China’s announcement of military drills around Taiwan as US House Speaker Nancy Pelosi visits the island is creating ripple effects across global supply chains, prompting detours and delaying energy shipments.

Gas suppliers are rerouting or reducing speed on some liquefied natural gas vessels currently en route to North Asia, according to people familiar with the matter. Shipments to Taiwan and Japan this weekend will be affected, said the people, who requested anonymity as the information isn’t public.

China, which regards Taiwan as part of its territory, condemned Pelosi’s visit and said its military exercises would include “long-range live firing” near Taiwan starting as soon as Tuesday evening, as well as more drills encircling the island from Aug. 4. Early Wednesday, state broadcaster CCTV said China had begun joint Navy and Air Force maneuvers in the region.

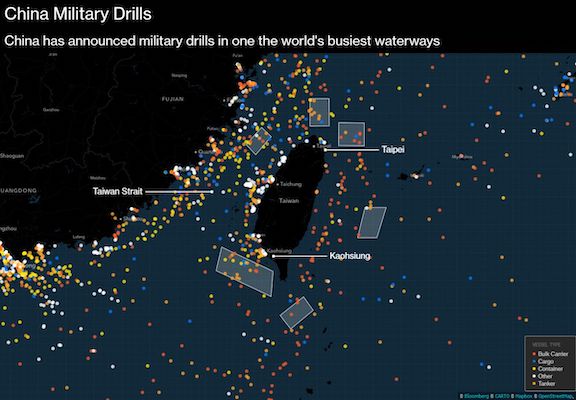

Local branches of China’s maritime safety administration have issued multiple warnings for ships to avoid certain territories, citing the military exercises. A notice from the regulator in Fujian, the province along the Taiwan Strait, said ships were banned from sailing into the areas where exercises will be conducted from Thursday to Sunday.

Taiwan’s Maritime and Port Bureau warned ships to find alternative routes to access and depart from seven major ports on the island during China’s drills, according to the Apple Daily.

Ship managers and shipowners said traffic overall through the Taiwan Strait was normal on Wednesday, and consulting firms reported little impact for oil tankers in the region.

But as China ramps up military activity and bans take effect, shippers may need to reroute vessels around the eastern side of the island, rather than through the busy waterway between mainland China and Taiwan. That will create delays of about three days, according to shipbrokers.

“If there is live firing in the part of the straits that are used for navigation, then tanker traffic is likely to divert,” said Anoop Singh, head of tanker research at Braemar. He added, however, that “it is likely counterproductive economically for China to close navigations through the straits.”

While the disruptions could exacerbate a shortage of LNG amid an energy crunch, delays of a few days aren’t uncommon. Shippers often face typhoons at this time of year that create similar disruptions.

The Taiwan Strait is a key route for supply chains, with almost half of the global container fleet passing through the waterway this year, according to data compiled by Bloomberg. However, only about 14% of China’s oil and gas vessels have transited the strait this year, according to analytics firm Vortexa. Smaller vessels or those with shorter voyages are more likely taking that route, while bigger oil tankers sail east of Taiwan.

The military exercises are scheduled to end by next week, and shippers and analysts will be watching to see if it blows over quickly.

“We might be concerned if the drills become longer and more intense to impact supply chains, but there is no sign of that happening now,” says Huang Huiming, a fund manager at Nanjing Jing Heng Investment Management Co.