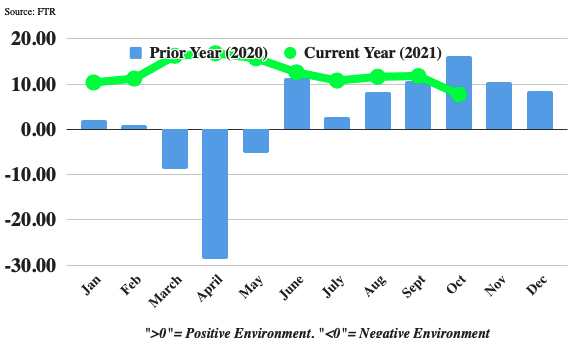

\FTR’s Trucking Conditions Index (TCI) measure for October fell to a reading of 7.75 – the weakest reading since July 2020 – because of a surge in diesel prices. Had fuel prices been a neutral factor, the change in the index from September’s 11.79 reading would have been negligible. Freight rates remain the largest positive factor, although they were modestly less positive in October. However, freight volume and utilization were stronger positive factors than they had been in September. Fuel costs have now stabilized, and the TCI outlook is for solidly positive readings well into 2022.

Details of the October TCI are found in the December 2021 issue of FTR’s Trucking Update, published November 30. The December edition includes a discussion of why the nearly complete recovery of payroll jobs in trucking does not describe what is happening with truckload drivers. Beyond the TCI and additional commentary, the Trucking Update includes data and analysis on load volumes, the capacity environment, rates, and the economy.

The TCI tracks the changes representing five major conditions in the U.S. truck market. These conditions are: freight volumes, freight rates, fleet capacity, fuel price, and financing. The individual metrics are combined into a single index indicating the industry’s overall health. A positive score represents good, optimistic conditions. Conversely, a negative score represents bad, pessimistic conditions. Readings near zero are consistent with a neutral operating environment, and double-digit readings in either direction suggest significant operating changes are likely.

_-_127500_-_fd58817006781b0655e77d342459c13ff31c7a97_yes.png)