Maersk is not only the largest container carrier in the world but also the shipping company leading the maritime quest for the zero-emission vessel (ZEV) of the 21st century. Maersk's Sustainability Report is one of the shortest (46 pages) of all the reports we reviewed; only COSCO (35 pages) and ONE (26 pages) released shorter ones. The length, however, is secondary: Maersk's report tops the list; one can practically say that it belongs to a different dimension to all the others because it does not only report on its actions during 2019, but it also presents a vision for 2030 and 2050. The report holds the bull by the horns—GHG emissions—from the very beginning, and almost no paragraph is wasted. If the report is so good, why is Gliese Foundation not given 5 stars out of 5 to Maersk? You will find the answer below.

The difference with other liners starts from the beginning: while most companies play the traditional card that shipping transports about 90% of the global trade and shipping CO2 emissions are barely less than 3%, Maersk assumes the responsibility: "Our industry is a significant contributor to global GHG emissions, which is why we have set ambitious CO2 targets for Maersk."

Skou immediately moves to the biggest challenge of the maritime industry, and does it boldly: "On climate change, our target is to have net-zero emissions from our shipping activities by 2050." Bang! Not before 2100, not during some undefined year after 2050, not repeating the unambitious commitment by the IMO, not by carbon offsetting with cheap projects in developing countries, not playing the same cards that almost all the other shipping companies—liners, bulkers, tankers, OSV, cruises, ferries—are using today, but by emphasizing the aggressive goal that Maersk and other founder members of the Getting to Zero Coalition have been hoisting, flag around which a growing number of maritime companies have been agglomerating around. We all have been listening and reading about the 2050 ambitious goal by Maersk, but if the largest liner achieves it, the demonstration effect across the maritime industry, the transformation that it will deliver could become the most important maritime turning point in decades, only comparable to the replacement of sails by steam in the XIX century or the replacement of coal by oil in the XX century.

And in the next sentence, Skou adds: "We determined where the vast majority of our investments in new fuels will go in the next years, zooming in on three potential fuel types based on alcohols (methanol and ethanol), bio-methane and ammonia." On this issue, many may disagree since the quest for the holy grail seems much more crowded. Why is Maersk betting for those types and not for hydrogen, for instance (methanol and ammonia are expected to be produced with hydrogen indeed)? That, of course, will not be answered in a Sustainability Report, but what calls attention is that by mentioning specific fuels, Maersk seems to have advanced significantly, and probably not only through the Getting to Zero Coalition but also by its own.

We have spent several paragraphs in the introductory letter by Maersk's CEO because it sets the rhythm of what follows in the rest of the report—not an excess of words but content, if one skips the Sustainable Development Goals (SDGs), which has lights and shadows. On this topic, Maersk claims: "The business of A.P. Moller - Maersk touches, directly or indirectly, on all 17 SDGs." One can debate that claim because the "indirectly" could be quite indirectly, but then it follows by a more realistic statement: "Five SDGs are prioritised through our shared value commitments: SDGs 8, 9, 12, 13 and 17."

Nonetheless, Maersk neither settle for the 17 goals nor for the five just mentioned, but for twelve (a bit confusing, is not?) as if different teams had been in charge of the various chapters. The analysis at the end of the report in the section called: "Summary of targets and progress" is one of the most complete we have found among the liners indeed, but is it really useful? For us, some parts are good, others only average. Let's illustrate it with the case of air emissions:

"SDG goals: 3 and 14. SDG targets: 3.9 and 14.1." That is quite precise; if one reviews the 169 targets, Maersk has selected the two that should be included regarding air pollution. From the UN "3.9 By 2030, substantially reduce the number of deaths and illnesses from hazardous chemicals and air, water and soil pollution and contamination. 14.1 By 2025, prevent and significantly reduce marine pollution of all kinds, in particular from land-based activities, including marine debris and nutrient pollution."

