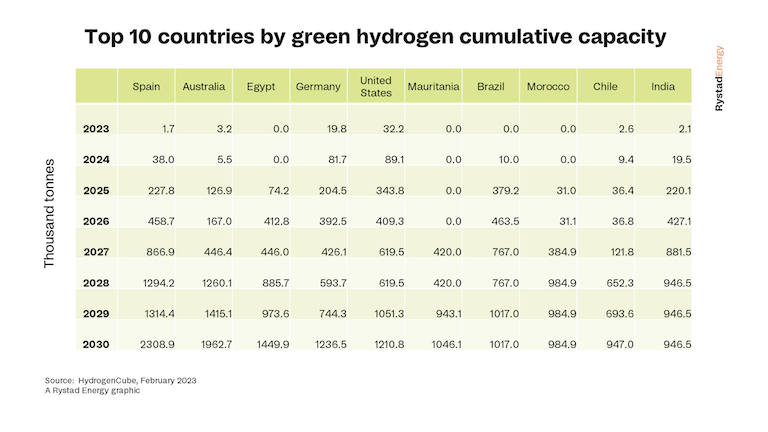

If 2022 turbocharged the green hydrogen economy, then 2023 is the start of a long slog for this nascent sector that is set to be the backbone for decarbonization, transition and energy security strategies. Rystad Energy research has found that electrolyzer capacity is expected to grow by 186% from 2022 to 2023. Attention is therefore turning to the supply chain capacity necessary for electrolyzer production. Even though many of the raw materials needed for the sector’s growth have seen high price tags in recent years, Rystad Energy expects a 10-15% decrease in electrolyzer service price inflation between 2022 and 2027, as green hydrogen adoption grows, and cost cuts are realized. Rystad Energy’s latest projection for green hydrogen production by 2030 is 24 million tonnes from 212 gigawatts (GW) of electrolyzers, fueled by the latest round of incentives such as Inflation Reduction Act and Europe’s multitude of support schemes.

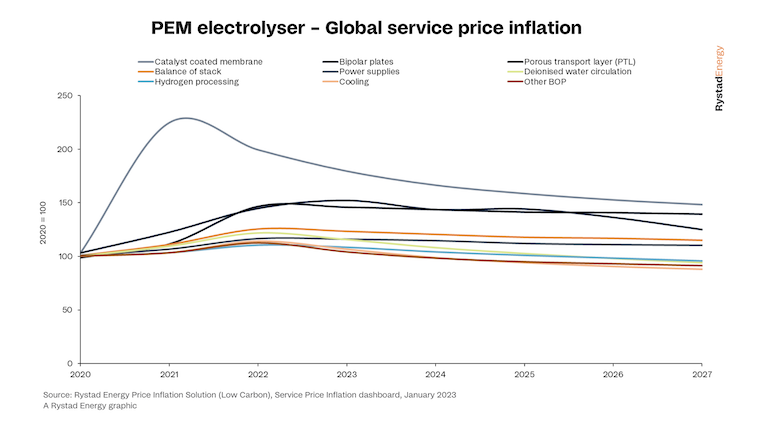

Currently, the two most common electrolyzer technologies are alkaline water electrolysis (AWE) and polymer electrolyte membrane (PEM). Both PEM electrolyzers and AWE electrolyzers have experienced particularly high inflation in the past two years – on average prices for PEM electrolyzer components have spiked around 30%, while AWE costs increased around 21% over the 2020-2022 period. Platinum and iridium price volatility between January 2021 and January 2023 contributed to the recent inflation seen hitting catalyst coated membranes – and highlights the significant challenges coming with using iridium and platinum catalysts in PEM electrolyzers.

“In the short term electrolyzer prices will start to decrease as key raw materials see their prices stabilize after a volatile period. In the medium to longer term technological innovation and efficiency gains will reduce the need for iridium, resulting in a significant cost reduction. However, unexpected jumps in costs could occur as iridium faces supply pressures as key producer South Africa faces power outages. This demonstrates how the energy transition will not be predictable with many betting that green hydrogen will take a similar path to photovoltaics which saw investment costs drop by around 80% between 2010 and 2020”, says Selena Remmen, supply chain analyst, Rystad Energy

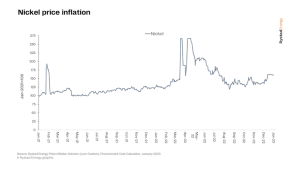

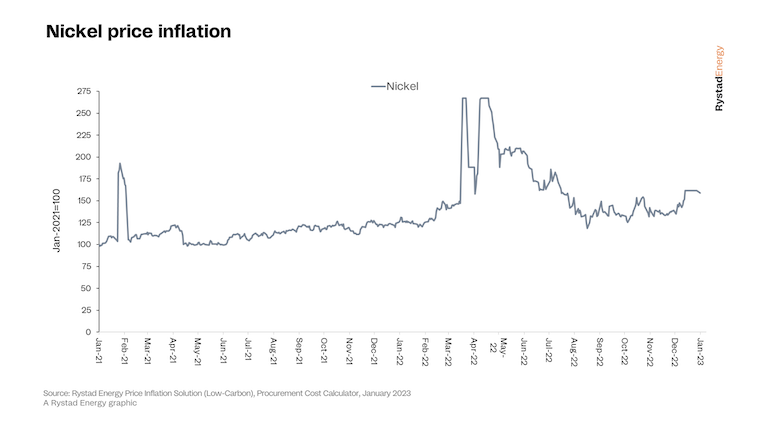

Nickel and stainless-steel impact

Over the past year, the global nickel price has increased by 30% on average, with a much higher spike in June. This is largely attributed to a lower than usual Chinese output associated with Covid-19 lockdowns in the country, and sanctions against Russian raw materials. As AWE uses Raney nickel as a catalyst, and nickel for porous transport layers, bipolar plates, and end plates, the metal contributed to significant inflationary pressures since the beginning of 2020, with an average increase of 10% between 2021 to 2022. Furthermore, stainless-steel production accounts for approximately two thirds of global nickel demand. Nickel is used as an alloying material in stainless steel production to increase steel’s formability, weldability, and ductility, while also increasing its corrosion resistance. Due to the importance of nickel in stainless steel production, nickel prices are a large driver of the cost of stainless-steel. Stainless steel is a common material used in electrolyzers, including PEM stack components such as bipolar and end plates, as well as balance of plant (BOP) components such as piping, valves, tanks, and pumps.

According to Rystad Energy research, the price of nickel is expected to continue its downward price trend and is estimated to fall towards $25,000/tonne (or lower) in 2023, due to the relaxing of Chinese zero-covid policies and additional Indonesian supply hitting the market. In addition, global steel prices are expected to lower as the US ramps up steel production and starts importing more from Europe (where prices are significantly lower). These price reductions should help reduce the cost of electrolyzer components containing stainless steel and nickel.

There are many pathways to electrolyzer cost cuts: reducing the presence of precious metals, increasing electrolyzer efficiency, increasing production volumes, and automizing manufacturing processes. Additionally, there are actual governmental supports to turn these pathways into realities too. For instance, the Important Project of Common European Interest (IPCEI) ‘Hy2Tech’ €5.4 billion fund released in 2022 or the recently announced Green Deal Industrial Plan where the bloc’s Innovation Fund will focus on scaling up manufacturing of electrolyzers’ components among other. Overall, Rystad Energy expects that such cost cuts will help reduce electrolyzer service price inflation by around 15% by 2027, and thus improve the economics of green hydrogen production.