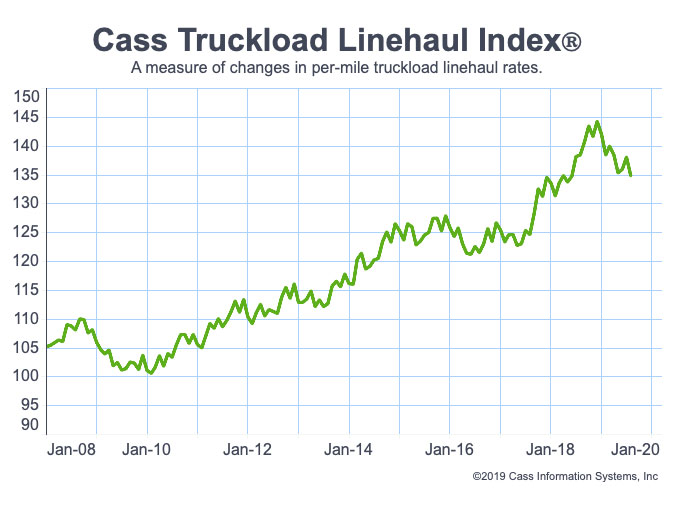

After more than two years of year-over-year increases in truckload linehaul rates, the Cass Truckload Linehaul Index® went negative in August (-2.6%). It also fell 6.9% sequentially.

We see three factors driving the decrease: 1) spot rates that are below contract rates by larger margins than appear sustainable; 2) capacity additions; and 3) a consumer and industrial economy in which growth is stalling (the Cass Freight Index shows year-over-year negative volumes for the last nine months).

Intermodal freight costs inch upwards

Per-mile intermodal costs (including fuel, accessorials, etc.) moved in the opposite direction of TL linehaul rates. The Cass Intermodal Price Index® increased 1.2% YoY and 1.4% sequentially in August. This marks 35 consecutive months of YoY increases. If there’s a positive for shippers, it’s that the rate of increase is decelerating, and the three-month moving average has fallen to only 2.2%, after getting and staying above 10% throughout the latter half of 2018.

With competing truckload rates swinging downward, we predict that intermodal costs will do the same within the next few months.

_-_127500_-_adebdcc0e07d3faa22ffd6c1efa37fb9ec5e645a_yes.png)