But then it continues: "Targets: Fully comply with regulatory demands and continue investing in maintaining and implementing solutions that will enable this. Actively engage at international and regional levels to secure a level playing field across the industry." Not much on that, but let's continue: "Progress 2019: Successful completed preparations for implementation of the IMO's global cap on sulphur dioxide from 1st January. Registered five cases of non-compliance with SOx emissions requirements in regulated zones, caused by errors during fuel switch." Nothing about actions on NOx or PM, but during 2019 all eyes were undoubtedly focused on SOx. Finally: "Governance: Our work is guided by a high-level cross-organisational steering committee on SOx compliance and readiness established by the Executive Leadership Team." Once again, as if ships were expelling only SOx from their stacks, but the emphasis on SOx could be understood given the entry into force of IMO 2020. You see why we were referring to lights and shadows, but trying to end the SDG section in a positive tone, it is certainly excellent to appreciate that Maersk is the only liner that has gone to the level of detail of identifying twenty-five targets from twelve goals that the company is impacting: 2.1, 2.2, 3.9, 5.1, 5.2, 7.3, 8.2, 8.3, 8.5, 8.7, 8.8, 9.3, 10.2, 10.3, 12.3, 12.6, 13.1, 14.1, 14.3, 16.3, 16.5, 17.1, 17.6, 17.10, and 17.16. As we have said in previous reviews, once we released the twelve independent reviews, we will analyze some cross-sectional issues, one of them will be the enormous disagreement among liners about the SDGs their operations are impacting, almost as if they were on different lines of business and not all carrying containers, and we will explain the goals and targets that according to us they should include in future Sustainability Reports.

We found interesting some of the dilemmas in sustainable consumption that Maersk raises: "What does degrowth mean – and is it necessary? And how will developing countries cope, when they already need 600 million jobs by 2030 just to keep up with population growth? What will new business models look like and who are the winners and losers in the transition to a green economy? How will the realisation of closed loop production and carbon free logistics change this debate?" One is tempted to believe that Maersk has become too academic 😊 since those are the type of questions we, researchers, formulate when discussing the impact that new trends such as additive manufacturing or vertical farming may have in the future of trade. But, of course, that is not the case, because Maersk wants to be ahead of the curve regarding its future as a business: "We follow the development in this field avidly, as changes in consumption patterns could directly lead to changes in our business."

The core about Maersk report is in two chapters: "How we work towards decarbonising logistics," and "Our journey towards carbon-neutral shipping." The company states the two strategic targets on CO2 emissions: "1) To have net-zero CO2 emissions from our own operations by 2050, which includes having commercially viable, net-zero vessels on the water by 2030. 2) To deliver a 60% relative reduction in CO2 emissions by 2030 compared to 2008 levels." As we have said above, Maersk overpasses the IMO, leaving the London headquartered institution quite behind, as if the IMO's strategy were nothing else than a bureaucratic, outdated and non-visionary document.

The report makes an important methodological addition that seems secondary, but it is not: "In 2019, we changed the indicator underlying our relative CO2 reduction target. Instead of the previous indicator, which used average-based assumptions to calculate emissions, we now use the EEIO indicator based on our actual operational performance. The result is more accurate data and calculations of impact, and alignment with what we suggest become the indicator to be used to measure progress on the IMO efficiency targets." It will always be better to work with "actual operational performance" than with "average-based assumptions."

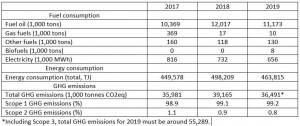

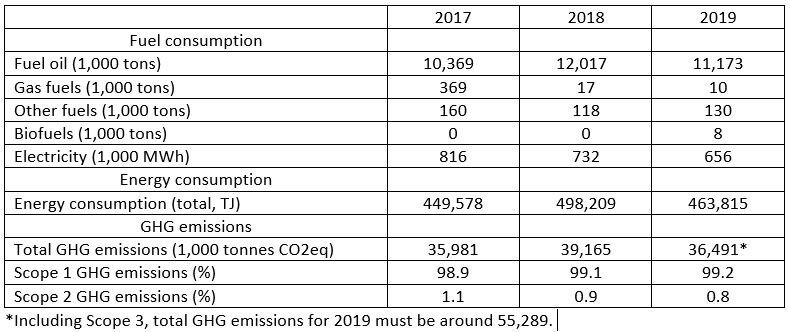

Maersk summarizes the enormous challenge that climate change mitigation imposes on successful and growing companies, a category to which it belongs: "While emissions have grown in absolute numbers, we have decoupled growth in business from CO2 emission levels (...) improving efficiency is not enough. Even with 41.8% efficiency gains, absolute emissions remain roughly flat (...) To get to net-zero emissions, we know that breakthroughs will need to happen in at least three areas: market, technology and legislation." That is the real challenge: companies must not only reduce their carbon footprint (per nautical TEU in this case), but they must do in such a way that the absolute amounts are also lowered, up to the point of becoming zero.

