Container availability index (CAx) values rise, suggesting the surge in containers diverting from Colombo to eastern Indian ports

According to the latest container logistics report titled “Where are all the containers?” released by Container xChange, the world’s leading neutral marketplace for shipping containers and a technology logistics infrastructure company, the trading and leasing prices of containers have decreased by 20% from March to April 2022 in India. This corroborates well with the global trend of declining container prices across China, the US, Europe, the Middle East, Indian Subcontinent, and Asia.

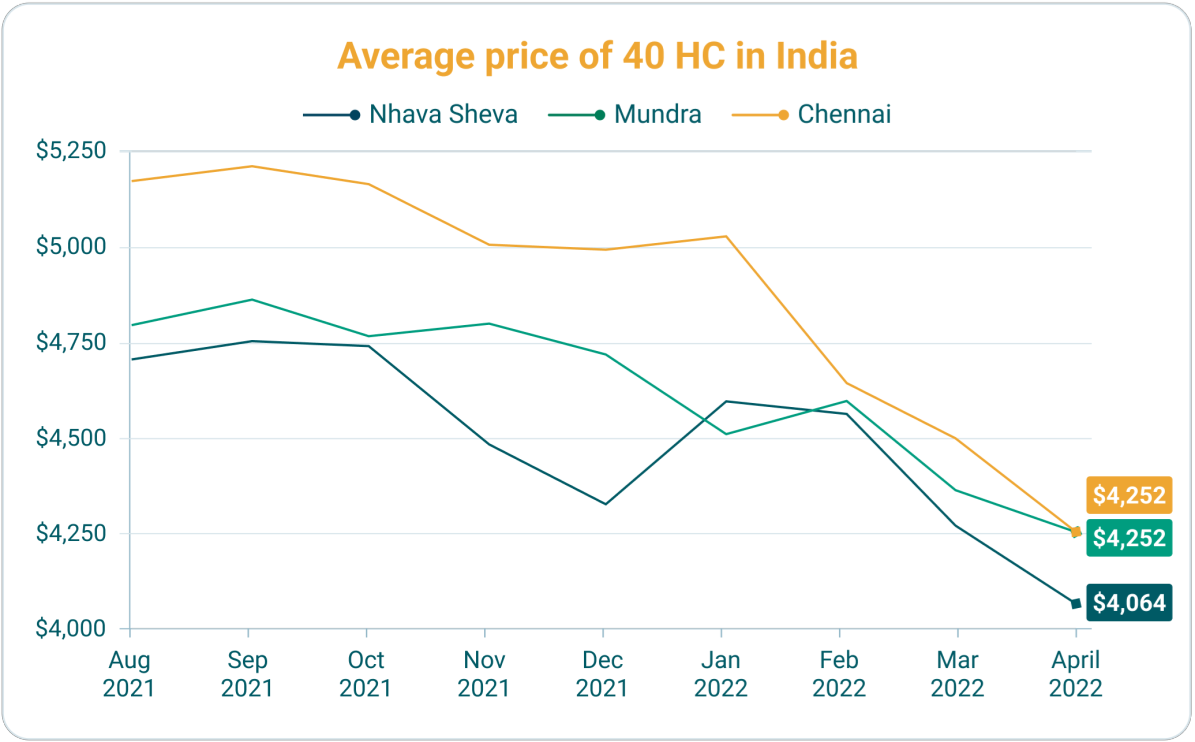

An 18% decline in average container prices has been observed from $4706 (INR 3,64,600) in January to $3909 (INR 3,02,852) on May 1st week at the Nhava Sheva port, whereas Mundra saw a drop of 9% from $4740 (INR 3,67,234) as on 24 February to $4269 (INR 3,30,743) on May 3, and Chennai saw a drop of 18% in prices for 40 ft HC cargo worthy containers.

Mundra, ranking 5th globally, is the costliest port to buy 40 ft HC in India, whereas Chennai ranks 9, and Nhava Sheva ranks 11.

