IAPH-WPSP Port Economic Impact Barometer for week 21 also confirms global trend towards decreasing capacity utilization of liquid and dry bulk storage at ports

In its seventh weekly edition before switching to a new bi-weekly format, the IAPH-WPSP Barometer report confirms that regional differences are becoming increasingly pronounced in terms of the global impact of the COVID19 crisis on ports.

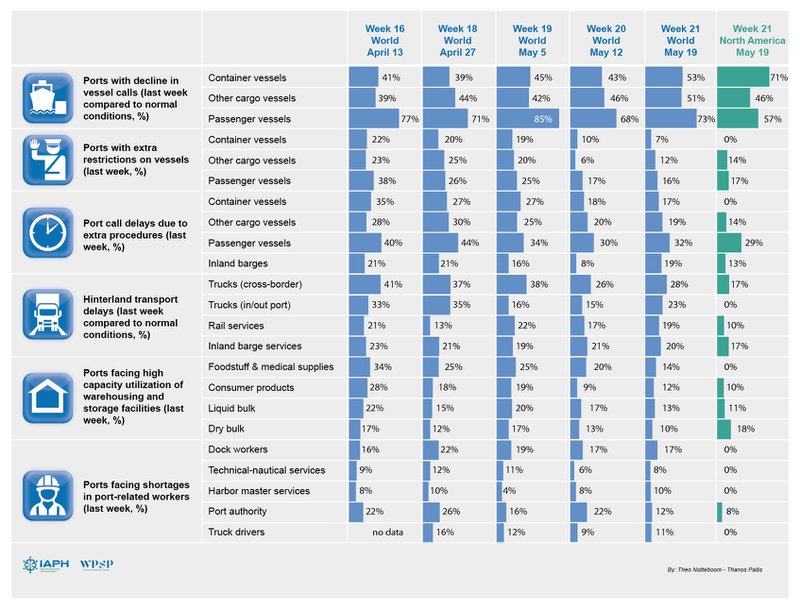

Impact of blanked sailings by container lines and falls in other cargo vessel calls on the rise

Blank sailings, mainly on trade routes with the Far East, are clearly affecting this week’s results for container vessels. About 45% of the ports are reporting that the number of container vessel calls fell by 5 to 25% compared to a normal situation (34% last week), while the share of ports facing a significant drop (in excess of 25%) in container vessels calls reaches 8%, a figure that is about 2 percent below the results of weeks 17, 18 and 20, but much higher than what we could observed in weeks 15 and 16. The share of ports reporting reductions in other cargo vessel calls of more than 25% increased further to 16% (vs. 12 to 15% throughout weeks 16 to 20). Less than half of the ports mention that the number of calls by other cargo vessels is rather stable compared to a normal situation.

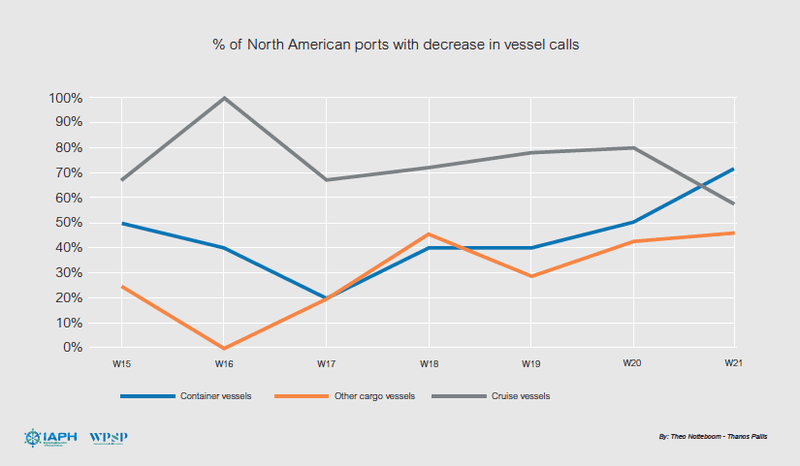

In North America, the situation for container vessels calls has rapidly deteriorated in the past weeks (see graph above) : this week already 71% of responding ports witness a 5 to 25% reduction in container vessel calls, a figure that is much higher than the world average.

Nonetheless, some ports in Asia from the WPSP COVID19 Task Force are forecasting a recovery by the end of May and beginning of June in terms of container vessel liner services, which will have a corresponding positive knock-on impact between six to eight weeks later in regions such as Europe and North America. Report co-author Professor Theo Notteboom commented : “We are starting to see some lines re-introduce sailings on the main East-West trades which they had previously shelved. We have also received reports from East Africa of a return of liner services out of Asia this week, which is a positive development.”

Trend in under-utilization of storage capacity persists

More and more ports are reporting under-utilization of liquid bulk storage facilities: 26% this week compared to a 15-23% range in the past six weeks. The share of ports with increased utilisation levels in liquid bulk storage facilities has dropped to 13%, the lowest figure since the start of the survey. A similar development can be seen in the dry bulk sector: 32% of the ports report an under-utilization of facilities compared to a 17-25% range in the past six weeks. The share of ports with increased utilisation levels in dry bulk storage has declined to 10% (also here the lowest figure to date).

North American ports experiencing less hinterland transit delays and better port worker availability

The situation in hinterland transport for North America is on average far less disrupted than what can be observed around the world, particularly for trucks moving in and out of the port areas. Except for rail, the number of ports confronted with disruptions in inland transport has remained below 20% throughout the survey period.

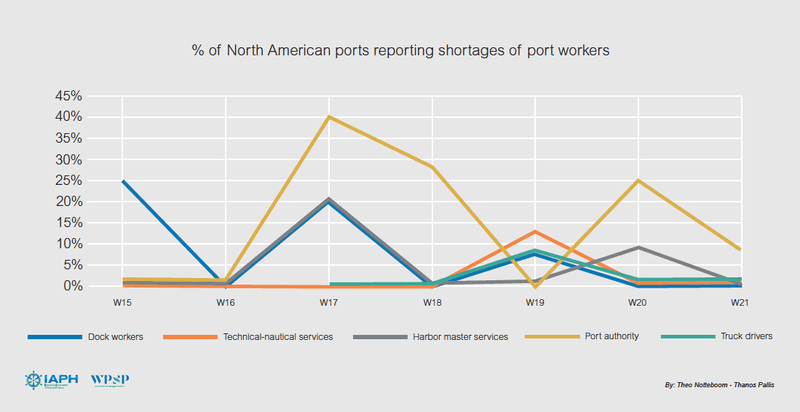

In addition, North American ports generally report few problems on port worker availability (see graph above). The figures for this week are much lower than for the global sample: zero shortages are reported for all port worker categories except for port authority staff, although some fluctuations are observed over the period of observation.

Looking ahead to the next survey, co-author Professor Thanos Pallis commented : “The data we are now collating will not just serve a useful purpose in measuring the immediate impact of the COVID19 virus on ports around the world. As our Task Force colleagues from Asia have taught us with their recent preventive actions, the impact of the Coronavirus is far from over. So it will be vital to collect data moving ahead in order to analyse, map out and mitigate business risk.”