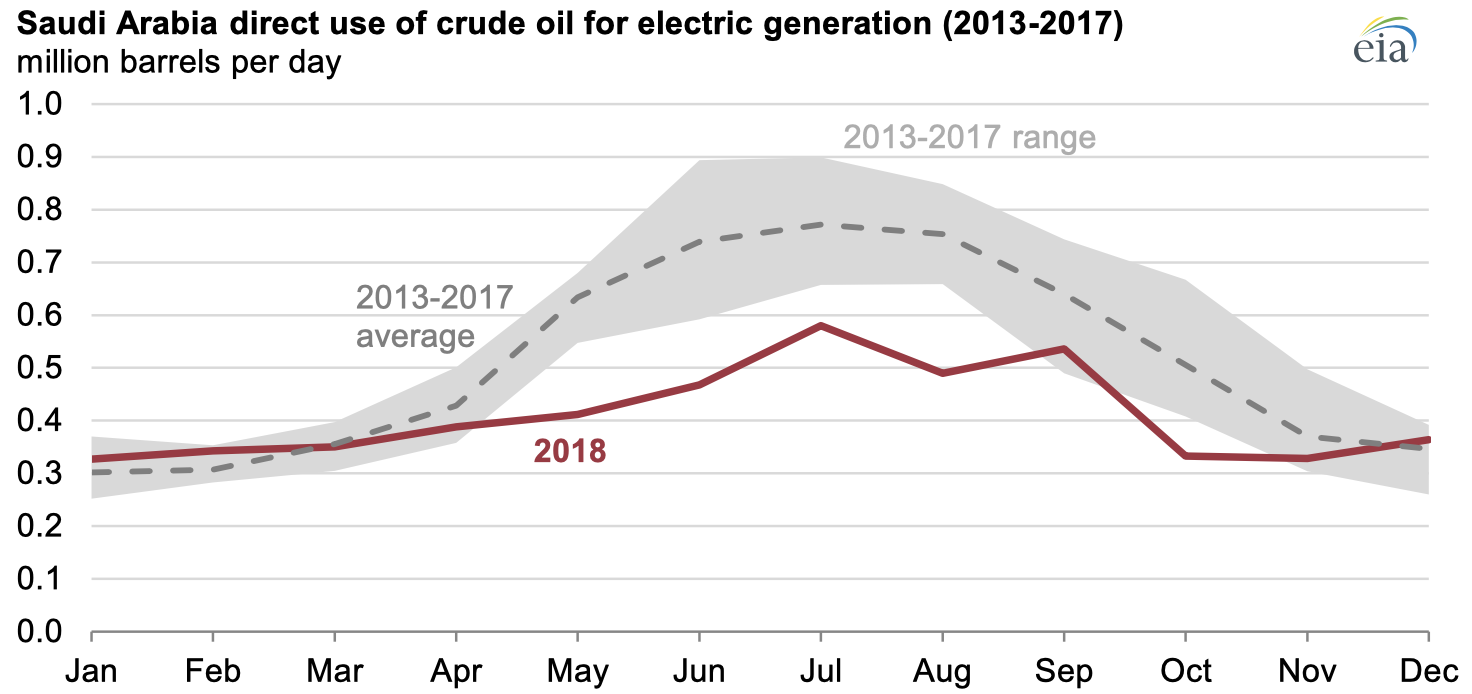

In 2018, Saudi Arabia reported burning an average of 0.4 million barrels per day (b/d) of crude oil for power generation, the lowest amount since at least 2009, the earliest year that data are available from the Joint Organizations Data Initiative (JODI). Saudi Arabia burns considerably more crude oil directly for power generation than any other country. Between 2015 and 2017, Saudi Arabia used more than three times the amount of crude oil for power generation than Iraq, the second-largest user of crude oil for power during those years.

Saudi Arabia relies on crude oil and other fossil fuels, such as petroleum products and natural gas, for power generation. During the summer months, Saudi Arabia’s electricity consumption increases as domestic demand for air conditioning rises. Saudi Arabia’s direct crude oil burn for power generation reached a record high during the summer of 2015, averaging 0.9 million b/d from June to August. In comparison, direct crude oil burn in the summer of 2018 was 41% lower at 0.5 million b/d.

