The biggest risk in battery materials from Russia’s increasing economic isolation centers on supplies of top-notch Arctic nickel controlled by the country’s richest man.

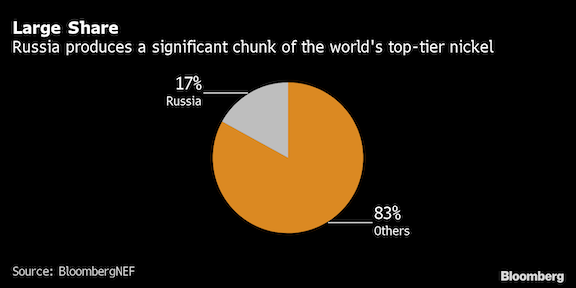

Russia is a major producer of the metal that will be needed in huge quantities as the world’s auto fleet goes battery-powered. That means the electric-vehicle industry has much at stake as global businesses rejig ties in the wake of the invasion of Ukraine. Mining giant BHP Group on Monday warned of nickel supply shocks.

“I certainly think the invasion will have a knock-on effect of further tightening Class 1 availability,” Greg Miller, analyst at Benchmark Mineral Intelligence said by email. “Many customers—particularly in Europe and North America—will either be unable or very reluctant to accept Russian nickel, driving competition for alternative sources.”

Nickel jumped to a fresh 11-year high on Wednesday above $26,000 a ton on the London Metal Exchange. There’s the risk that more expensive nickel will ratchet up pressure on battery and car-makers already grappling with soaring costs—especially for lithium.

While Norilsk primarily supplies nickel to the steel and alloys sectors, any reduction in its shipments would have a knock-on effect across all nickel markets at a time of very low inventories.

So far, Norilsk Nickel’s shipments have not been significantly disrupted, a person familiar with the matter said on Wednesday. Some shipholders have declined to transport its nickel and a shortage of containers is a concern, but the effect is not material and buyers are still taking the metal, the person said.

Russia doesn’t have a big heft in other key battery materials. It produces some cobalt as a by-product of nickel, and its presence in lithium, graphite and manganese is negligible to small.