Regarding the green fuels of the future, Maersk makes a case for biofuels mainly as a transitional fuel: "Biodiesels play a key role in the transition phase, as an element in establishing and growing the market for carbon-neutral transport and to build acceptance of diversified pricing dependent on carbon footprint." Well, it shows that biofuels are not exactly future fuels but are available now: "We launched the Maersk ECO Delivery ocean product, where the carbon footprint of cargo transported under this name will be neutralised through use of carbon neutral biofuels in the Maersk network. The end-to end process is verified by the Roundtable on Sustainable Biomaterials." No other liner goes as far as this; others limit themselves to point out one or two trial voyages with biofuel. And Maersk is correct in highlighting the main problem with biofuels: "The main challenge in decarbonising shipping is not at sea but on land. The technological changes inside the vessels are minor compared to the massive innovative solutions and fuel transformation that must take place in the fuel supply chains to produce and distribute entirely new energy sources."

After the reconnaissance of biofuels is when Maersk brings its three main bets again: "In 2019, we completed the first step on this journey by mapping available pathways and possible technologies for carbon neutral shipping (...) It resulted in the development of three working hypotheses on future fuels: alcohol (ethanol and methanol), biomethane and ammonia." And then it comes the time sequence: "To meet the deadline of a commercially viable net-zero vessel at sea by 2030, we must pro actively pursue the most likely fuel options found at this stage. Towards 2023, we will primarily invest in developing fuel solutions within each of the three pathways." With a final open-minded addition: "However, our door remains open to other ideas."

Given that companies may include a wide range of items for their estimations of Scope 3, it is not surprising to find that the results between Maersk and CMA CGM differ significantly: 34% vs. 16.5%. Let's hope that the first estimations by the two European companies will accelerate better reporting by shipping companies in the coming year and more information on the categories for such a complex issue. Maersk only says: "The five material categories in scope 3 are transportation and distribution, which is at least double the size of all others, purchased goods and services, use of sold products, fuel and energy related activities and waste generated in operations." (CMA CGM, on its side, does not provide much information either: "Scope 3 emissions stem from ship- and container building, on-board waste (solid and liquid), employee business travel, the consumption of fuel oil specific to inland transport, and upstream bunker fuel production and transport.") Let's hope that in future years, companies will provide at least one page of methodological explanation for such a complex issue.

Most liners talk about their terminals. In the case of Maersk, an interesting case study is mentioned: "Green Gateway Gothenburg as a showcase for decarbonisation of existing terminals. With renewable electricity and use of biodiesel made from recycled waste vegetable oils, the Gothenburg terminal will reduce its CO2 emissions by 90% from 1 January 2020. Ways to eliminate the last 10% of emissions are being pursued with terminal customers, to provide a fully CO2 neutral container handling service." These numbers make evident that, similar to aviation, in which airports will reach carbon neutrality much faster than airlines, in the maritime industry, ports will do the same much earlier. 90% is already an outstanding figure.

Then it comes the section on the Task Force on Climate-related Financial Disclosures (TCFD). As we said in the last review about Evergreen Marine, that company and Maersk are the only two liners reporting according to the TCFD. That implies, for instance, that both go further than reporting on climate change mitigation to discuss also climate change adaptation issues. For example, referring to the transit along the Panama Canal, Maersk says: "[the Panama Canal] suffered the worst drought in its 115-year history. Water levels were so low that some ships had to unload part of their cargo to pass through the waterway. In the short term, canal customers will need to rely on information on canal conditions to evaluate network options of transiting via the Panama or the Suez Canal when they are loading ships in Asia. This adds uncertainty to our customers' supply chain and in our network planning."

Regrettably, the TCFD section by Maersk is too brief (Evergreen Marine elaborates more) because later Maersk adds: "We performed a hot-spot analysis in 2018, estimating the effect of five climate hazards (heat stress, floods, cyclones, water stress and sea level rise) on ports, other fixed assets and strategic commodities within a 2020–2040 timeframe." Hooray! Except for tropical cyclones, we have not seen any mention of these climate change impacts on shipping companies' operations. That must be a fascinating document on the carpet of confidential studies by the company. And Maersk continues: "Building on this, in 2019, we took steps to perform an economic analysis and engage with stakeholders in the Pearl River Delta, which was established as a hot-spot. We will finalise this analysis and report on it in 2020. This work will be instrumental in evolving our approach to managing physical risk from climate change." Another hooray! Even though the information in the report is so brief (scarcely half-a-page of the report), there is no doubt that Maersk is going much further than most companies reporting according to the TCFD: It uses its framework to analyze climate change mitigation and adaptation, has studied the top climate hazards to shipping and port operations, and it is already doing a country case study.