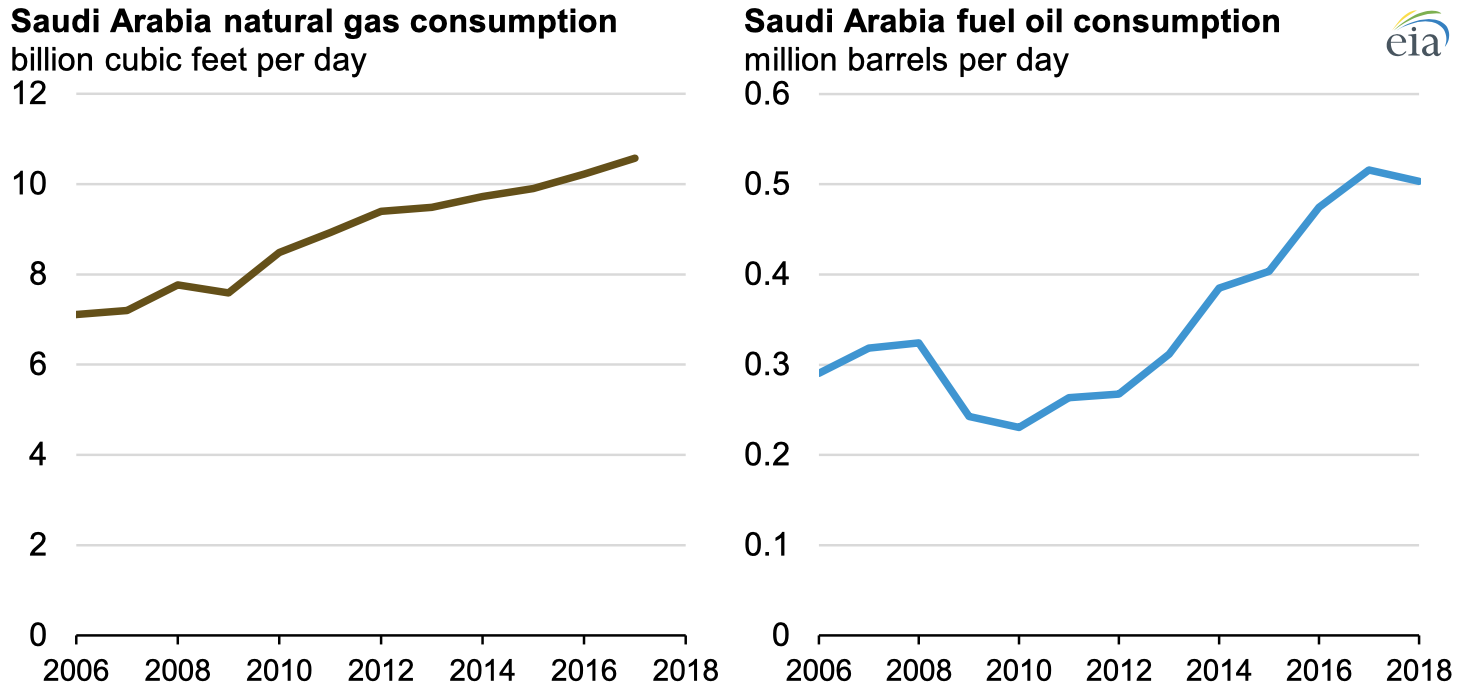

Natural gas processing capacity is also increasing. Consumption of natural gas in Saudi Arabia reached 10.6 billion cubic feet per day in 2017, the latest year for which data are available.

In addition to natural gas, Saudi Arabia has also been using fuel oil as a partial replacement of crude oil in power generation. Saudi Arabian fuel oil consumption has increased despite fuel oil consumption declining in most regions of the world because of environmental concerns and competition with other fuels. Some trade press reports indicate that one potential side effect of the upcoming changes to the sulfur limits in marine fuels in 2020 is that the stranded high-sulfur fuel oil could be sent to Saudi Arabia to further replace crude oil in power generation.

