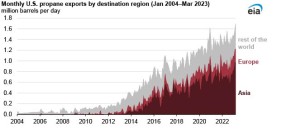

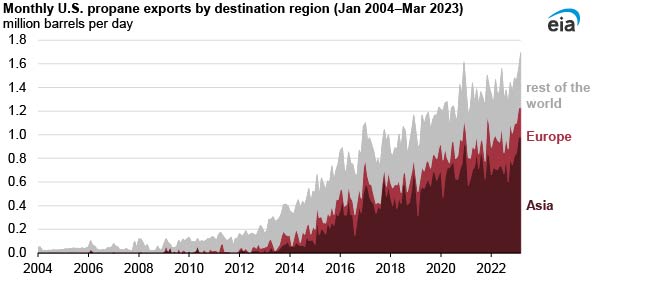

U.S. propane exports reached a record 1.7 million barrels per day (b/d) in March 2023, the highest level since we began collecting this data in 1973. Propane is consumed globally for space heating and is used as a petrochemical feedstock.

Low U.S. demand for propane this past winter and higher propane production led to lower U.S. propane prices relative to Northwest Europe and Asia, underpinning the record export levels. Propane production, a byproduct of natural gas processing, has increased rapidly over the past 10 years as U.S. natural gas output has expanded. Expansion projects at U.S. propane export terminals in recent years have allowed for more U.S. exports. Propane exports also reached a record annual high in 2022, averaging 1.4 million b/d.

Japan is the largest importer of U.S. propane, followed by China and South Korea. In 2022, approximately 53% of all U.S. propane exports went to markets in Asia, and the three major East Asian economies (Japan, China, and South Korea) accounted for nearly 84% of Asia’s propane market. U.S. propane exports to China increased to 211,000 b/d in March 2023 from 92,000 b/d in March 2022 and averaged 176,000 b/d during the first three months of 2023. China’s demand is set to increase further: seven new propane dehydrogenation (PDH) units started up in 2022; six more are expected to start up in 2023.

U.S. propane exports to Europe set record highs of 236,000 b/d in the summer of 2022 because of uncertainty about propane supply resulting from Russia’s full-scale invasion of Ukraine. U.S. propane exports to Europe averaged 247,000 b/d in the first three months of 2023.

The increase in propane demand as a petrochemical feedstock in Asia has contributed to higher global propane prices and incentivized increased propane exports from the United States. Propane prices rose significantly in both Asian and Northwest European trading hubs this winter. Spot prices at the Mont Belvieu export hub in the United States also rose, but at a slower rate.