Note this forward curve is an amalgamation of indicative and traded Air Freight Forward Agreements, allowing counter-parties to establish potential trading positions and for market information purposes. The forward curve is not an outright projection of airfreight price however provides a view into market sentiment.

India is put on lockdown, putting approximately 1/4 of the world's population under quarantine measures. Capacity is being driven into the market by passenger carriers eager to book expensive cargoes, however global equities are already plotting a recovery from a previous crash. The Trump administration in the US have provided an arguable optimistic return to business target of mid-April.

Trading Interest

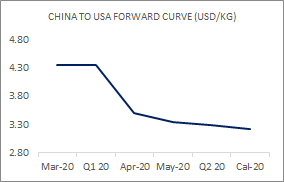

- China to USA last CAL 20 last offered at $3.40

- China to Europe Q2 20 last bid at $2.65

| Forward Curve - Indicative Update | ||||

| FIS AFFA, CHINA - EUROPE | USD/KG | ||||

| BID | ASK | VALUE | CHANGE | |

| Mar-20 | 2.95 | 3.85 | 3.4 | 0 |

| Q1 20 | 2.95 | 3.85 | 3.4 | 0 |

| Apr-20 | 2.6 | 3.5 | 3.05 | 0.05 |

| May-20 | 2.6 | 3 | 2.8 | 0 |

| Q2 20 | 2.65 | 2.8 | 2.73 | 0.03 |

| Cal-20 | 2.76 | 3.16 | 2.96 | 0 |

| Forward Curve - Indicative Update | ||||

| FIS AFFA, CHINA - USA | USD/KG | ||||

| BID | ASK | VALUE | CHANGE | |

| Mar-20 | 3.71 | 5 | 4.35 | 0 |

| Q1 20 | 3.71 | 5 | 4.35 | 0 |

| Apr-20 | 3 | 4 | 3.5 | 0 |

| May-20 | 3 | 3.7 | 3.35 | 0 |

| Q2 20 | 3 | 3.4 | 3.3 | 0 |

| Cal-20 | 3.05 | 3.4 | 3.23 | -0.02 |