The two-page section called "Our journey towards carbon-neutral shipping," is creative behind its simplicity. The first page presents the main actions that the company adopted or in which it participated on three fronts: markets, technology, and policies. In the second one, one can see how those three separate branches join in a trunk once the first ZEVs are fully operational: not pilot vessels, of course, but fully commercial operational deep-sea vessels. In the beginning, we were referring to cases like this when we said that the document almost belongs to another dimension of sustainability reporting. It does not only report what the company did in 2019, but it presents those actions in the context of the much greater vision that triggers a force in 2030 and reaches a great goal in 2050. The technological sequence from 2020 to 2030 is particularly illustrative: "2020-23: Explore the three working hypotheses for future fuels. 2023-27: Vessel design and supply chains pilots. 2027-30: First vessels in production."

Regarding IMO 2020, it is interesting to appreciate how Maersk has changed its environmental position on the issue of scrubbers due to profitability reasons. Let's compare the "evolution" or "regression" of Maersk's stance on the topic. This report: "The health and environmental impacts of both closed and open-loop scrubbers are being investigated by the IMO. We clearly favour tackling sulphur at land-based refineries rather than on vessels at sea. However, in the current state of uncertainty over the price and supply of compliant fuel, we have chosen to use scrubbers as a secondary part of our approach to compliance. At the same time, the price and supply of the new compliant fuels are still unknown. What we do know is that the price of low-sulphur fuels is much higher." The year before, Maersk's report said: "Invested in scrubbers on a share of our vessels. Scrubber technology is a less extensive element of our sulphur cap fuel sourcing strategy, the vast majority of our container vessels will comply using low sulphur fuels. In 2017, we publicly stated that we would not rely on this technology, but for the time being we need to secure that we are not overly reliant on a single means of compliance." And two years before, Maersk's report said: "In the spring of 2017, we made a decision not to install scrubbers on our vessels. Following tests, we concluded that the installation, operation and maintenance costs related to this complex machinery would not be offset by the level of cleanliness of emissions that can be achieved through using it. Furthermore, scrubbers reduce fuel efficiency by as much as 2%." The expression "level of cleanliness of emissions" completely disappeared from the 2018 and 2019 reports. Soren Skou went even further on his criticisms of scrubbers in interviews. Here is the text of one of those interviews (Seatrade Maritime News): "We don't like solution, I've spoken to that many, many times, we think that the sulphur should be taken out of the fuel at the refinery where you have the big process plant to do so and for us to build washing plants to 700 ships simply does not make any sense to me."

This scrubbers' "elasticity" by Maersk is not an isolated case—Maersk has done it before. It did something similar with ships' demolitions, and it has been wavering about using the Arctic route. Although we acknowledge that Maersk's report is more in-depth than all the others, for hesitance on other environmental issues, Gliese Foundation does not award 5 stars out of 5 to Maersk, but we take at least a symbolical 0.1 since Maersk's recent history seems to indicate that when profitability overcomes the environment, the company may backtrack (of course, that does not apply to the strong commitment on the decarbonization of its fleet for the year 2050). Let's see those other two cases.

Regarding the transit through the Northern Sea Route, we have very strong commitments by other liners that have clearly said no to that route. CMA CGM: "CMA CGM decides not to use the Northern Sea Route. A forward-thinking choice for biodiversity protection in the Arctic and more generally planet-wide. The Northern Sea Route, a channel between Asia and Europe that follows the polar coasts of Russia, has become navigable due to glacial melting from global warming. Teeming with unique biodiversity that is only partially understood, the Arctic plays a crucial role in regulating currents and the global climate. Massive use of the sea route would pose real danger to the outstanding natural ecosystems of this part of the globe due to the risk of accidents, oil pollution, and ship strikes to dolphins and whales. To avoid endangering this fragile environment even further, Rodolphe Saadé has decided that none of CMA CGM Group's 500 vessels will take the Northern Sea Route." Evergreen Marine: "Evergreen Marine demonstrates its commitment to sustainable development with concrete actions. In 2019, we signed the 'Declaration of Refusal to Sail the Arctic Circle' to support the 'Protecting the Arctic' initiated by the Ocean Conservancy and Nike." MSC: "The Northern Sea Route connects Europe with Asia through Arctic waters, which until now have typically been blocked by year-round sea ice. The Route has been heralded by some as an opportunity for new commercial shipping lanes with additional potential for fossil fuel extraction. MSC will not use the Northern Sea Route for container shipping. MSC prides itself on a long nautical heritage and passion for the sea; entry into these Arctic waters would contravene these deeply held principles. We believe that efforts should be focused on limiting environmental emissions and protecting the marine environment, and that the 21 million containers that we move each year can be transported through existing shipping global trade routes."

