According to Container xChange's June Forecaster, the persistent decline in container prices is being accompanied by resurging supply chain disruptions such as the Panama Canal drought, labor strikes on the US West Coast, and a technical recession in the Eurozone.

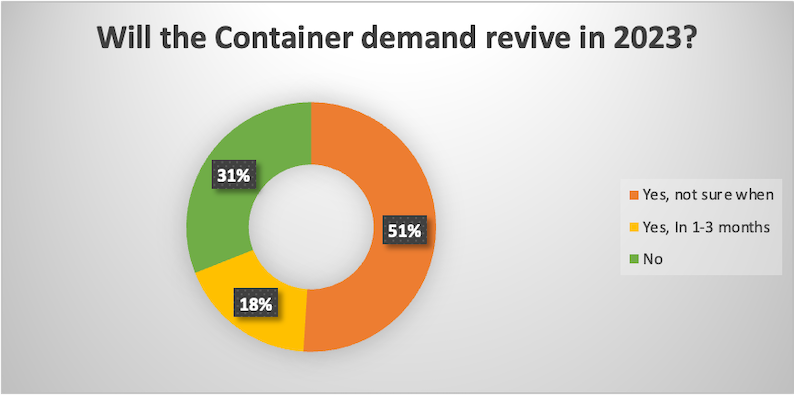

The forecaster also predicts a further slide in average container prices in the coming weeks, with no signs of container demand revival. The sentiment is reflected in a survey that Container xChange recently conducted (in May 2023) with the global freight forwarding community. About 69% of respondents (406 sample size) are hopeful of a container demand bounce back this year in 2023. Only 18% are hopeful of this revival in short term (1-3 months). And about 51% are “guestimating” without a clear outlook of timeline for container demand bounce back.

“The supply-demand imbalance worsens with upcoming vessel deliveries and low scrapping rates. Spot rates are at pre-pandemic levels in most trades, and contract rates are sliding. Coupled with low demand, the industry continues to grapple with overcapacity of containers and vessel capacity. Now we have labour disruptions and the Panama Canal drought, which in normal circumstances would lead to an uptick in freight rates as they absorb effective capacity, but any significant price effect is now highly doubtful in the current market.” Shared Christian Roeloffs, cofounder and CEO, Container xChange.

“For shippers this means that supply chain reliability will deteriorate again, potentially leading to a "pull forward" on orders. This in turn will likely "flatten out" any peak season and further decrease the likelihood of a freight rate increase in the second half of 2023,” Roeloffs added.

No signs of container demand yet for peak season

Container prices generally surge during the preparation for the peak season. So far, these prices have failed to pick up. A study of average container prices on the Container xChange platform indicates a disappointing revival of demand.

Below is a table that compares average container prices across some of the busiest ports in the world from the Container xChange platform. The prices have fallen to the lowest levels in the last three years of comparison. Clearly, the data indicates poor demand for containers so far till June.

20 ft DC cargo-worthy average prices |

JUNE 2021 |

JUNE 2022 |

JUNE 2023 |

SHANGHAI |

2197 |

2140 |

1263 * |

NINGBO |

2298 |

2238 |

1289 |

SINGAPORE |

2142 |

2039 |

1118 |

SHENZHEN |

2106 |

2177 |

1240 |

GUANGZHOU |

1094 |

2322 |

1312 |

LOS ANGELES |

2366 |

1599 |

1667 |

LONG BEACH |

3865 |

1955 |

1431 |

NEW YORK |

3525 |

1731 |

1175 |

* Indicates decrease in average prices from the last month

New York witnessed the average price of 20 ft dry containers to reach $6500 in June 2021, which has now crashed by 82% to reach at $1175 in June (1st week) 2023.

Similarly, Long Beach port saw average prices reaching a peak at $4118 in the beginning of August 2021, which has reduced by 65% to reach $1430 in May 2023.

This persistent fall of average container prices comes at a time when the shipping industry prepares for a ‘supposed peak season’.

Average Container prices expected to fall further

The average price trends of subsequent months from 2022 indicate that, these prices further declined in the months of July – December at majority of these ports in that year. If the same trend continues, these prices could further fall.

“There are enough and more reasons to be pessimistic. With the peak season coming, the industry sentiment is negative. The industry is waiting for a demand comeback which doesn’t seem anywhere on the horizon.”

Bottom of spot freight rates reached?

"In a highly competitive environment such as container shipping, the minimum offer price tends to gravitate towards the level of variable costs. In the case of container transportation, variable costs have surged by approximately 15-25% since 2019, depending on the trade lane" remarked Christian Roeloffs, CEO and co-founder of Container xChange.

"Consequently, the lower limit of freight rates offered by carriers has also increased by 15-25%. This poses challenges for shippers who now face higher variable costs for transporting cargo. Despite the significant decline in average container rates from 2021 to 2023, reaching almost 85% reduction, the underlying variable costs remain elevated—which makes a significant additional and sticky decrease in spot freight rates unlikely while contract rates still have room for further depreciation.”

Retail Sales lagging, US imports slump

According to the National Retail Federation (NRF), US retail sales are slowing, and US container imports are on track to drop by more than 20% in the H1 2023.

“Both the US and Eurozone markets are experiencing disturbances contributing to a significant loss in consumer confidence, creating a ripple effect. Since the pent-up demand observed in late 2021, the industry is waiting for a 'demand comeback', which seems less likely in the coming peak season. Ofcourse there will be some demand, but rather subdued.” Added Roeloffs.

Eurozone ‘Technical’ Recession

“The impact of inflation on the global supply chain can be significant and wide-ranging. Rise in input costs and costs of financing, change in consumer behaviour and changing trade behaviours will lead to a ripple effect on global supply chains, impacting the demand for certain products or industries. Business will need to adapt their production levels, inventory management, and distribution strategies accordingly,” added Roeloffs.

"With consumer demand remaining persistently sluggish for the peak season, sticky inflation levels are poised to exert an additional detrimental effect on demand." Roeloffs concluded.

_-_127500_-_af2475051b08444da3db9b8b61ad95cfda3dfaef_yes.jpg)