Ti and Upply’s European Road Freight Rate Benchmark Q1 2020 shows that although road freight rates are down, they have held reasonably firm in the face of the Covid-19 pandemic.

• The Q1 2020 European Road Freight Rate Benchmark was €1,099, marking a drop of 0.8% against the previous quarter

• Substantial demand-side shocks were felt in March

• Capacity was cut heavily, counter-balancing the demand-side slowdown

• 28 out of 34 lanes showed greater volatility than in the previous quarter

Although in the first two months of the year the demand side was stable, but relatively muted, the situation on the ground changed drastically towards the end of the quarter.

As a result of Covid-19, most demand eroded, but there were sector-by-sector variations. Production in the automotive sector largely came to a standstill in mid-March, eradicating significant road freight volumes related to the sector. There were violent jumps in demand for grocery-related transport early on as a result of panic-buying, which later subsided. Chemical and pharmaceutical production have seen sustained higher demand levels throughout the crisis, but the fashion-retail and industrial sectors have suffered.

Meanwhile, hauliers were fast to cut capacity from the market, which caused particular shocks on lanes open to cross-trade. Border controls designed to cut passenger transport had an adverse effect on road freight operations throughout the continent. The Saudi-Russia oil dispute that weakened prices has filtered through to European diesel prices, softening the blow somewhat for hauliers’ bottom lines.

Thomas Larrieu, Upply’s Chief Data Officer, explains, “Due to Covid-19, volumes in Europe collapsed in March. While the impact on the market average price is unclear, the price volatility strongly increased. The remaining question is: how the market will react post-lockdown? As many small carriers closed business in the past weeks, we need to follow carefully the balance between offer and demand to foresee the likely rates increase.”

Andy Ralls, Quantitative Analyst at Ti, comments: “Q1 began with continued slow growth in economic activity, but this soon turned on its head. Demand- and supply-side shocks have pulled prices in opposing directions, meaning rates overall were more volatile in the first quarter of 2020. As demand is set for a bumpy recovery whilst capacity returns to the market, we expect this trend to continue in the months ahead.”

Individual lanes react differently to Covid-19

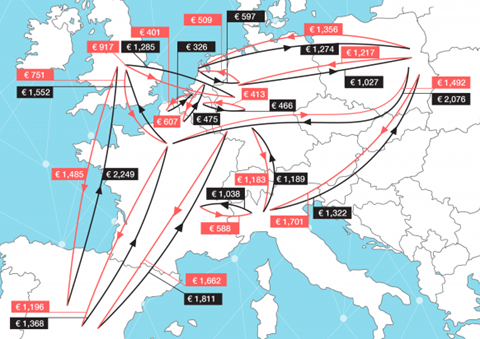

The report investigates rate changes on major international routes. On France – Spain, rates fell as demand collapsed but capacity could not cut as quickly. These capacity cuts were not seen to as great an extent on the Poland – Germany lane, where border congestion further complicated matters. Meanwhile, continued weak German export trade with the rest of the world is contributing to a wider imbalance in Germany – Netherlands rates.

Shippers paid an average rate of €1.61/km for road freight services in Q1 2020. Birmingham-Madrid and Duisburg-Madrid stand out as some of the cheaper lanes covered at €0.80/km and €0.91/km.

The biggest price change was seen on the Paris – Warsaw fronthaul trade lane, with rates up 7.5% year-on-year, with higher demand momentum, border congestion and cost increases playing a part.

Italian lanes showed a larger price drop than the European average in Q1, but rates jumped higher in March as a result of capacity cuts.