Recent developments in the oil market have sent cold shivers through Rystad Energy’s oil market team, calling into question our temporary bullish view for the first part of 2020 linked to the new IMO shipping fuel regulations.

“Economic recession risk and further escalation of the US-China trade war are key concerns in the near term. How long OPEC+ is willing to continue to manage production adds uncertainty,” says Bjørnar Tonhaugen, head of oil market analysis at Rystad Energy.

“This adds downside risk to already moderate growth numbers. Continued worsening of US-China trade relations could lower demand growth by 200,000 barrels per day (bpd) to 1.0 million bpd in 2020,” Tonhaugen observed.

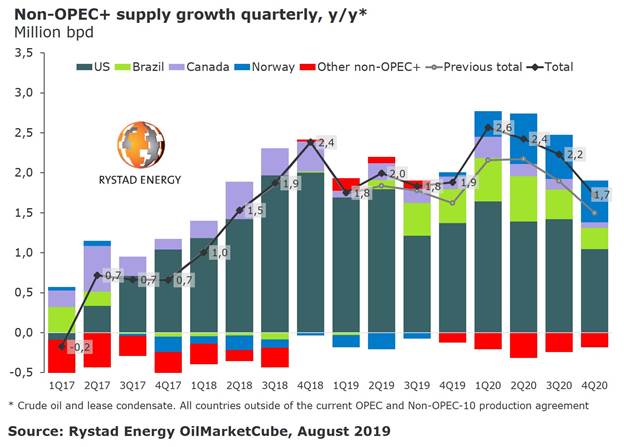

Our global field production forecast for 2019 is largely unchanged from last month’s Oil Market Update Report, but 2020 field production (crude, condensate and NGLs) has been revised up by 0.5 million bpd to 97.6 million bpd in this latest update, again led by the US and followed by Norway, China and Canada.

OPEC production cuts have helped buoy oil prices so far this year, but there is plenty of production ticking up outside of OPEC nations. The growth forecast for 2020 is quite exceptional, climbing by 3 million bpd or more over a period of just nine months, if OPEC+ does not extend or deepen their production cuts next year.

“We a see clear downside risk to 2020 prices due to excessive supply growth. We still believe the market does not recognize the positive effect on crude demand that IMO 2020 will bring. However, if the IMO effect on crude demand is less than expected, OPEC intervention may be needed as early as the first quarter of 2020 to avoid imbalances in the oil market,” Tonhaugen added.

Rystad Energy still believes demand growth globally will improve in the second half of 2019, but the recent exchange of US-China trade tariffs and overall weak manufacturing, exports and trade indicators elsewhere in the world could cap demand growth recovery if we see no trade deal in the immediate future. Hence, the market may send oil prices downward before 2020. At present, only large unplanned outages to the tune of 1.0 million bpd would create a somewhat tight market outlook in the near term.

“Needless to say, the second half of 2019 will be very exciting indeed,” Tonhaugen remarked.