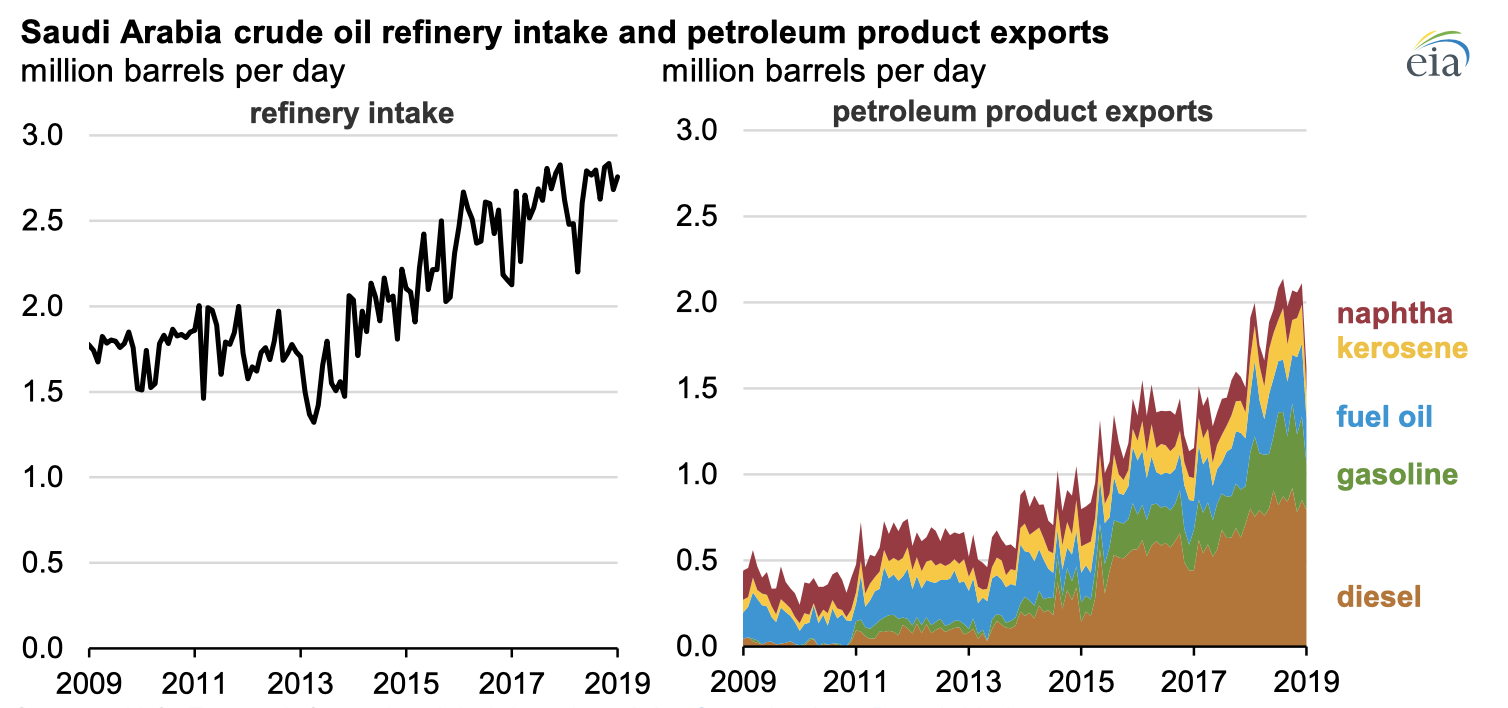

With less crude oil directly used for power generation, more crude oil is available for Saudi Arabia’s refining and exports. For many years, Saudi Arabia has worked to increase its domestic refinery capacity and is currently able to process 2.9 million b/d of crude oil. Crude oil refinery runs averaged 1.8 million b/d in 2009, and they subsequently rose to an average of 2.6 million b/d by 2018, according to JODI data. As a result of increased refinery runs, Saudi Arabia also increased the amount of petroleum products it could export and most recently exported an average of 2.0 million b/d of petroleum products in 2018.

Saudi Arabia crude oil refinery intake and petroleum product exports

Principal contributors: Rebecca George, Emily Sandys