Trading Update

Market momentum runs out, as the rate of climb for aggregated trade lane prices drops off significantly. China to Europe is pushed up 1 cent, providing a marginal gain with the majority of November yet to come. In a sudden shift China to USA loses 2 cents in the middle of traditional peak season.

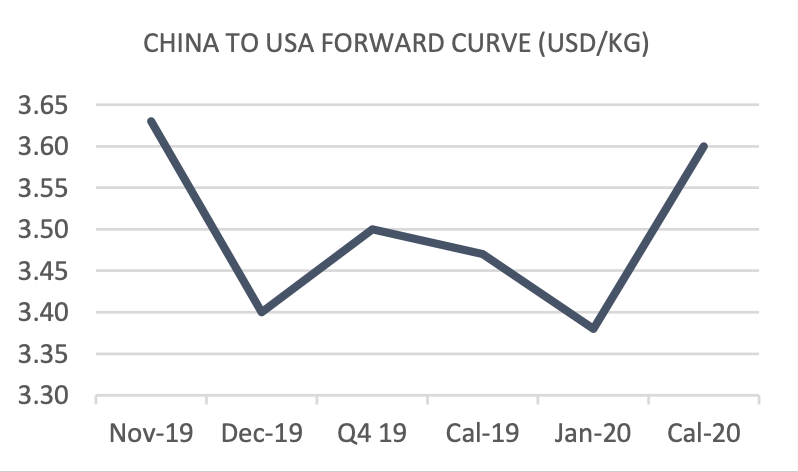

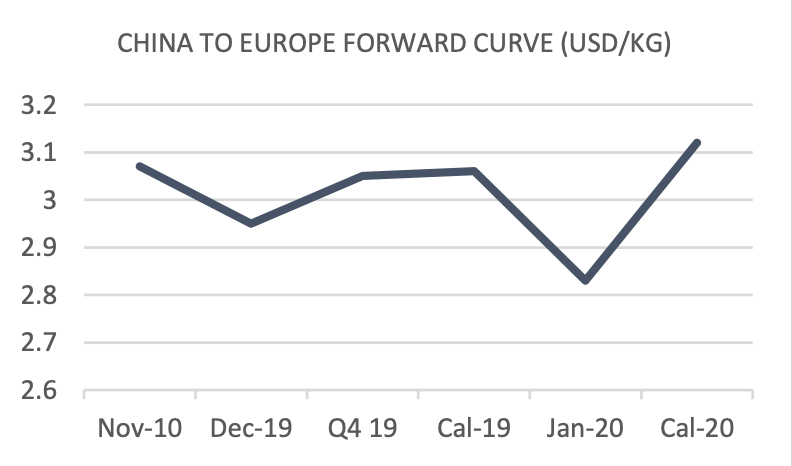

The forward curve front month appears to call the markets top, down 1 and 5 cents respectively. China to Europe December and Q4 prices drop 5 cents, rationalising forward contract prices in line with spot price movement.

Market Comment

A marked change from last week, and reflecting a number of comments that came out last week about a 'phantom' peak season - air freight prices have levelled out unusually early into November.

Although fundamental analysis of weak cargo volume would lead us to believe that the momentum we saw last week could not be maintained for long, 2018 saw the rates falter at the end of November and then continue to climb to highs of $3.42 by mid-December. Spot market rates therefore remain as volatile as they always are, whilst our spotlight on the weekly news reports show a highly diverse range of perspectives clouding the landscape for the prospective market.

Although we could consider changing the record and start focusing on what 2020 might bring, this outlook remains completely uncertain. US-China trade politics have been put under the threat of rollback, and whilst British trade has been given a stay of execution with the progress of a deal, the landscape of post-Brexit trade and European trade remains impossible to predict.

As such we must focus on the near-term, carriers will be doing all they can to float the price of capacity for as long as possible (this lasted well beyond peak season over December 2017 through to February 2018). However, temptation will loom for rates to be dumped in order to secure market volumes and revenue. Such an inflection point is notoriously difficult to forecast, NOV-DEC hedges will aim to strike through this inflection point, removing the risk of market spikes and dumps.

All the while news of records being broken in Hong Kong and Liege gives a notion of hope that the market is rumbling along, albeit at a less sustained pace.

| Basket | USD/KG | CHANGE | CHANGE % | MTD |

| CHINA - EUR | 3.07 | 0.01 | 0.33% | 3.06 |

| CHINA - USA | 3.63 | -0.02 | -0.55% | 3.64 |

| Blended | USD/KG | CHANGE | CHANGE % | MTD |

| PVG/EUR | 2.85 | -0.06 | -2.06% | 2.88 |

| HKG/EUR | 3.30 | 0.10 | 3.13% | 3.25 |

| PVG/US | 3.45 | -0.10 | -2.82% | 3.50 |

| HKG/US | 3.81 | 0.06 | 1.60% | 3.78 |

| Airfreight Route (AR) | Description | PREVIOUS | USD/KG | CHANGE |

| AGR 1 | HKG to LAX & ORD & JFK | 3.82 | 3.91 | 2.36% |

| AGR 2 | HKG to LHR & FRA & AMS | 3.15 | 3.2 | 1.58% |

| AGR 3 | HKG to SIN & BKK & PVG | 1.13 | 1.16 | 2.65% |

| AGR 4 | PVG to AMS & FRA & LHR | 2.93 | 2.94 | 0.34% |

Forward Curve - Indicative Update

| CHINA - EUROPE | USD/KG | ||||

| BID | ASK | VALUE | CHANGE | |

| Nov-19 | 3.00 | 3.14 | 3.07 | -0.01 |

| Dec-19 | 2.90 | 3.00 | 2.95 | -0.05 |

| Jan-20 | 2.77 | 2.89 | 2.83 | 0.00 |

| Q4 19 | 3.00 | 3.10 | 3.05 | -0.05 |

| Cal - 19 | 3.01 | 3.11 | 3.06 | -0.05 |

| Cal - 20 | 3.07 | 3.17 | 3.12 | 0.00 |

| CHINA - USA | USD/KG | ||||

| BID | ASK | VALUE | CHANGE | |

| Nov-19 | 3.57 | 3.69 | 3.63 | -0.05 |

| Dec-19 | 3.35 | 3.44 | 3.40 | 0.00 |

| Jan-20 | 3.32 | 3.45 | 3.38 | 0.00 |

| Q4 19 | 3.46 | 3.54 | 3.50 | 0.00 |

| Cal - 19 | 3.42 | 3.52 | 3.47 | 0.00 |

| Cal - 20 | 3.55 | 3.65 | 3.60 | 0.00 |