Post-lockdown traffic added to seasonal tourism and essential roadworks causes delays to cargo and traffic at some ports. Vessel crew changes reported for the first time.

The tenth WPSP-IAPH COVID19 Port Economic Impact Barometer published today reveals an important development for ports located in countries where lockdown restrictions are being eased. This report accumulates results from ninety ports predominantly located in Europe and the Americas, with some representation from Africa and the Far East.

The current situation has had serious consequences for some container terminals. Ultra large container ships (ULCS) calls are less frequent in numbers but are filled up with more cargo. Major container ports in both Europe and North America report that the average moves per ULCS per call have significantly increased, with some hubs reaching up to 10.000 TEU moves. This is creating peaks in both ship-to-ship operations and yard activity at the terminals and is starting to impact land-side operations, especially on truck arrivals and departures. Some ports report that it takes days to return back to a normal situation at the yard and gates and lost movements of cargo are on the rise. The workforce in some ports are under increasing pressure as these peaks impact resource on some days, followed by several days off duty with no activity at all.

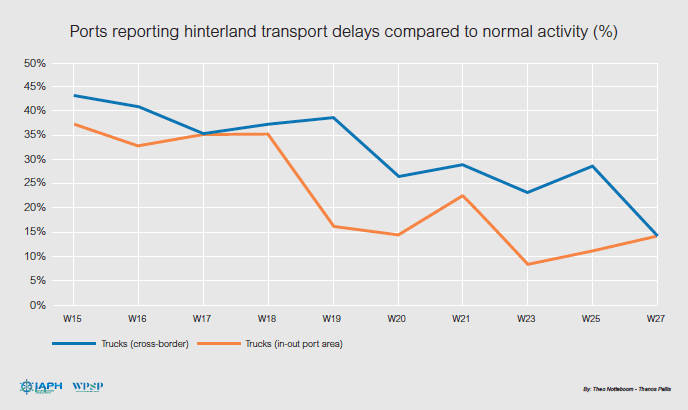

Cross-border transits more fluid whilst truck availability is declining at some ports

Modest return for some passenger services

Dies war eine der beiden alten Fähren die zwischen Rostock und Gedser gependelt ist, aufgrund der kurzen Verbindung zwischen Berlin und Kopenhagen führte bis Mitte der 1990er Jahre über Rostock. Jetzt gibt es neue Fähren und die heißen Berlin und Copenhagen mit Hybrid.

Ro/Ro and passenger traffic, which has been massively impacted by COVID19 in recent weeks, has seen some renewed activity, especially in Europe. Some ports have seen increases exceeding expected calls by up to 60%. More and more countries re-start the temporarily suspended operations of passenger ships. “This recovery however might not be a full one” commented co-author Professor Thanos Pallis. “Even though passenger vessel calls have recovered, the number of passengers on board these vessels in many cases is still more than 60% less than a year before. In some countries this is also due to restrictions that prevent passenger vessels from carrying more than 50 to 60% of their capacity” he added.

Despite a few small cruise vessels returning to operation, nearly all other cruise operators have cancelled their operations until autumn, or even 2021, while some countries have officially announced that there will be no cruise operations for the coming months. This has resulted in some layoffs of port staff.

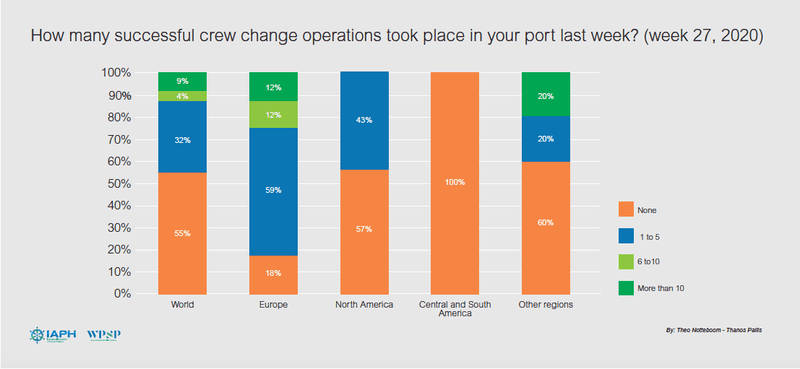

Evidence of some successful crew changes at ports with big differences in availability between continents

On a global scale, 55% of ports in the survey reported no crew changes have taken place in week 27. In one third of the ports, a very limited number of crew changes have occurred (less than 5). When comparing regions, European ports show the best picture in terms of the crew change situation, although 6 out of 10 European ports only recorded less than a handful of crew changes in the past week. In North America, crew changes are at a very low level with 57% of ports indicating there have not been any crew changes in week 27. No crew changes have taken place in the 29 responding ports from Central and South America. Despite best efforts from ports, the above figures show the crew change situation remains very precarious, particularly in the Americas.

For some ports reporting in that that crew changes are permitted by health authorities and immigration offices, there are no regular/commercial international flights within close vicinity for completing the operation. In some cases seafarers have to hire cars or use alternatives to be able to connect back home. Others report the need for finding accommodation for crews to be housed during the obligatory quarantine period or whilst awaiting charter or regular flight connections.

IAPH Managing Director Patrick Verhoeven commented : “While these findings of our survey gives some hope about crew changes, more needs to be done, especially in countries where nationals need repatriating. The measures taken recently in some countries such as Singapore and the Philippines to help repatriate sea staff long overdue for leave are encouraging. Other IMO member states need to follow suit, allowing our port members to help get crew home and their replacements onboard.”

As governments meet this week in London to address the growing crisis around crew changes, IAPH supports the International Chamber of Shipping’s call on all ships to sound their horns in support of all seafarers at 12 noon local time on 8 July.