U.S. exports of liquefied natural gas (LNG) have been growing steadily and reached a new peak of 4.7 billion cubic feet per day (Bcf/d) in May 2019, according to the latest data published by the U.S. Department of Energy’s Office of Fossil Energy. This year, the United States became the world’s third-largest LNG exporter, averaging 4.2 Bcf/d in the first five months of the year, exceeding Malaysia’s LNG exports of 3.6 Bcf/d during the same period. The United States is expected to remain the third-largest LNG exporter in the world, behind Australia and Qatar, in 2019–20.

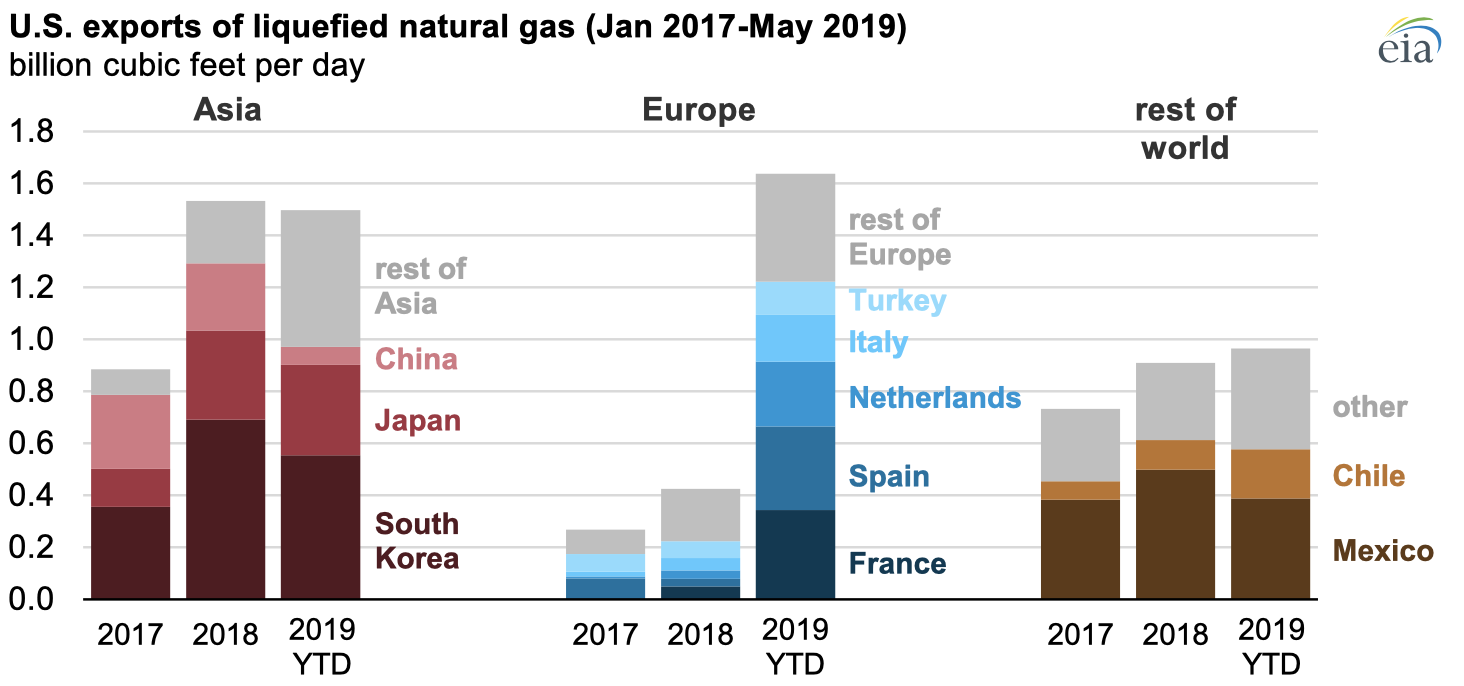

U.S. LNG exports have increased as four new liquefaction units (trains) with a combined capacity of 2.4 Bcf/d—Sabine Pass Train 5, Corpus Christi Trains 1 and 2, and Cameron Train 1—came online since November 2018. Although Asian countries have continued to account for a large share of U.S. LNG exports, shipments to Europe have increased significantly since October 2018 and accounted for almost 40% of U.S. LNG exports in the first five months of 2019. LNG exports to Europe surpassed exports to Asia for the first time in January 2019.

Total LNG imports in the three largest global LNG markets—Japan, China, and South Korea—started to decrease in February 2019 amid a milder-than-normal winter and, in Japan, the restart of nuclear power plants. China, which became the world’s second-largest LNG importer in 2017 (surpassing South Korea) and the world’s largest importer of total natural gas in 2018 (surpassing Japan and Germany), continued to increase LNG imports. Its LNG imports were 20% (1.3 Bcf/d) higher in the first five months of 2019 compared with the same period last year as the country continued to expand LNG import capacity and implement coal-to-gas switching policies.

LNG from the United States accounted for 7% of China’s total LNG imports in the first six months of 2018. In September 2018, China imposed a 10% tariff on LNG imports from the United States, and in the months since then (October 2018 through May 2019), U.S. LNG has accounted for 1% of China’s LNG imports. Because no long-term contracts between suppliers of U.S. LNG and Chinese buyers exist, LNG from the United States is supplied to China on a spot basis. Spot LNG shipments are dispatched based on the prevailing global spot LNG and natural gas prices, and the tariff made LNG imports from the United States to China less competitive.

