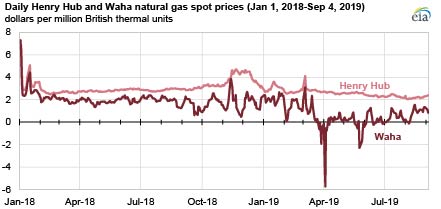

Natural gas spot prices at the Waha hub in western Texas, located near Permian Basin production, settled at $1.55/million British thermal units (MMBtu) on August 15, the highest price since March 2019. This price increase coincides with the 2 billion cubic feet per day (Bcf/d) Gulf Coast Express Pipeline (GCX) preparing to enter service. GCX will provide much-needed additional natural gas takeaway pipeline capacity from the Permian region of western Texas and southeastern New Mexico.

Limited natural gas pipeline takeaway capacity from the region has kept prices very low, or even negative, in recent months. During the first eight months of 2019 (through August 19), the Waha spot price averaged just 65¢/MMBtu. The Waha spot price has been consistently lower than the Henry Hub spot price—the national benchmark price for natural gas. However, in recent days, that differential has significantly decreased, and Waha spot prices posted 59¢/MMBtu lower than the Henry Hub spot price last Thursday, which was the lowest daily differential since January. In comparison, this differential averaged between $2/MMBtu and $3/MMBtu between March and June of this year.

The Permian Basin in western Texas and southeastern New Mexico has seen large increases in natural gas production in recent years. Natural gas produced in the Permian Basin is largely associated natural gas, which is produced as a byproduct of crude oil production. Crude oil takeaway capacity in the region expanded in early 2019; however, GCX is the first addition to takeaway capacity for natural gas since this date. Producers in the region may vent or flare limited volumes of natural gas, and the Texas Railroad Commission regulates these activities.

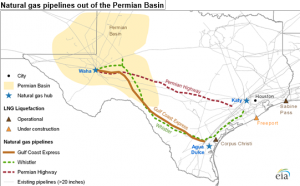

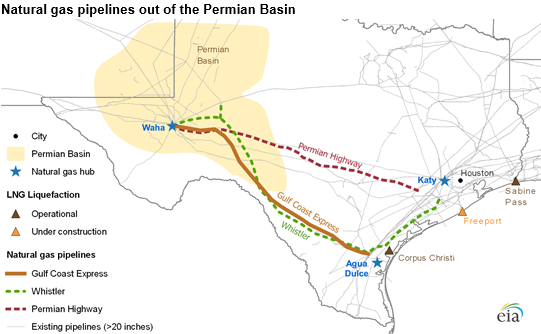

After GCX enters service, several additional new natural gas pipelines are currently planned from the Permian to the Gulf Coast, which may further reduce the Waha-Henry Hub price differential. These projects include

• The Permian Highway Pipeline (2.1 Bcf/d)

• The Whistler Pipeline (2.0 Bcf/d)

• The Permian 2 Katy Pipeline (1.7 Bcf/d to 2.3 Bcf/d)

• The Pecos Trail Pipeline (1.9 Bcf/d)

• The Permian Global Access Pipeline (2.0 Bcf/d)

• The Bluebonnet Market Express Pipeline (2.0 Bcf/d)

• The Permian Pass Pipeline (2.0 Bcf/d)

Of these additional projects, currently only the Permian Highway Pipeline and the Whistler Pipeline have reached a final investment decision (FID) and are currently scheduled to enter service in 2020 and 2021, respectively. These projects plan to serve growing natural gas demand along the Gulf Coast, in particular at liquefied natural gas export facilities.