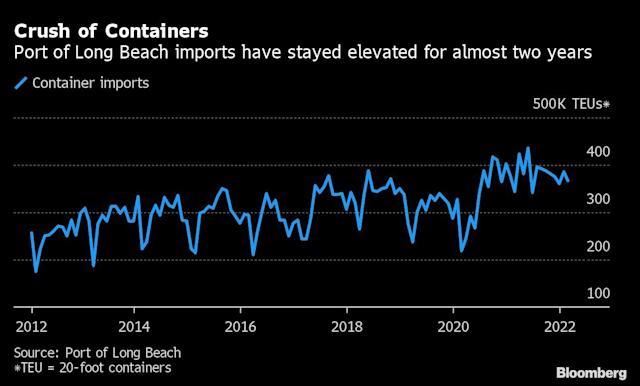

The head of the U.S.’s second-busiest container seaport said he has seen no letup in import volumes, though there may be some slowing in coming months as high inflation and growing services spending threaten to temper consumer demand for goods.

In an interview on Wednesday, Port of Long Beach Executive Director Mario Cordero said the March total for containers moving through the port is looking “pretty good” and will be announced in the next couple of days.

Meanwhile, lockdowns in Shanghai, Shenzhen and other cities in China have led to growing bottlenecks off its coast, threatening more delays in merchandise shipping and higher freight rates in coming months. A potential whiplash of goods heading into the U.S. risks another snarl as factories and logistics operations emerge from those shutdowns.

Cordero said he’s watching the Covid-19 situation in China closely as the Asian country struggles with an outbreak that’s locked down two major cities. Cordero said he’s keeping an especially close eye on Shenzhen’s Yantian port, as many of its containers transit through Southern California gateways.

“We’re going to monitor this for next couple of weeks to see how extensive that shutdown is” and whether China can control the outbreak, Cordero said. “We’ll go from there, but I myself, yes, I am concerned.”

Cordero said the surge in inflation could cool U.S. consumer demand, though he hasn’t seen evidence of that at the port yet. In addition, he’s watching for Americans to boost spending on services and entertainment, potentially hitting spending on goods, while Russia’s war in Ukraine is also a “disruptor to the global supply chain.”

Contract Optimism

Cordero said he’s “optimistic” that upcoming talks between dockworkers and their employers will be resolved without any major disruption to operations, because both sides will realize it’s in everyone’s interest to reach a deal.

While he’s isn’t directly involved in the talks, Cordero said his impression from speaking with the parties is that he doesn’t expect a repeat of the situation in 2014-15, when talks dragged on for months, causing shipping bottlenecks.

“The times today will require both both parties to sit down at the table and iron out their differences in a reasonable period of time,” Cordero said. “There’s too much at stake for either side to kind of leverage this.”

Talks to hammer out a new labor contract are set to begin in May for about 22,000 West Coast dockworkers—represented by the International Longshore and Warehouse Union—and the ocean carriers and port operators, represented by the Pacific Maritime Association, ahead of the current contract expiration on July 1.

Two years of record household spending have seen cargo loads hammer ports with delays and congestion—creating a windfall of record profits for the container lines while giving dockworkers extra bargaining power given their influence over global trade. While wages and benefits are frequent sticking points, the employers’ right to automate some operations could emerge as a particularly thorny issue.

Market Share

U.S.-bound mega vessels have increasingly turned to the East Coast since the second half of 2021, when supply-chain disruptions peaked on major transpacific routes and contributed to historic delays at L.A.-Long Beach.

It isn’t a trend he’s concerned about. Cordero said the increase in goods heading to East Coast and Gulf of Mexico ports has been an “ongoing dynamic” that preceded the pandemic. He said the volume of cargo coming through Los Angeles and Long Beach is still projected to rise this year.

While eastern U.S. ports like Charleston, South Carolina, may be experiencing record volumes, they are also seeing congestion. Big importers may be spreading out shipments to hedge in case of a disruption due to the labor negotiations.

“Shippers, they’re placing their bets. And for those who think that there’s going to be prolonged union negotiation, you know, they have to make their business decisions,” Cordero said. But “it’s not such an easy calculation now. Just because you go through the Panama Canal and you go to Charleston or Savannah doesn’t necessarily mean that now you’re not going to wait there.”

“This gateway will always be a competitive gateway,” Cordero said.