A Dun & Bradstreet and E2open Perspective on the Ripple Effect of Ever Given Blocking the Suez Canal and Best Practices for Building Supply Chain Resilience

On Tuesday, March 23, the Ever Given, 193 feet wide vessel, ran aground in the Suez Canal. While the vessel was freed yesterday, the ripple effect of its lodging in the Canal will have continued ramifications for global supply chains in the weeks to come as global trade resumes, goods start to be unloaded at destination ports and suppliers look to replenish shortfalls in essential materials that threatened downstream production and manufacturing of consumer goods.

The Suez Canal incident gives us yet another reason for businesses to invest in data and technology to create an agile, geographically dispersed supply chain that can quickly pivot during unexpected events.”

– Brian Alster, General Manager, Third-Party Risk & Compliance, Dun & Bradstreet

“While considerable attention has focused on the economic value of cargo trapped on vessels and their inability to move through the Suez Canal, the financial impacts on downstream production that depend on the timely delivery of these materials is magnitudes greater. For instance, the delay of an inexpensive but crucial automotive part en route from China can prevent the sale of the entire vehicle in Germany.

The ability to peer inside containers, understand downstream business impacts of transport delays and systematically take corrective actions, provides a distinct competitive advantage for global businesses.”

– Pawan Joshi, Executive Vice President of Product Management and Strategy for E2open

Impact On Global Supply Chains – By The Numbers:

According to industry data, it is estimated that 12 percent of the world’s seaborn trade and 30 percent of global container traffic passes through the Suez Canal annually, with approximately 50 container ships passing through every day, accounting for an estimated $400M in cargo flowing through each hour.

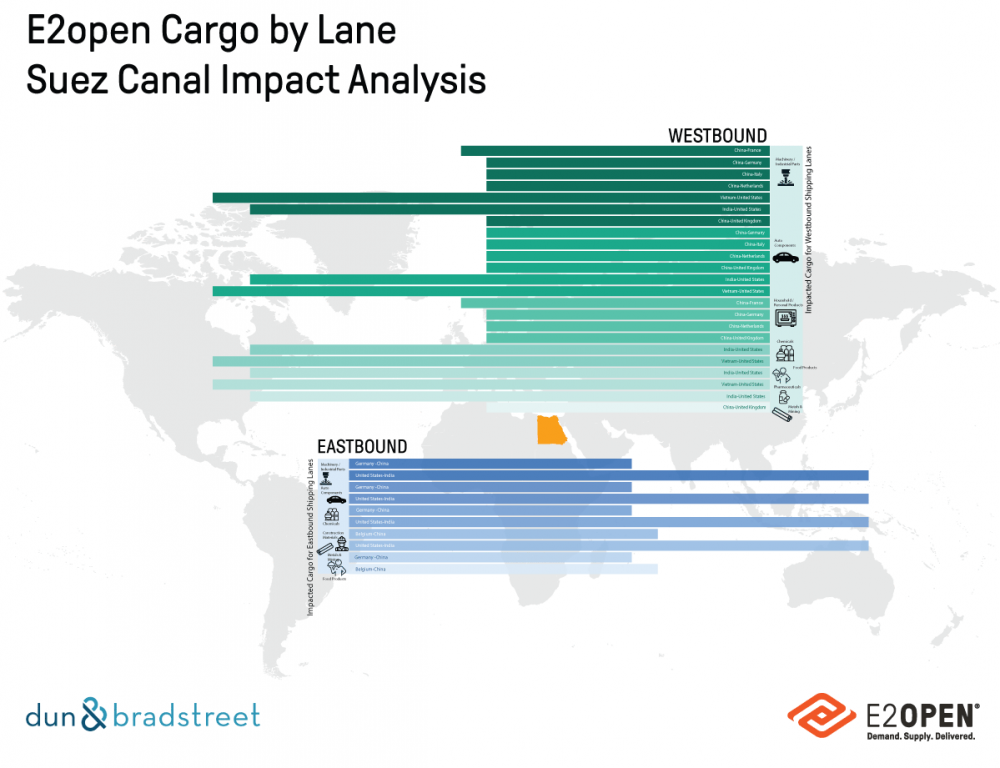

Dun & Bradstreet’s and E2open’s team of data and analytics experts, joined together to provide insights on the impact of this incident on global supply chains, focusing on the global business impact that this blockage will cause industries and countries long-term. Using proprietary supply chain and shipping data, the team found that Europe is the region that will feel the strongest impact due to the blockage of the canal. Companies located in Asia will be impacted not only by the delay of shipments from Europe, but also by a shortage of empty containers returning to their region - further stalling their abilities to deliver goods around the world.

Based on annual shipping data that tracks the vessels and materials found onboard that travel through the Suez Canal, Dun & Bradstreet data and analytics experts found:

In Europe:

- The top countries most impacted by the Suez Canal blockage include: the United Kingdom, Germany, Belgium, France, Netherlands, Italy, Switzerland, Spain, Turkey and Austria.

- The top 10 materials found in shipments thr ough the Canal to Eur ope include: V ehicle parts and accessories, garments, electrical and photosensitive materials, wheeled toys such as tricycles and scooters, copper, machines and mechanical appliances, plastics, pharmaceutical goods, wine, plastics.

- The top industries that will be most impacted by this incident include: Eating and drinking establishments, construction, wholesale trade, chemicals and allied product-related businesses, health services, food retailers, industrial and commercial machinery and equipment, metal production and automotive repair services.

In the United States:

- The top 10 materials found on shipments through the Canal to the U.S. include: Kitchen and bathroom linens, electrical and photosensitive materials, construction materials such as floor, wall and ceiling polymers, vehicle parts and accessories, wheeled toys such as tricycles and scooters, furniture, plastics, athletic equipment, rubber and pharmaceutical materials.

- The top 10 industries most impacted by this incident include: Grocery stores, department stores, auto and home supply stores, hardware stores, surgical and medical equipment suppliers, plumbing, heating and air-conditioning, semiconductor, general warehousing and storage, trucking and sporting goods.