Offshore wind spending is increasingly closing the gap on oil and gas (O&G) investments and is forecast to surpass them in several key markets by 2030, Rystad Energy analysis indicates. While global O&G capital expenditure will rise nominally in this timeframe, anticipated growth in offshore wind investments will bring Europe, the United States and Asia (excluding China) to the tipping point before the end of the decade.

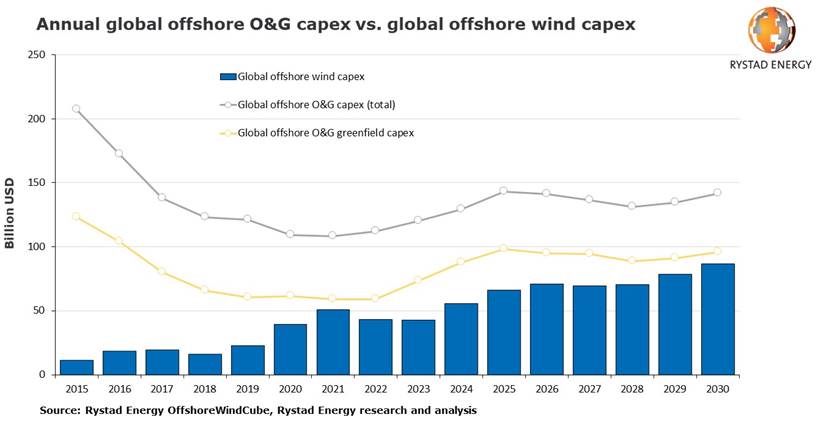

Although we expect global offshore O&G expenditure to increase marginally to more than $140 billion by 2030, the rapidly growing offshore wind sector is forecast to reach a market size of $87 billion over the same period – a 70% increase compared with 2021’s market value of $50 billion. Furthermore, estimates show that less than $10 billion will separate offshore greenfield capex for O&G and offshore wind investments by 2030.

Of the countries and regions analyzed by Rystad Energy, the US offshore wind sector is expected to see the fastest growth in investment, albeit from very low levels in 2020. At the same time, offshore wind activity is surging in China, but the country will see investments decline towards 2030 as feed-in-tariffs (FiTs) phase out from 2022 onwards. Nevertheless, significant ongoing investment is expected to make China the world’s largest offshore wind market, with 58 GW of installed capacity in 2030.

“To remain relevant in a changing market, offshore service companies will need to monitor this trend closely as they draft long-term strategies that position them for a smooth transition into offshore wind, enabling them to take advantage of what promises to be a major growth industry,” says Alexander Dobrowen Fløtre, offshore wind expert and Vice President at Rystad Energy.

Two regions are expected to see clear and opposite trends between the two industries – Europe and Asia (excluding China). For Europe, investment levels in offshore wind have been high for some time, making it the most mature offshore wind region in the world with 25.7 GW of operational capacity. With the decline in offshore O&G investment and capex budget cuts by E&P companies during the pandemic, offshore wind and offshore O&G capex levels are expected to nearly intersect in 2022. However, with a slight recovery for O&G as the economy recovers in a post-pandemic world, paired with a temporary slow-down in offshore wind investment growth due to project timing, the crossing point is not expected to occur in Europe before 2026. From then on, the offshore wind and offshore O&G markets are expected to part ways in terms of investment levels.

The offshore wind industry in Asia (excluding China) is still in its infancy, but capacity is expected to see rapid growth during the decade. In the short-to-medium term, intertidal (near-shore, shallow-water) wind farms in Vietnam and conventional offshore wind in Taiwan are expected to drive capital investment towards 2025. We expect mainly Japan and South Korea to add to sectoral growth in the second half of the decade. With declining offshore O&G investments, the crossing point is expected to occur in 2028.

Different countries have different stories, and some have already seen offshore wind investment surpass those for O&G. The UK is currently the largest offshore wind nation in the world, with around 10.5 GW of operational capacity. At the same time, the UK continental shelf is a mature offshore O&G region where many fields have already been decommissioned. Although the levels of investment in offshore O&G and offshore wind have intersected previously, the more permanent crossing point occurred in 2020. As the UK is targeting 40 GW of offshore wind capacity by 2030, activity levels are forecast to remain high, meaning the offshore wind market is expected to remain larger than the offshore O&G market through 2030.

China’s limited, shallow-water offshore O&G sector has seen flat investment levels of around $5 billion annually. At the same time, offshore wind investments have grown rapidly since 2015, thanks in part to supportive policies. As a result, China experienced its crossing point in 2017. Although offshore wind activity is likely to slow once current investments tail off, the sector is expected to remain larger than offshore O&G throughout this decade.

Denmark has had limited offshore O&G activity and was one of the early movers in the offshore wind sector. Despite this, it currently ranks only fourth in Europe in terms of operational capacity, with 2.3 GW, as many of its early wind farms were relatively small. The two industries have trailed each other in recent years, but it will not be until 2022 that investment in offshore wind is expected to surpass offshore O&G in Denmark. This follows the nation’s current tendering activity and ambitious plans for large-scale energy islands with long-term targets of more than 10 GW of additional offshore wind capacity.

The US, meanwhile, has seen declining O&G investment levels, with capex levels expected to fall below $10 billion from 2023 onwards. At the same time, the Biden administration has set an ambitious federal offshore wind target of 30 GW by 2030. While Rystad Energy expects the US to fall short of its declared target, our forecast of 21 GW by 2030 will still entail rapidly increasing investments to between $8 billion and $10 billion from 2025 to 2030. Although offshore wind investment is expected to fall below that of offshore O&G in 2030, following a slight recovery in the latter sector, offshore wind in the US will again see larger capex levels than O&G after 2030, as upstream investment tails off.