On explaining why these prices were declining, Christian Roeloffs, cofounder and CEO, Container xChange commented, “The ever-increasing disruptions have led to increased uncertainties in the supply chain. However, it does seem like we have now reached the peak container turnaround times. The container demand v/s supply has reached near balance levels and that will mean that prices will also taper off a little bit while probably not falling through the floor as is evident in the report. Beyond this, it really depends on the disruptions. Once China resumes operations in full swing, there will be a pent-up demand for containers considering we have peak season coming. This will cause a traffic jam of vessels and the demand for containers will rise causing container prices to shoot up again (in mid-term).”

“In the long run, however, this pent-up demand for containers will eventually ease. Because we hope that the disruptions will end. And then we can expect that there will be a surplus of containers leading to container prices stabilizing or even will fall again.”

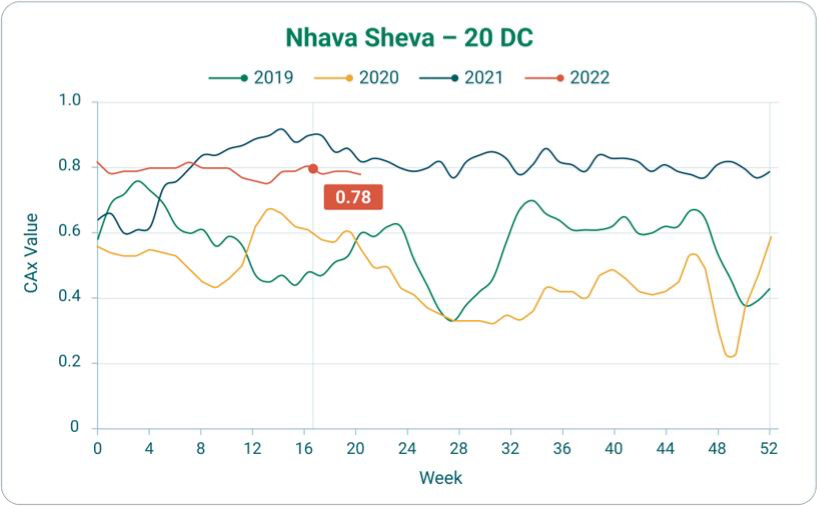

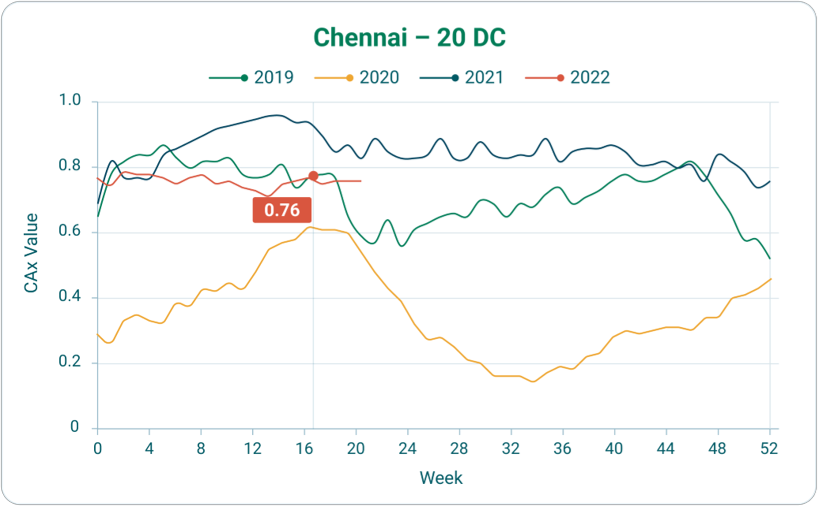

Chennai, just like other eastern ports in India, exhibited a rise in inbound containers as is seen in Container Availability Index (CAx) values rising to 0.77 on week 16, which is expected to be at this level throughout May.

The rise in CAx value is an indication of the increasing accumulation of containers, carriers missing calls, or, a rise in blank sailings while the outbound containers are not being transported at the same rate.