As brand-name retailers nationwide struggle to fill shelves, a crop of online platforms that trade in secondhand wares are poised to profit handsomely from the global supply chain crunch.

The products for sale on sites such as The RealReal Inc., a members-only consignment marketplace for luxury goods, or Poshmark Inc., a mobile app for second-hand apparel, are already manufactured and sitting in people’s closets. This allows them to largely avoid backed-up ports and freight transport, and more importantly, they’re currently available.

Consumers are facing dire warnings to get their holiday shopping done early this year, especially if they’re planning to do it online. Bottlenecks in the global supply chain are posing a new challenge to the e-commerce industry, and out-of-stock items represent a growing concern. According to Adobe Inc., which tracks online commerce, “out of stock” messages on retailers websites are up 172% compared with last year. And many companies are signaling that supply will remain tight through the end of the year, opening an opportunity for secondhand retailers to gain an edge while consumer demand is high.

“This may be the perfect scenario for resale, which relies on inventory already in the seller’s hands,” Roxanne Meyer, an analyst for MKM Partners, wrote in a recent market report. “We believe Poshmark and the resale sector are well-positioned to take market share in Q4 as supply chain issues linger.” With logistics constraints hitting nearly every category and retailer nationwide, sales of new products will likely be restricted, she said.

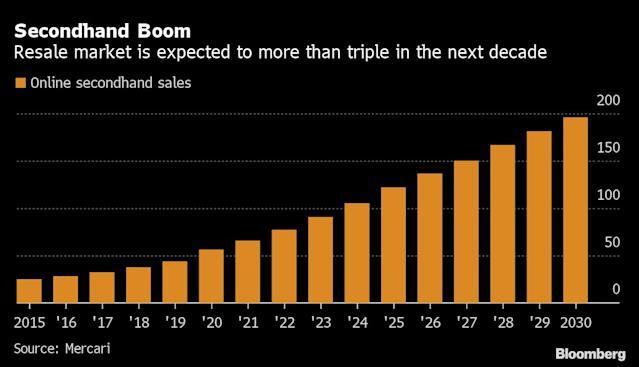

Adobe is predicting a record $207 billion in online spending this holiday season, and resale companies are banking on sharing in the spoils. This year’s secondhand online retail market is expected to top $65 billion, an all time high for the industry according to a survey from Mercari, a secondhand e-commerce site. Mercari’s report showed that three in four people surveyed said they were likely to buy at least one secondhand item this holiday season.

The market for used goods took off long before Covid-19 spurred record consumer demand, leading to shortages and backlogs around the world. Upcycled clothes and accessories have been sold online for decades, but in recent years peer-to-peer platforms such as Poshmark made it much easier for buyers and sellers to connect. That helped turn reselling into a lucrative part of the gig economy. The mostly younger consumers are also drawn to used items for their lower prices and reduced impact on the environment.

Secondhand U.S. retail purchases have reached an all-time high, with 63% of the population selling at least one previously-owned item in the last year, according to Mercari.

Larger online retailers are trying to get in on the resale space, too. Etsy Inc. bought the U.K.-based online platform Depop in July, to tap into a younger and more social-media savvy demographic. Since the $1.6 billion deal was announced, Etsy’s shares have jumped 48%.

Several of the secondhand retailers made splashy public stock listings this year, but have since seen enthusiasm for their shares fade amid market concerns that people will return to in-person shopping as lockdown orders eased and stores reopen. Poshmark, for instance, gained 142% in its trading debut in January, but its shares have since sunk 76%. ThredUp, which offers clothes to borrow or buy, similarly underperformed initial expectations after it went public in March, jumping 43% on its first day of trading before giving up most of those gains in the first month.

The RealReal has faced a similar rocky path since its 2019 IPO and is down 36% this year. Now, analysts estimate revenue will increase substantially in the fourth quarter, projecting the San Francisco-based company will rake in $129 million, up 53% from a year earlier. The RealReal—along with competitors Etsy and ThredUp—will release third-quarter earnings in early November. If the companies give an optimistic forecast for the rest of the year, it could be an opportunity for shares to regain lost ground.

Concerns that consumers would return to in-person shopping as the virus wanes have yet to pan out. A recent report on retail sales from the U.K. showed that in-store sales remain subdued.

Annie Roberts, a 22-year-old Depop seller and shopper from New York, said she will likely turn to the online marketplace instead of relying on firsthand retailers. “I tend to prefer Depop because I don’t have to worry about clothes being out of stock,” she said. “If I see something on a friend, on an influencer, or even at a different store, I know that I will probably be able to find someone who sells it on Depop or at the very least something similar.”