Key insights:

1 Ocean spot rates ex-Asia continued to fall this week, with US West Coast rates falling 45% so far this month to below $3,000/FEU for the first time since August of 2020.

3 East Coast congestion is driven by a shift of volumes from the West Coast, partly to avoid labor disruptions possible since July. This week, ILWU members temporarily slowed operations in Seattle and Oakland, marking the dispute’s first industrial actions.

Asia-US rates:

• Asia-US West Coast prices (FBX01 Daily) fell 8% to $2,978/FEU. This rate is 82% lower than the same time last year.

• Asia-US East Coast prices (FBX03 Daily) decreased 5% to $6,952/FEU, and are 63% lower than rates for this week last year.

Analysis

Ocean spot rates out of Asia continued to fall this week even as carriers cancel significant amounts of scheduled sailings to the US and Europe to meet falling demand. Asia - US West Coast rates fell 8% to less than $3,000/FEU this week, a 45% drop since the start of the month and the lane’s lowest level since August of 2020, though prices remain 128% higher than in September 2019.

Rates from Asia to the East Coast and to North Europe have each declined by about 25% this month but remain more than 150% and 400% higher than in 2019, respectively. The slower rate slides relative to Asia - US West Coast price decreases are likely due to still-severe port congestion on these lanes.

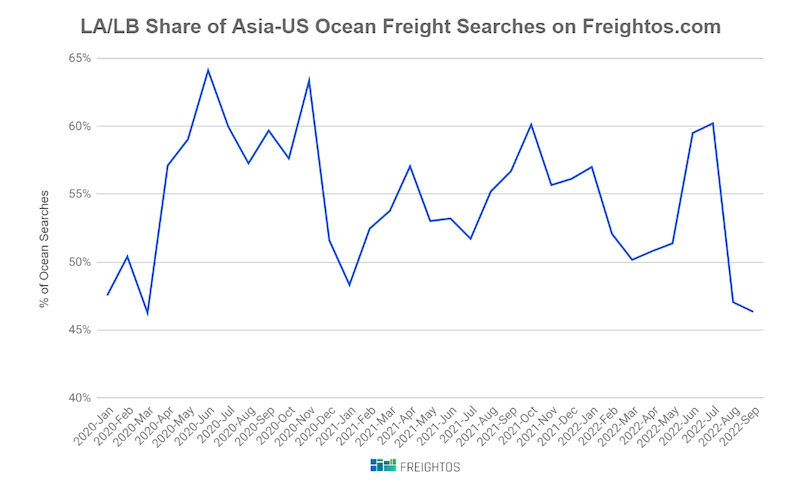

Though European ports like Hamburg and Rotterdam continue to suffer delays despite decreasing volumes, the spike in US East Coast port congestion over the last few months is driven by a significant shift of volumes from the West Coast which handled only 45% of US import containers in August.

Importers shifted away from LA/Long Beach not only to avoid the congestion and delays they experienced during last year’s peak season, but also to stay clear of possible labor disruptions since July when the ILWU’s contract with west coast ports expired.

This week the first industrial actions of this dispute took place as ILWU members at the ports of Seattle-Tacoma and Oakland temporarily slowed operations. Strikes in the UK are also affecting operations at the ports of Felixstowe and Liverpool, though not to the same extent as during the first Felixstowe strike in August.