There are no hard numbers yet to illustrate the extent to which the Covid-19 pandemic has affected the oil and gas industry’s digitization. However, a Rystad Energy analysis of service companies’ earnings calls reveals a clear growth in cost-saving remote work technologies.

Given the limited options of low-hanging cost savings in the current downturn, operators and suppliers are looking towards digital technologies to realize cost efficiencies. For operators whose cash balances are not under short-term strain, the low oil-price environment is an ideal testing ground for new technologies as the opportunity costs of implementing these are lower.

Recent earnings calls have given us a taste of how digital technologies have fared during the start of the downturn. Despite recent market events that have forced operators and suppliers to turn their focus towards cash conservation, development on this digital revolution still seems to be relatively robust.

In fact, both Schlumberger and Halliburton noted in their earnings calls for the first quarter of 2020 that the current downturn could accelerate the adoption of digital technologies. This is especially true for technologies that enable remote operations, which remains an area where great cost efficiencies could be realized with more efficient operations.

Covid-19 has already accelerated remote operations due to the movement restrictions imposed in many countries to limit the outbreak. Schlumberger recently deployed its DELFI platform for Woodside so that the operators’ asset team and geoscientists could have full access to their data while working from home.

Schlumberger, in its first quarter earnings call, underlined intentions of doubling down its digital strategy in the years ahead, with over 60% of the OFS provider’s drilling operations in March being conducted remotely. At a more general level, Covid-19 has also paved the path for key decision makers to get more first-hand experience with digital tools. This could eventually increase their willingness to fully buy in on the digital revolution in other parts of their companies.

Halliburton, similarly, noted during its first-quarter earnings call that demand for cloud infrastructure services saw an uptick in April 2020. In late February, Halliburton helped Pertamina deploy a large portion of its processes and applications to the iEnergy cloud, which has allowed for well data to be structured and analyzed to improve drilling performance, increase production and allow for better data-driven decisions along the well life-cycle.

National Oilwell Varco (NOV), one of the largest suppliers within the drilling tools and services segment, also reported updates on its digital technologies in the latest earnings call. Using its TrackerVision augmented reality technology, which streams real-time audio and video, NOV is able to provide instructions on rig repairs remotely.

Despite the growth in remote work digital solutions, not all is well for suppliers of digital technology, warns Holmedal.

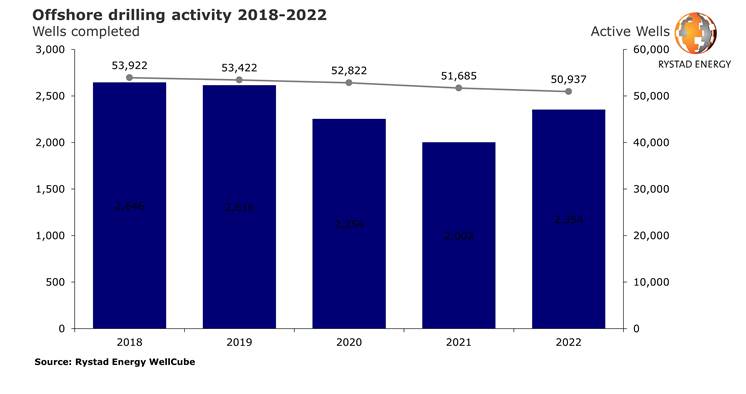

“Our activity forecast for 2020 indicates that spending on new technologies in the well services market will come under significant pressure. We expect the number of wells drilled globally this year to drop by 21% from 2019, ending up at around 56,000 wells, with 2,200 of the wells being drilled offshore,“ Holmedal notes.

Service companies also warned of a downturn, with some already taking action such as furloughing some employees related to research and development and cutting back on sales, general and administrative expenses.

Schlumberger noted in its first quarterly report for 2020 that discretionary spending and activity was cut towards the end of the quarter in several markets. Lower drilling activity, more shut-ins and stretched balance sheets among operators could hurt spending on digital technologies going forward.

Baker Hughes noted in its earnings call that its Digital Solutions business, which also covers segments outside of oil and gas, saw revenues and margins come under significant pressure during the first quarter.