Key insights:

- Restrictions around Ningbo have mostly been lifted, with logistics operations largely back to normal, though new outbreaks are being addressed in Shenzhen and Tianjin.

- Ex-Asia ocean rates climbed this week ahead of the Lunar New Year holiday, though are still well below September’s peak season levels.

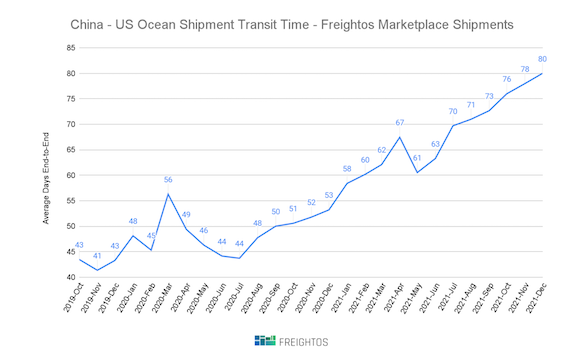

- Still-surging demand and congestion are keeping delays a reality for US importers. Freightos.com data show the average monthly end-to-end transit time for China-US ocean shipments hit a record of 80 days in December, 50% longer than in December 2020, and 85% longer than in 2019.

Asia-US rates:

- Asia-US West Coast prices (FBX01 Daily) increased 16% to $14,572/FEU. This rate is 169% higher than the same time last year.

- Asia-US East Coast prices (FBX03 Daily) climbed 6% to $17,476/FEU, and are 190% higher than rates for this week last year.

Analysis

Ahead of Lunar New Year (LNY), spot rates out of Asia have started to climb. Asia-US West Coast rates climbed 16% since last week after an early month dip, and East Coast rates increased 6%, though prices on both lanes remain more than 20% below peak season highs hit in September.

This bump in pre-LNY demand comes with no significant easing in congestion at the major port of LA/Long Beach. The latest demand projections continue to show no expectation that volumes will ease in the coming months, with omicron’s spread likely to help keep spending on goods above pre-pandemic levels.

With no opportunity to clear the backlog, delays persist: Freightos.com marketplace data show the average monthly end to end transit time for China-US ocean shipments hit a record of 80 days in December, 50% longer than in December 2020, and 85% longer than in 2019.

Air rates remain stable, but still very elevated in what is typically a slow period for air cargo. Recent cancellations of passenger flights – including from travel bans in Hong Kong and elsewhere – due to the omicron surge, will further restrict cargo capacity and help keep rates up.