Compare those sentences with Maersk's statement: "One of the unfortunate consequences of increasing CO2 levels in the atmosphere, is the melting of the Arctic ice cap. As a result, it has become possible to sail through the Northern Sea route for a few months during summer. On the one hand this can cut thousands of miles off shipping routes between Europe and Asia, reducing transport time and CO2 emissions. On the other hand, it is currently associated with severe environmental risks." Up to that point is not bad, but the ending could not be worse: "In 2018, we sent a vessel from Asia to Europe using the Northern Sea Route. Based on this trial our conclusion is that the Northern Sea Route is not a viable alternative to our current routes." The wording is so vague that it could be changed at any moment. Since COSCO has not hidden its intention to use the Northern Sea Route, does it mean that once COSCO or other liner starts to use the route (first during late Summer and early Autumn, when ice is at its lowest point), Maersk will delete the first word from the last phrase: "not a viable alternative to our current routes"? Given such a lukewarm position, it is not surprising that Maersk has not signed the initiative by Ocean Conservancy and Nike.

The third case is ship recycling, a very complex topic quite sensitive for Maersk, mainly after the Danish Environmental Protection Agency (MST) investigated in 2016 the re-flagging of four vessels to scrap them at beaches of India. The case, by the way, ended in favor of Maersk: The MST declared that Maersk did not violate any rules with the re-flagging. Besides, Maersk made a point on its Sustainability Report 2015, when it was not yet recycling in the beaches of Alang in India: "Since 2009 it has been the Maersk Group's policy to only recycle ships responsibly. This policy was reconfirmed in 2015. Currently, this is only possible in a limited number of yards in China and Turkey. On average, using one of these yards has an added cost of one to two million US dollars per recycled vessel. Also, our policy does not consider the fact that the majority of our vessels are sold off before they reach end of life. These vessels are not necessarily recycled responsibly, and some stakeholders have claimed that we employ double standards by accepting these actions." When most of the vessels are "sold off before they reach end of life" and "some stakeholders have claimed that we emply double standards," one cannot condemn the company for having decided for Alang but, of course, the "added cost of one to two million US dollars per recycled vessel," is clearly behind the decision. In the latest four reports (2016-2019), Maersk's stance has inclined heavily in favor of Alang. Shipbreaking (or recycling if one uses a more euphemistic word) is a very complex issue. Regarding ship demolition, we, at Gliese Foundation, are not at the level of the Shipbreaking Platform or the Ship Recycling Transparency Initiative (SRTI) (the names of the two institutions—shipbreaking vs. ship recycling—already tells one about the different conclusions they reach). Hence, even if we prefer recycling European ships in European shipyards (including Turkey), we cannot ascertain the quality of the upgrading of the shipyards in Alang.

Regarding the strong defense by Maersk about its decision (at least one page in each of its latest reports), we missed euros amounts spent on its improvement actions in Alang. In the latest report, the only three numbers are 29,000 people that receive free health care, 2,900 people that benefited from lab tests, and more than 5,000 workers that receive training on personal hygiene and health issues. How does the amount spent by Maersk compare with the one to two million additional US dollars that the company can get for recycling there rather than in Turkey? In other words, is Maersk spending in Alang the equivalent of three, or just two, or barely one ship's recycling? The amount of money makes all the difference, and that figure has not been provided for any year of the period 2016-2019. For such a sensitive topic, we consider that Maersk should reveal those yearly figures.

In summary, Maersk has presented us with an outstanding Sustainability Report. We can see a company that is not only reporting on its actions during 2019 as most liners do, but it has moved to a different dimension of reporting: It shows the strategy, the great vision towards the decarbonization of the shipping industry, which in the case of Maersk has the deadline of 2050, much more ambitious than the timid goals by the IMO, which is requiring only half of those results to the shipping industry. Most liners side with the IMO approach or, at most, say that they are working harder to deliver better results for that year. Maersk, leading the Getting to Zero Coalition, gathers more companies in favor of this bolder, much more aggressive strategy. We do not know if more companies that are part of the Getting to Zero Coalition are as committed as Maersk (some may have joined for pure PR reasons), but the movement that Maersk has put in motion indeed impressive. Hence, why is Gliese Foundation not given 5 stars out of 5 to Maersk? We consider that the reversal on scrubbers and the hesitance with the Arctic deserve, at least, to discount 0.05 points; in the end, it is just a symbolical reduction. And why are we not discounting more points than 0.1 in total? As we have said in previous reviews, since this is our first year producing these reports, we have been more lenient than we expect to be next year. For instance, we did not discount one star or at least half-star for delivering late the reports (not the case of Maersk). To conclude, Gliese Foundation considers Maersk deserves 4.9 stars out of 5 stars.