Corn

• CBOT corn has been following wheat higher, with worrisome northern hemisphere planting weather pushing up the wheat/corn spread. Funds have stretched the long positions on wheat.

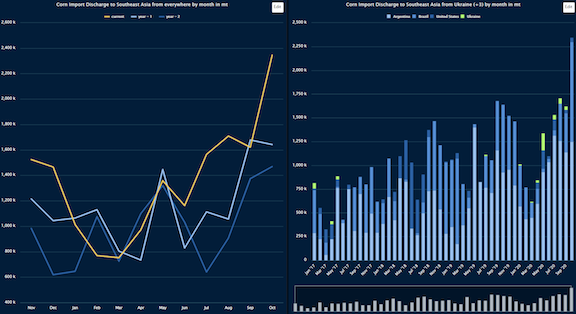

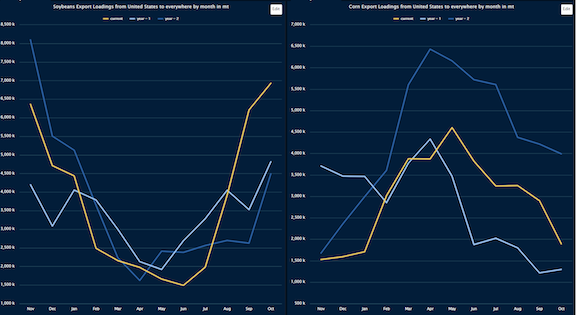

• Global corn offtakes recovered in October after a poor September, mainly led by strong US loadings at the start of the 20/21 crop year. Stronger offtakes in Southeast Asia suggest sustained feed demand, limited domestic production and feed wheat supply.

• Chinese corn imports remained upbeat despite shrinking import margins, though corn is increasingly priced at a premium to wheat, leading to feed wheat substitution and wheat imports.

Soy

• Major origin soybean loadings for October were higher YoY, led by the US, which more than offset South American bean and meal loadings.

• Protein offtakes for regions outside of China were generally lower YoY, a trend witnessed starting September as the transition months between South American and US programs saw weak loadings as a result of the supply pinch felt in South America, aided by continuously weakening currencies.

• China has so far committed more than 71% of the Phase 1 agricultural purchase in dollar values. Based on the current USDA crop year US export estimate, more than 75% of the crop year target has been sold, a pace only surpassed by 2013/14. Though 13/14 saw final export higher than the initial target by 20%.

• China has taken up roughly 55% of US bean sales, above the pre-trade war levels of 50%. While overall US bean exports are estimated at a record, this indicates the US supply available for the rest of the world is capped, especially given the projected tight US bean carry-out for 20/21.

• Anticipated late Brazilian bean harvest in 2021 due to planting delays, coupled with a lower carry-in, has led to the concern of supply in 2021, which has kept the premiums in CBOT.

Wheat

• Global wheat offtakes out of China were weaker YoY in October, following a lower Q3, suggesting the world is still largely going through the pipeline as a result of the stocks building from the first half of 2020, led by Middle East and sub Sahara Africa.

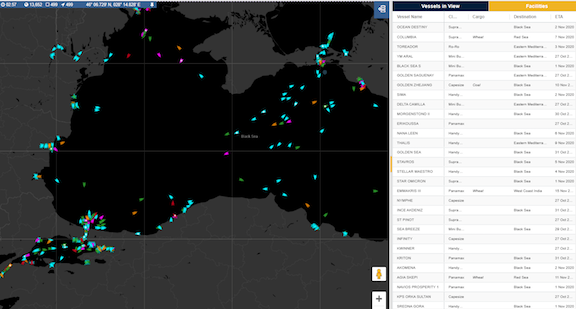

• US exports slowed precipitously while Canada dominated the hard wheat export space. Black Sea exports remained upbeat, which coupled with a weaker ruble, has led to surging domestic price and talks of an export restriction later in the 20/21 season.

ª While Southern hemisphere crop is less than a month away from harvest, the Argentine crop size is lower YoY, hence not expected to shift demand in a significant way. On the other hand, Australian wheat traded at competitive levels, drawing demand away from the Northern hemisphere.