Total warehouse space to hit 33 billion square feet by 2025

The Warehouse Building Stock Database – a comprehensive assessment of the global warehouse industry – showed that in 2020 there were 150,000 warehouses globally, offering roughly 25 billion square feet of space. This figure is expected to rise by 5.2% year on year to 33 billion square feet in 2025. Though North America and Europe have by far the highest number of these installations per capita, warehouse growth in developing countries is set to take off as incomes rise. The shifting of supply chains away from China is also a driving factor in the proliferation of warehouses in fast-developing Southeast Asian economies such as Malaysia and Vietnam. By the end of 2025, the global stock of warehouses will be approaching 180,000, with China, the United States, Japan, India, and Germany accounting for over half of that number.

Our forecasts show that warehouse automation revenues will increase by an average of 11.9% each year from 2019-2024. E-commerce demand rocketed during COVID-19, when the US Census Bureau, for example, estimated that online sales in North America increased by 50%. And much of this shift towards e-commerce is likely to be permanent. In 2020, particular pressure was put on the general merchandise, food and beverage and groceries sectors. This has hastened the pace at which retailers are automating warehousing processes to ensure speed and efficiency and facilitate social distancing. Global warehouse automation revenues in 2020 did in fact dip as the pandemic delayed projects from being completed in the year, and also hit durable and non-durable manufacturing, and the apparel industry in particular. But this temporary reduction in revenues is insignificant compared to the impressive year-on-year revenue growth in the rest of the 2019-2024 timeframe, as is clear from the graph below. Automation companies enjoyed record order intake in 2020 and are sitting on a huge backlog, with big players such as Dematic currently hiring 1,000 new people.

Automated micro-fulfillment: getting close to the customer

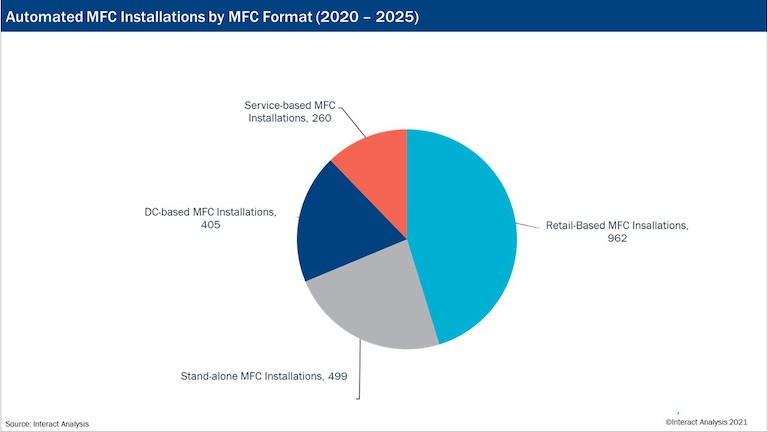

Several market trends in warehousing are set to grow radically in importance. One is automated micro-fulfillment centres (MFCs). Our recent report studied this market, comparing it with centralized warehousing and also exploring how automated MFC formats are likely to change over time.

We define an automated MFC as a goods-to-person picking system of less than 3,000m2. The majority have so far been retail-based, within existing stores, mostly in the grocery sector. Grocery chains have large real estate footprints so setting up MFCs is somewhat easier for them. General merchandise and apparel retailers, on the other hand, tend to operate from large out-of-town warehouse facilities, but face the same pressures as grocery to cope with e-commerce demand and also reduce delivery times. Some retailers will respond by setting up MFCs in existing manual distribution centres (DCs), others will set up stand-alone MFCs in empty high street units and shopping malls. Exotec and Attabotics have already installed a large number of automated MFCs for general merchandise and apparel retailers with many more in the pipeline. Another approach is service-based MFCs from companies such as Fabric. These are built and owned by the automation vendor and offered to customers on an OpEx basis. We predict that 110 automated MFC projects will be installed in 2021.

Automated machinery servicing: unmined gold for OEMs and integrators

The servicing and maintenance of warehouse automation equipment is a lucrative area. Our latest report on this market predicts that revenues for servicing installed automation machinery will see double-digit growth, year on year, from $4.3bn in 2020 to $8.7bn in 2025. The automated equipment servicing market is stable and offers higher margins than machinery sales. And the research shows considerable potential in the market for OEMs and integrators to exploit, with many end-users currently conducting maintenance in-house, or through third parties, and a significant number of them considering it cost-effective to leave their machinery un-serviced. In fact, the potential revenue to be made by an OEM or integrator offering a lifetime service contract on an automation project is equivalent to the CAPEX spent on the installation itself. Meanwhile, the increasing complexity of automation machinery makes good service contracts ever more important.