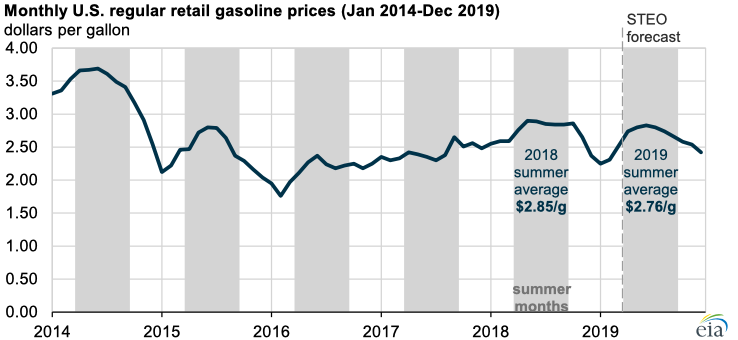

In the April 2019 update of its Summer Fuels Outlook, EIA expects the retail price of U.S. regular-grade gasoline will average $2.76 per gallon (gal) during the summer from April through September 2019. EIA’s expected average is down 3% from the 2018 summer average of $2.85/gal, mainly because EIA expects crude oil prices will be lower than last summer. EIA publishes the Summer Fuels Outlook as a supplement to its monthly Short-Term Energy Outlook (STEO).

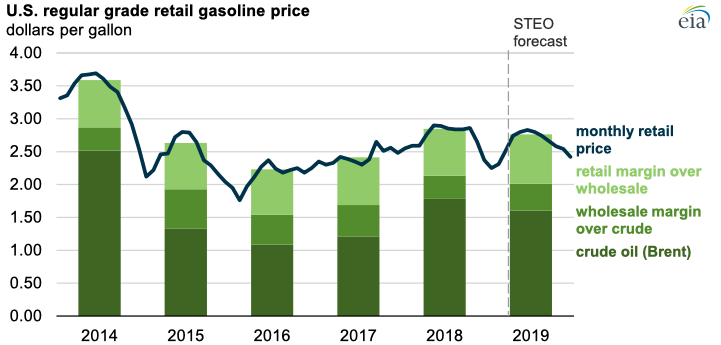

Because gasoline and diesel taxes and distribution costs are generally stable across the United States, changes in U.S. retail gasoline and diesel prices are generally driven by changes in crude oil prices. EIA forecasts the Brent crude oil price to average $67 per barrel (b) this summer, the equivalent of $1.60/gal, compared with an average of $75/b, or $1.78/gal, last summer.

EIA expects that domestic U.S. refinery production of motor gasoline, including gasoline blendstock output, will be 8.6 million barrels per day (b/d) this summer, or 80,000 b/d higher than last summer. EIA forecasts that the United States will be a net exporter of total gasoline, including blending components, during the summer months and export an average of 87,000 b/d from April through September in 2019. If realized, this summer would be the first time since 1960 that the United States exports more gasoline on average than it imports during the summer months.

EIA forecasts U.S. motor gasoline consumption during the summer will average 9.5 million b/d, up 29,000 b/d (0.3%) compared with last summer and about the same as the record set in summer 2017. EIA projects that gasoline inventories will total 232.0 million barrels at the end of September 2019, or about 7.6 million barrels lower than last year's level.

U.S. retail diesel fuel prices projected in the Summer Fuels Outlook average $3.09/gal this summer, down from $3.22/gal last year. EIA expects that U.S. consumption of distillate fuel, including diesel fuel and heating oil, will average 4.1 million b/d this summer, or 20,000 b/d more than last summer. EIA expects slower growth in the primary drivers of distillate consumption, including economic growth, industrial output, international trade activity, and crude oil and natural gas drilling activity, all of which contribute to higher trucking activity. However, the International Maritime Organization’s (IMO) new fuel regulations (IMO 2020) are expected to cause some uncertainty in the diesel market this summer.

More information on EIA’s forecast for petroleum markets this summer is available in the Summer Fuels Outlook.

Principal contributor: Matthew French