This price index is based on the export prices recorded by the Port of Valencia, a benchmark in the world of the Mediterranean Sea container due to its volume.

In August, the VCFI stood at 4,919.77 points, accumulating an increase of 391.98% since the beginning of the series in 2018.

The Western Mediterranean area shows a decrease of 1.32% compared to the previous month and the Eastern Mediterranean is down by 2.81%, accumulating in the last four consecutive months of decline.

Congestion levels in Xinese ports are falling while they are rising in European port areas and increasing in North American ports.

The Valencia Containerised Freight Index (VCFI) for August is growing steadily in a scenario in which maritime sector activity is marked by the uncertainty linked to the global economic situation and the geopolitical situation. Thus, in August, this price index, which is based on the export prices recorded by the Port of Valencia in 13 geographical areas around the world, stood at 4,919.77 points, which represents a monthly increase of 1.1% and a cumulative growth of 391.98% since the beginning of the series in 2018.

This increase in the value of the index is unevenly distributed in the time frame of the data, as well as in the geographical areas that make up the index. In this sense, while areas such as the Indian Subcontinent and West Coast Africa have increased significantly, by 7.96% and 6.01%, respectively, the nulls of other areas more connected to the major container routes have shown a decline, such as the areas of the East Indies (-2.81%) and Pacific Latin America (-2.55%), among others.

In the face of the uncertainty linked to the war in Ukraine, the increase in inflationary pressures and the tightening of monetary policy in some economies, after months of upward pressure, the energy market has been weakened by fears of recession, which have almost certainly dampened the outlook for demand. There has been a 10.03% drop in the average price of a barrel of Brent crude oil: during August the average price was $100.70 compared to $111.93 in July.

Likewise, maritime fuels have generally fluctuated downwards. According to the data offered by Ship&Bunker, the price of bunkering (supply of fuel for ships at sea) of the 20 main ports of the world, represented by the price of VLSFO (Very Low Sulphur Fuel) has decreased by 9.9%, standing at 823.5$ during the month of August compared to 914.50$ in July.

As for the capacity offered, the Alphaliner data show that the repurchase of the fleet of inactive container ships has increased compared to the previous month, with a total of 57 idle vessels (270,591 TEU) at mid-August, which represents 3.4% of the total fleet.

As far as overall port congestion levels are concerned, the trend has been flat and unchanged during the month of August. The congestion of the ports in the south of China due to typhoons in mid-August decreased at the end of the month. For its part, the increase in congestion in northern Europe in August was linked to the port traffic in the United Kingdom and the low water level on the Rhine. However, North American ports continue to have the most critical congestion, with 38% of world congestion, followed by the ports of North Asia and Northern Europe, with 21% and 15% of world congestion respectively.

From the point of view of demand, according to the RWI/ISL Container Throughput Index estimates for the last available month, there has been a certain stagnation in the volume of port traffic, in line with world trade in goods, which has lost momentum. In this sense, the Xinian ports show a weakening in container traffic activity. Similarly, according to the North Range index, an indicator of economic development in Northern Europe and Germany, a decline has been recorded in these areas.

Regarding the different areas that make up the VCFI, the increase in the area of East Coast Africa (9.87%) stands out due to the floods that have affected the Port of Durban. Increases have also been noted in the areas of Central America and the Caribbean and the USA and Canada. At the same time, there were significant falls in the West Coast Africa (-6.41%), Middle East and Indian Subcontinent.

VCFI Western Mediterranean

Regarding the Western Mediterranean sub-index, a decrease of 1.32% is observed compared to the previous month, standing at 2,455.11 points, and accumulating a growth of 145.51% since the beginning of the series in 2018.

The consequences of the decision taken by the Government of Algeria to suspend the trade agreement signed with Spain two decades ago continue to be felt, giving rise to an important retraction, quite intensified according to the latest data observed, in the trade flows with this country from Valenciaport. Also noteworthy is the fall in traffic to Morocco, while traffic to Tunisia has increased slightly.

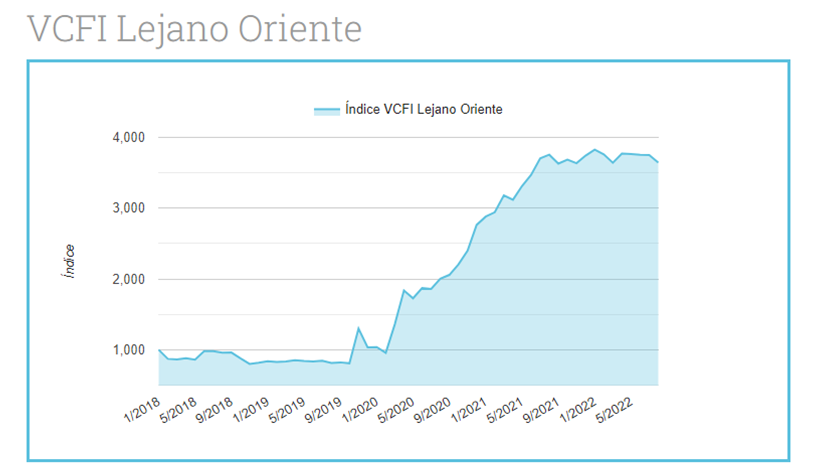

VCFI Far East

As regards the Far East area, a decrease of 2.81% is observed, standing at 3,644.41 points and accumulating a growth of 264.44% with respect to the start of the series in January 2018.

Considering these figures, a decrease in Valenciaport's export flows with China continues to be perceived, in line with the aforementioned trend regarding the contraction in port traffic volumes in the Asian giant. All this is contributing to a progressive and gradual downward pressure on freight price levels.