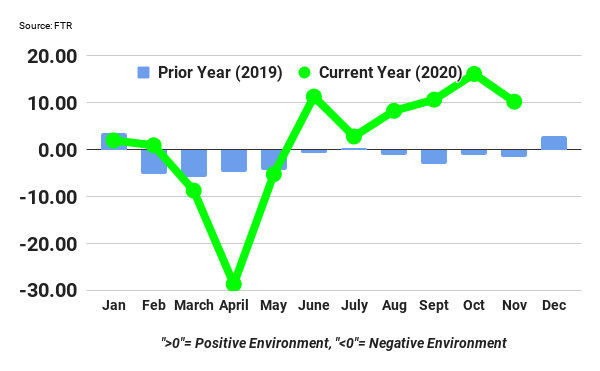

FTR’s Trucking Conditions Index (TCI) fell in November from the previous month’s record high. The November reading of 10.26 is still strong as rising freight rates continue to power robust trucking conditions FTR expects the index to settle into single-digit positive readings through 2021, reflecting a healthy but more stable truck freight market.

Details of the November TCI are found in the January 2021 issue of FTR’s Trucking Update, published December 23, 2020. Additional commentary discusses forecast risks and renewed uncertainty for 2021. Beyond the TCI and additional commentary, the Trucking Update includes data and analysis on load volumes, the capacity environment, and rates. FTR also publishes ongoing publicly available analysis on the impact of COVID-19 on freight transportation at FTR’s COVID-19 intelligence.

The TCI tracks the changes representing five major conditions in the U.S. truck market. These conditions are: freight volumes, freight rates, fleet capacity, fuel price, and financing. The individual metrics are combined into a single index indicating the industry’s overall health. A positive score represents good, optimistic conditions. Conversely, a negative score represents bad, pessimistic conditions. Readings near zero are consistent with a neutral operating environment, and double-digit readings in either direction suggest significant operating changes are likely.

_Alliance_-_127500_-_b8933d3fb84a2acdb9eadbb9044f8ff29c748df0_yes.png)

_Alliance_-_127500_-_8518a8cb53bfa1ee3241a9389b0c47f7b53ad9ce_lqip.png)