From neighborhood gas stations to America’s interstate highway system to the friendly skies, soaring fuel costs amid dwindling supplies look set to further squeeze consumers and businesses alike this summer.

Across the board, fuel prices are at or near records. Average retail gasoline prices have remained firmly above $4 a gallon since early March, while diesel continues its record rally. Meanwhile, New York wholesale jet fuel prices have come off historic highs seen last month, but at almost $7 a gallon, that’s still more than double the cost prior to Russia’s invasion of Ukraine.

While elevated gasoline prices hit consumers directly, expensive diesel is costly to the economy because it’s deeply embedded in just about every sector.

“Diesel is in everything,” Mark Finley, a fellow at Rice University’s Baker Institute for Public Policy, said in an interview. “The diesel price shock will be longer-lived because it will take time for systems to digest and pass through.”

That’s an ominous warning. Considering diesel is the lifeblood of the nation’s transportation system, soaring prices for shippers risk being passed on to American businesses and consumers at a time when overall inflation is running at the hottest pace in four decades. Everything from building materials to food to general merchandise will be impacted because of increased costs to move merchandise around the country and operate farm equipment.

The pain at the pump has already been a big headache for the Biden administration, and the situation could only get worse with prices running way ahead of crude oil.

Refining Quandary

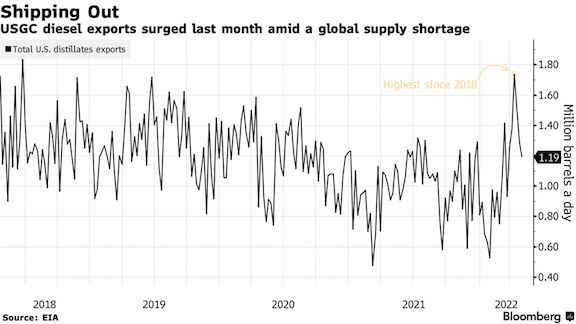

Refineries are facing a tough choice as they seek to meet demand for both road fuels and jet ahead of the peak travel season. Gasoline production is under pressure from higher-margin diesel and jet fuel, which they have prioritized in part to enable massive exports to satiate global demand.

While refiners on the U.S. Gulf Coast were able to raise run rates to their highest seasonal levels in more than a decade over the past month or so, they have failed to prevent gasoline stockpiles from slipping further below the five-year average.

At the same time, refiners are generating some of the highest profits on record. The U.S. diesel crack spread—which measures the profitability of turning crude into diesel—surged to a fresh high last week, excluding the rare blip when West Texas Intermediate futures turned negative in the wake of the coronavirus pandemic.

Diesel’s squeeze on gasoline is likely to continue this summer, given it’s the fuel the rest of the world lacks the most as Russia’s war in Ukraine drags on. And domestic demand remains robust.

Inventories of diesel on the East Coast slumped to the lowest on record in the latest weekly data, according to the Energy Information Administration. That helped send overall U.S. stockpiles of distillates—comprised mostly of diesel used as a transportation fuel as well as heating homes—to a fresh 14-year low.

Given the oil market was already tight prior to Russia’s attack, the situation likely won’t improve anytime soon, especially with prices trading over $105 per barrel. An official European Union ban on Russian crude could contribute to even higher prices.

All this comes as families plan their summer vacations, posing a balancing act for consumers.

“We are expecting prices to rise this summer,” Devin Gladden, a spokesperson for AAA, said in an interview. Consumers “will have to balance travel desires with other concerns.”

On the Road

While American consumers may be grumbling about paying more at filling stations, there’s little indication that U.S. demand will weaken significantly two years after the pandemic disrupted social and leisure activity. Economists expect the urge to travel will take on a fevered pitch in the coming months, something industry executives are already seeing playing out.

“We think we will probably have the biggest leisure summer we’ve ever had only to be—only to surpass last summer,” Christopher Nassetta, chief executive officer of Hilton Worldwide said on the company’s earnings call earlier this month.

Credit-card data support this. Bank of America Corp. credit and debit card spending in April at airlines and travel agencies was 60% higher than a year ago, according to Bank of America Institute data, painting a healthy picture of the consumer.

As such, implied U.S. gasoline demand has reverted to the rising seasonal norm, easing earlier concerns that high prices may have deterred some drivers in March. The U.S. EIA forecasts gasoline demand to exceed 2020 levels this summer while still trailing 2019. The latest EIA report showed gasoline stockpiles tumbled for a fifth straight week.

Demand Destruction

Rising pump prices are likely under the current supply shortage and will remain volatile amid the war in Ukraine. The question remains at what point does the hit cause the consumer to cut back.

“It’s hard to say at what price level demand destruction will occur,” John Auers, executive vice president at oil consulting services firm Turner, Mason & Co., said in a phone interview. “That’s an open question, but it will happen along a continuum.”

Read more: Why gasoline price shocks go deeper than just crude oil

Airlines are echoing the strong demand sentiment. In an interview in April, Delta Air Lines Inc. Chief Executive Officer Ed Bastian said “for the last month” it had seen record-high sales and booking activity for travel through early summer. The company said it would have no trouble raising fares to cover fuel prices in the second quarter and possibly through the summer.

Ultimately, the breaking point for consumers may lie in the ongoing shocks of the diesel market.

“Increased last-mile delivery costs will be passed onto the consumer quickly,” said John Kilduff, co-founder at Again Capital LLC. “As the economy gets tamped down because of fuel surcharges and pump prices, it will start to hit demand for delivery of consumer goods, so diesel demand destruction is a daisy chain.”