Excerpts from the Wood Resource Quarterly WRQ - 32 Years of Global Wood Price Reporting

Global Timber Markets

With falling sawlog prices throughout the world, the Global Sawlog Price Index (GSPI) took a hit in the 3Q/19 and had its third largest q-o-q decline in ten years.

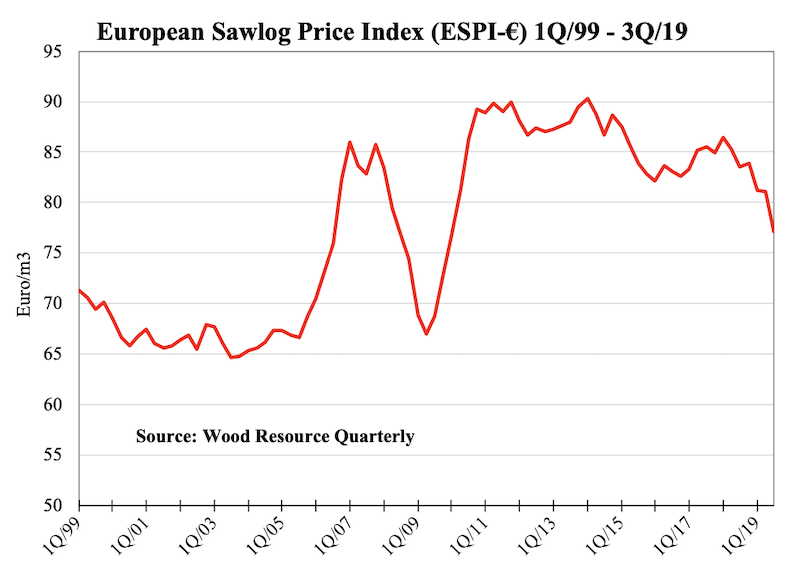

The European Sawlog Price Index (ESPI), which has been in steady decline for two years, fell another 5.0% in the 3Q/19, as reported in the latest issue of the WRQ.

Global Pulpwood Prices

Prices for softwood pulplogs and wood chips either remained unchanged or declined in the 3Q/19 compared to previous year. The biggest price reductions were seen in Austria, Germany and Sweden. The only region with higher prices in the 3Q/19 was Western Canada, where pulplog prices increased by 10% from the previous quarter. The Softwood Fiber Price Index (SFPI) fell by 2.2% q-o-q in the 3Q/19 and hit its lowest level in two years.

The Hardwood Fiber Price Index (HFPI) has been fairly stable over the past two years. In the 3Q/19, the HFPI experienced a slight decline from the previous quarter but increased about a one percent from the 3Q/18.

Global Pulp Markets

Pulp prices have continued their decline that started in the 4Q/18. In October, the NBSK price in Europe ranged from $820-850/ton, down from $1300/ton in October last year. With pulp inventories coming down to levels similar to last year, resistance to further price reductions is becoming stronger.

Global Lumber Markets

Russia has surpassed Canada to become the world’s largest exporter of softwood lumber in 2019 and is on track to ship almost 32 million m3 of lumber this year, representing 23% of globally traded lumber.

Lumber production has fallen in both the US and Canada in 2019 because of disappointingly low activity in the US housing market and meager demand for North American lumber in overseas markets.

Lumber import prices to China have fallen for three consecutive quarters and in the 3Q/19 hit their lowest level since 2016.

Germany’s exports of softwood lumber is likely to reach a ten-year high in 2019. The biggest increases in shipments have been to China, the US, the UK and India.

The gross margins for lumber producers in Finland, as reported in the WRQ, have fallen more rapidly than those of their Swedish competitors during 2018 and 2019.

Global Biomass Markets

The European Pellet Price Index (EPPI), a weighted import price for industrial pellets in Europe, has trended upward over the past two years to reach over €160/ton in 3Q/19.

North America exported 2.5 million tons of pellets in the 3Q/19, representing a 6% increase from the 3Q/18. The almost 1.8 million tons exported from the United States to Europe in the 3Q/19 was the highest volume on record.

Wood Resource Quarterly (WRQ). This 56-page report, established in 1988 and with subscribers in over 30 countries, tracks prices for sawlog, pulpwood, lumber & pellets worldwide. The WRQ also reports on trade and wood market developments in most key regions around the world.