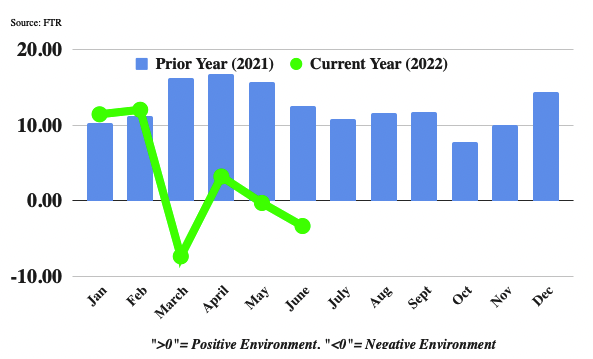

Trucking conditions deteriorated further in June as fuel and financing costs and freight rates were negative factors. FTR’s Trucking Conditions Index (TCI) fell to -3.36 from -0.3 in May. Before May and June, the TCI had not been negative in consecutive months since April and May 2020. In addition to negative cost and pricing conditions in June, freight volume and capacity utilization were weaker positive factors than they had been in May.

Avery Vise, FTR’s vice president of trucking, commented, “We might still see some positive outliers in the TCI – especially if diesel prices continue to fall sharply – but the truck freight market has hit an inflection point. Modestly negative readings likely will be the norm rather than the exception, although we are not forecasting that the bottom will drop out. We still expect that freight volume will grow slightly this year and next and that capacity utilization will bottom out above the 10-year average. However, this forecast does not presume an economic recession, so downside risks are substantial.”

Beyond the TCI and additional commentary, the Trucking Update includes data and analysis on load volumes, the capacity environment, rates, and the economy.

The TCI tracks the changes representing five major conditions in the U.S. truck market. These conditions are: freight volumes, freight rates, fleet capacity, fuel prices, and financing costs. The individual metrics are combined into a single index indicating the industry’s overall health. A positive score represents good, optimistic conditions. Conversely, a negative score represents bad, pessimistic conditions. Readings near zero are consistent with a neutral operating environment, and double-digit readings in either direction suggest significant operating changes are likely.