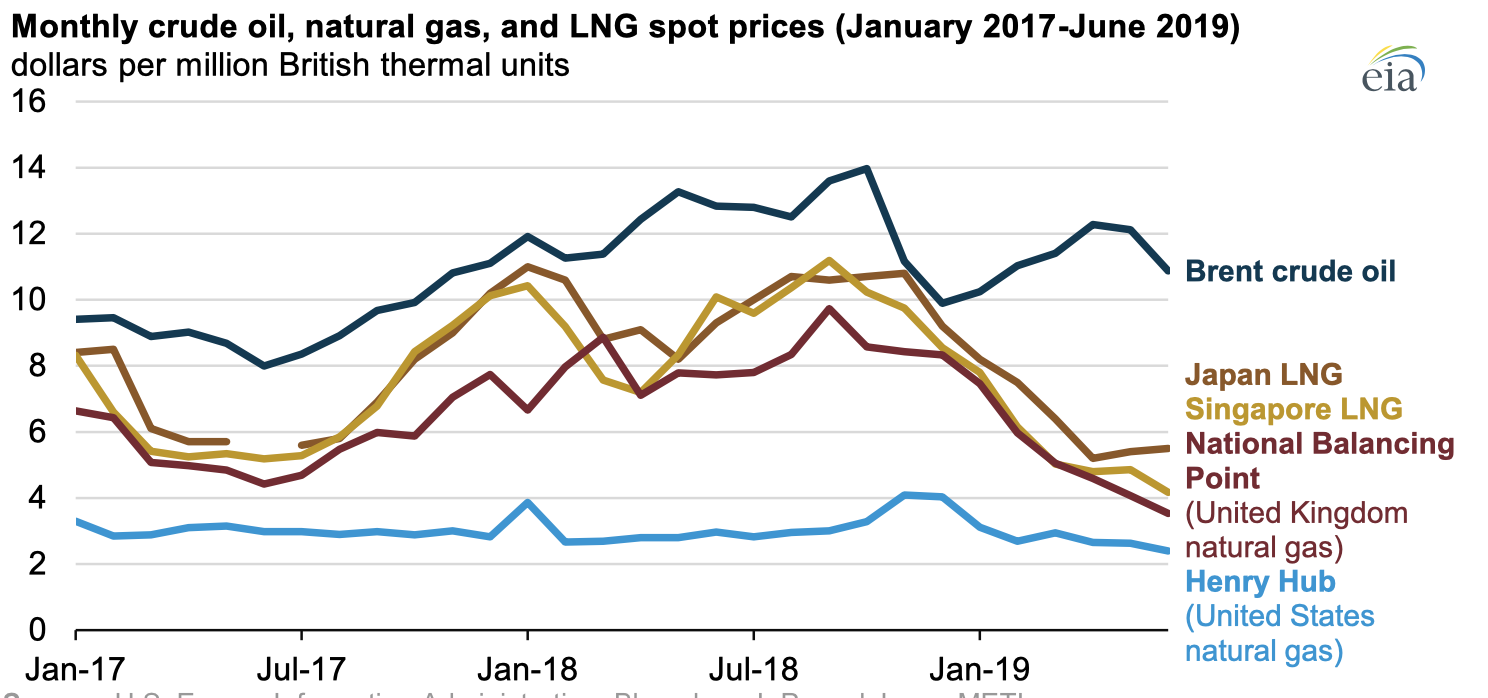

Recent declines in price differentials between European pricing benchmarks (including National Balancing Point (NBP) in the United Kingdom and Title Transfer Facility (TTF) in the Netherlands) and Asian spot LNG prices (including Japan LNG spot prices) have affected the flow of flexible (i.e., without a fixed destination specified in an offtake LNG contract) U.S. LNG exports.

Because the round-trip transportation costs from the U.S. Gulf Coast to Europe are about $1.50 per million British thermal units (MMBtu) lower than those to Asian markets, a sufficiently narrow price spread between European and Asian spot natural gas/LNG prices will make Europe the preferred destination for exporters of U.S. LNG. The spread between Japan spot LNG and NBP/TTF prices was about $1.00/MMBtu in December 2018 and January 2019, and it reached a low of $0.60/MMBtu in April, which supported continued high U.S. LNG exports to Europe.

The U.S. Energy Information Administration (EIA) expects U.S. LNG exports will continue to increase in 2019 as the first trains at the two new liquefaction facilities (Freeport LNG in Texas and Elba Island LNG in Georgia) come online in the next few months. In its latest Short-Term Energy Outlook, EIA forecasts U.S. LNG exports will average 4.8 Bcf/d in 2019 and 6.9 Bcf/d in 2020 as new liquefaction trains at Cameron, Freeport, and Elba Island are commissioned in the next 18 months.

By 2021, six U.S. liquefaction projects are expected to be fully operational. Another two new U.S. liquefaction projects (Golden Pass in Texas and Calcasieu Pass in Louisiana) that started construction this year are expected to come online by 2025. By that time, EIA projects that the United States will have the world’s largest LNG export capacity, surpassing both Qatar and Australia.

Principal contributor: Victoria Zaretskaya