Analysis of Market Demand

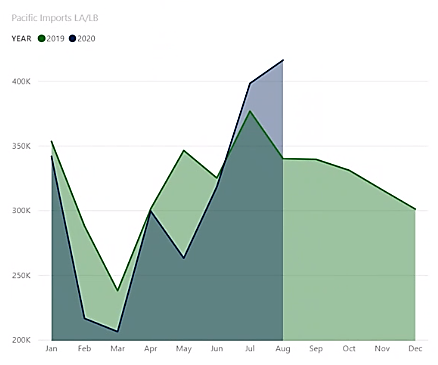

For the ports of LA/Long Beach specifically, Pacific Imports grew by more than 20% month over month in the periods of May – June and June – July, and around 5% for July – Aug. In July, Pacific Import volumes to LA/Long Beach surpassed 2019 levels, and August demand levels grew by 22% YOY. (Data source: US Customs Data (PIERs) – see below graphic)

Market Demand for Transpacific imports into LA-LB (2019 vs 2020)

Terminals

PNW:

Prince Rupert Terminal continues operating at maximum capacity. Vessel operations are being performed 24/7 with 13-15 gangs per day depending on yard space and train activity.

Centerm Vancouver is operating at maximum capacity. Current terminal recovery estimate is between weeks 46-48 after the completion of Centerm’s crane removal project (active through week 40).

Maersk actions

Closely coordinating and measuring performance of our rail partner (CN) for both Prince Rupert and Centerm.

Maersk will deploy an extra loader to return empties to Asia.

Southern California

APM Terminals Pier 400 Los Angeles

The terminal is managing import volumes and container yard utilizations to minimize impact to vessel operations.

Maersk actions

To lower the on-street dwell times, our Inland delivery team is picking up empties from Warehousing & Distribution facilities. Maersk's plan is for Maersk Customer Service to also help with this drive, providing CY customers the visibility of customer yards with idle empties that are available for use. This effort is being metered to avoid drop/pick facilities from being impacted.

APM Terminals Pier 400 is offering unrestricted empty returns under dual transactions.

APM Terminals Pier 400 offered a Saturday gate on September 26th. Based on the gate utilization experience, additional Saturday gates will be planned as needed.

Efforts are underway to add new truckers for expanded capacity for local drays.

Port Congestion fee

As a result of the surge in import volumes in the ports of LA/Long Beach and the impact on both processing capacity and infrastructure -including trucker turn times and dedicated weekend gates- additional costs have made it into the Supply Chain. A Port Congestion Fee has been introduced to allow us to recover part of these costs and retain shipment flows at maximum levels.

Other

Labor shortages: With the high volumes of peak season, Maersk is seeing a dip in labor availability with truckers, Warehouse & Distribution workers and Longshore Labor. In Maersk Longshore labor – we are seeing more casuals – since registered Longshore workers are reaching their maximum hours - so the labor hall work assignment cycle goes to casuals as next in line.

Chassis

High dwell times on street chassis (that have import loads and being used as storage) and increased chassis utilization continues to trend. Maersk is seeing out of service chassis levels that are decreasing which will help support peak season needs.

Long Beach, Gerald Desmond bridge – closed this weekend (October 3-4)

Gerald Desmond Bridge will close this weekend as crews switch lanes to new bridge.

Traffic routes leading to the Gerald Desmond Bridge will be closed 4:00 pm Friday to Sunday, Oct. 2-4, to allow construction crews to switch lanes over to the new cable-stayed bridge and enable the new route to open on Monday morning. Link

The outlook

The outlook for the remainder of Q4 remains uncertain but Maersk will continue to strive to match our trade capacity in line with market demand.

Maersk recommendation

"Based on the high volume of cargo flows of peak season, we encourage customers to add sufficient buffer to supply chain schedules - and inventory levels to ensure healthy supply chain resiliency."