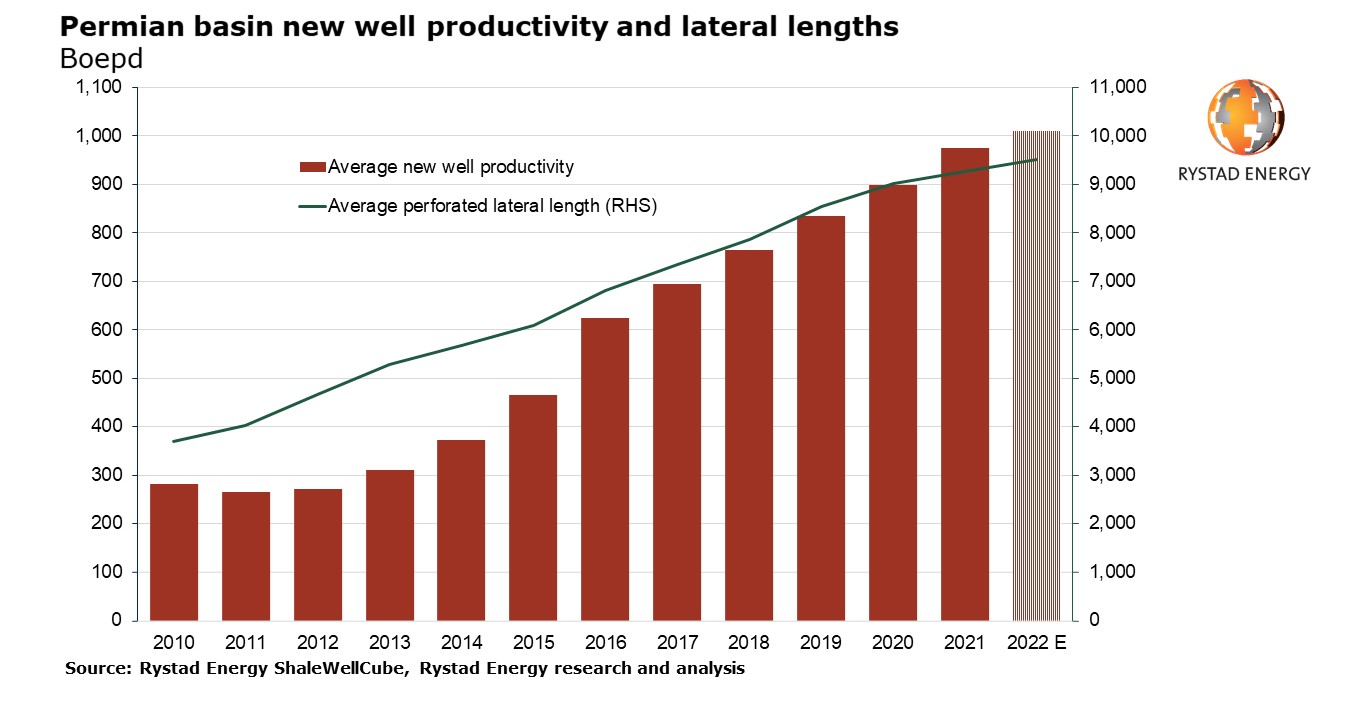

The average productivity of new wells in the Permian Basin is set to hit a record high in 2022, breaching past 1,000 barrels of oil equivalent per day (boepd) due to a surge in lateral well length, Rystad Energy research indicates.

New wells are expected to break the 1,000 boepd threshold in 2022 for the first time on record, rising from the 974 boepd achieved in 2021. Average daily production levels have steadily climbed since 2010, closely aligned with the horizontal well length, which is expected to reach 9,500 feet in 2022.

Operators only started using ultra-long wells, of up to three miles in length, in the Permian in 2014, but their popularity has quickly grown. Their market share has rocketed in recent years, representing only 4% of completions in 2017 versus 18% in 2021. However, considering total completed lateral footage in 2021, these wells accounted for as much as 23% of completions.

The average horizontal well length in the Permian increased to 9,300 feet in 2021, up from 9,000 in 2020, bucking the overall trend of average US shale well lengths, which stayed relatively stagnant. This increase signals a growing trend among operators to favor longer wells with an eye on increased productivity.

“The Permian is now entering a three-mile lateral era. Such long wells were viewed as inferior for their high finding and development costs in some deeper zones just a few years ago, but modern equipment and completion methods allow extended reach wells to spread across the entire basin,” says Artem Abramov, head of shale research at Rystad Energy.

The perforated length of the horizontal section of a well has always been viewed as a critical driver of well productivity and costs. When unconventional development began, horizontal well lengths were short, with most under 5,500 feet, the equivalent of about a mile. As technology and mechanical capabilities have advanced, well lengths have increased, helping new wells be more productive. Well productivity is measured over the first 180 days after a well starts producing oil due to the front-loaded nature of unconventional oil production.

Lateral footage of individual wells has expanded as operators increase efficiency and boost production. Ultra-long wells – typically between 2.5-3 miles long – were widely tested in nearly all US basins between 2016-2018, but these lengths becoming the norm in the industry seemed unlikely.

However, it may be too early to view the increase in ultra-long laterals as an industrywide trend in the Permian. Some key operators contribute to this segment with a disproportionally large weightage relative to their total number of completions. For example, the largest Permian operator, Pioneer Natural Resources, accounted for 12.6% of the basin’s horizontal completions in 2020-2021 – including wells originally completed by DoublePoint Energy, Parsley Energy and Jagged Peak Energy. Yet, Pioneer accounted for as much as 18.6% of completions with a perforated length greater than 12,500’.