Norwegian low-cost airline Flyr has entered administration just 18 months after starting operations. IBA Insight reveals that Flyr (which translates from Norwegian as ‘to fly’) operated a fleet of 12 leased aircraft (6 x Boeing 737 NG and 6 x Boeing 737 MAX). Seven of these were owned by Air Lease Corporation.

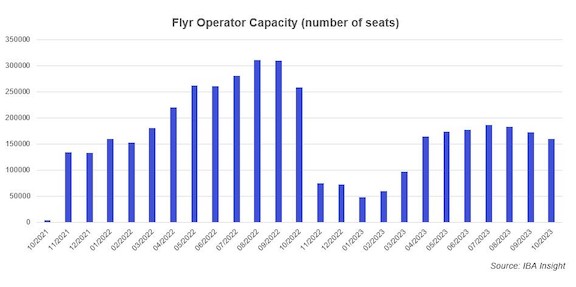

Flyr was a very seasonal operation, with its top city pairs featuring summer flights between Oslo and Alicante, Malaga, Barcelona and Rome, as well as domestic flights within Norway.

This shows us that it is not easy to remain cashflow positive in the weaker winter months, during a high oil price environment. It also makes the strong profits reported by Ryanair in Q3 even more impressive.

Kerosene prices come back to bite weaker operators.

Jet kerosene prices remain very elevated at USD 1,153 per metric tonne, in part due to a very wide crack spread caused by a lack of refinery capacity. The last time we saw such high kerosene prices was in 2008, just before the Global Financial Crisis. This period saw a similar playbook, with weaker players exiting the market, thereby reducing market capacity and giving other airlines more pricing power to cover higher fuel prices.

IBA remains positive on the general aviation recovery presented in our outlook for 2023, but we anticipate further failures and airline consolidation to occur amongst some of the weaker players in the coming weeks.