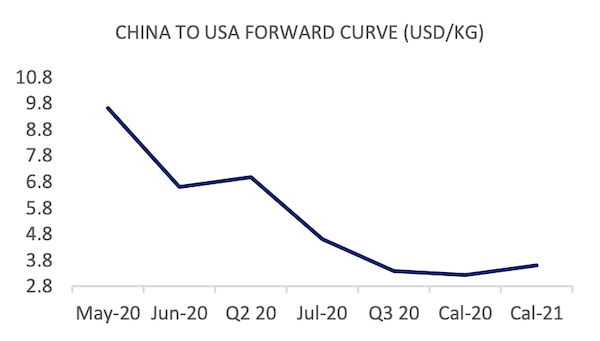

| FIS AFFA, CHINA - USA | USD/KG | ||||

| BID | ASK | MID | CHANGE | |

| May-20 | 9.62 | 9.62 | 9.62 | 0.37 |

| Jun-20 | 4.00 | 9.20 | 6.60 | -0.40 |

| Q2 20 | 4.50 | 9.45 | 6.98 | -0.37 |

| Jul-20 | 3.20 | 6.00 | 4.60 | 0.10 |

| Q3 20 | 2.50 | 4.25 | 3.38 | 0.00 |

| Cal-20 | 3.05 | 3.40 | 3.23 | 0.00 |

| Cal-21 | 3.10 | 4.10 | 3.60 | 0.00 |

-and-William-Lee-of-SF-Airlines-_-_127500_-_b76515ad8a48b365160a898b41931f2909db40fe_yes.png)

_N434AS_approaching_Newark_Liberty_International_Airport_-_127500_-_1b79f1ed8da0a8ef7399ec9ab6b688bc9321a1d0_yes.jpg)