Trading Update

Fundamental basket routes run out of steam as we reach the last half of November, with China to Europe going completely flat, and China to USA with a marginal gain of 1 cent over what has been a disappointing, if highly volatile Q4 peak. Beyond a sudden increase in volumes ex-Asia over the next two weeks, there is very little on the horizon to bolster an already weak year.

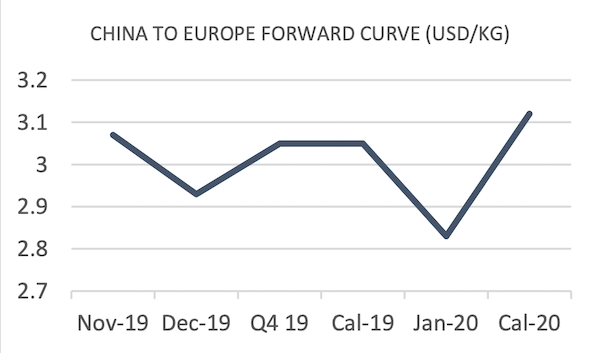

As a result of a flat but stable two weeks of trading, front month values on the forward curve remain flat. However potentially a sign of things to come, December enters backwardation dropping off 2 cents on both EU and US lanes. This has lowered the overall year-end Q4 period by a further 1 cent. Businesses should keep on eye on the movement of Cal 2020 and 2020 monthly forward prices as these start to actively trade.

| Basket | USD/KG | CHANGE | CHANGE % | MTD |

| CHINA - EUR | 3.07 | 0.00 | 0.00% | 3.07 |

| CHINA - USA | 3.63 | 0.01 | 0.27% | 3.64 |

| Blended | USD/KG | CHANGE | CHANGE % | MTD |

| PVG/EUR | 2.93 | 0.08 | 2.81% | 2.90 |

| HKG/EUR | 3.21 | -0.09 | -2.73% | 3.24 |

| PVG/US | 3.55 | 0.10 | 2.90% | 3.52 |

| HKG/US | 3.74 | -0.07 | -1.84% | 3.77 |

Market Comment

Carrying over the sentiment from last week, momentum has fizzled with little fundamental driver for a further increase in prices within the underlying market. This might worry carriers and forwarders alike given the market has reached a pre-mature top, and the only way may well be down, through into December.

This current market stasis might also reflect a continual macro-economic stasis, as container rates gyrate at a historically low level despite a few weeks of gains and the Brent crude benchmark bumps up and down 1-2% on a daily basis. Reflective of a stand-off within several trade arenas, the global logistics market is at the jumping off point - IMO 2020 stands to add billions to the shippers bill, with the ramifications of spilling off to every middle distillate market (including jet fuel) as crack spreads widen.

A continual roll-back of US-China trade tensions as the Trump administration, despite appearances, backs out of trade war commitments. Although Trump-era decisions have historically been as volatile as air freight prices, the scene appears to be set for greater liquidity in cross-border commerce (particularly trans-Pacific commerce) into the second half of 2020. This falls in line with a general market perception that fundamentals will begin to shift in Q3.

However, as seems to be the on-going theme, freight industry predictions are typically lacking in accuracy. FIS stands by to provide contract security for counterpart's into the depths of the murky prospective market.

| Airfreight Route (AR) | Description | PREVIOUS | USD/KG | CHANGE |

| AGR 1 | HKG to LAX & ORD & JFK | 3.91 | 3.92 | 0.25% |

| AGR 2 | HKG to LHR & FRA & AMS | 3.2 | 3.24 | 1.25% |

| AGR 3 | HKG to SIN & BKK & PVG | 1.16 | 1.16 | 0.00% |

| AGR 4 | PVG to AMS & FRA & LHR | 2.94 | 2.94 | 0.00% |

Forward Curve - Indicative Update

| HKG/CN - EUROPE AGGREGATE LANES - USD/KG | ||||

| BID | ASK | VALUE | CHANGE | |

| Nov-19 | 3.04 | 3.10 | 3.07 | 0.00 |

| Dec-19 | 2.88 | 2.97 | 2.93 | -0.02 |

| Jan-20 | 2.77 | 2.89 | 2.83 | 0.00 |

| Q4 19 | 3.00 | 3.10 | 3.05 | 0.00 |

| Cal-19 | 3.00 | 3.10 | 3.05 | -0.01 |

| Cal-20 | 3.07 | 3.17 | 3.12 | 0.00 |

| HKG/CN - US AGGREGATE LANES - USD/KG | ||||

| BID | ASK | VALUE | CHANGE | |

| Nov-19 | 3.58 | 3.70 | 3.64 | 0.00 |

| Dec-19 | 3.33 | 3.42 | 3.38 | -0.02 |

| Jan-20 | 3.32 | 3.45 | 3.38 | 0.00 |

| Q4 19 | 3.46 | 3.54 | 3.50 | 0.00 |

| Cal-19 | 3.42 | 3.52 | 3.47 | -0.01 |

| Cal-20 | 3.55 | 3.65 | 3.60 | 0.00 |