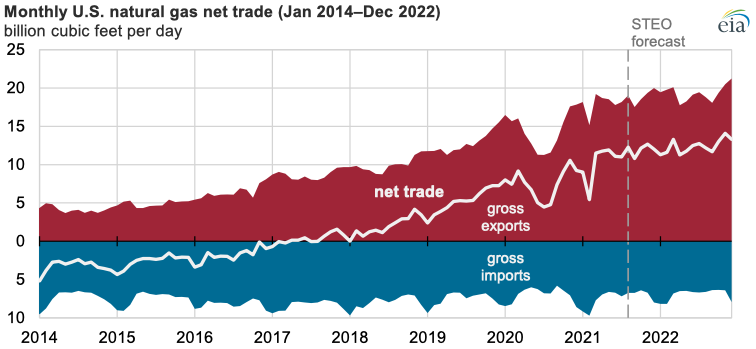

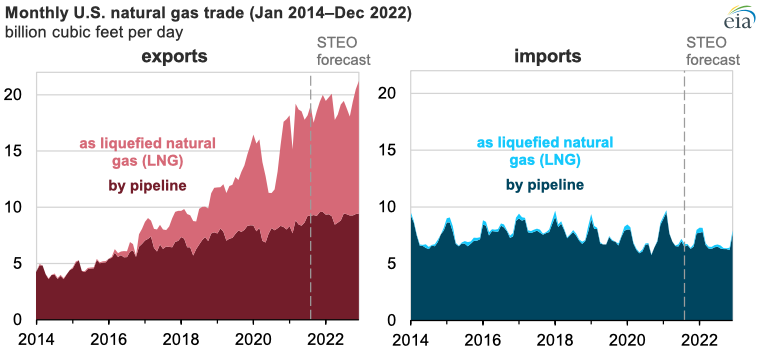

In our August 2021 Short-Term Energy Outlook (STEO), we forecast that U.S. natural gas exports will exceed natural gas imports by an average of 11.0 billion cubic feet per day (Bcf/d) in 2021, or almost 50% more than the 2020 average of 7.5 Bcf/d. Increases in liquefied natural gas (LNG) exports and in pipeline exports to Mexico are driving this growth in U.S. natural gas exports. For the first time since U.S. LNG exports from the Lower 48 states began in 2016, annual LNG exports are expected to outpace pipeline exports—by an estimated 0.6 Bcf/d—this year.

We forecast total U.S. natural gas exports to continue to grow throughout 2021 and 2022, exceeding the record of 14.4 Bcf/d set in 2020. We expect U.S. exports of natural gas by pipeline and as LNG combined to average 18.3 Bcf/d in 2021 and 19.3 Bcf/d in 2022. LNG exports exceeded pipeline exports for the first time on a monthly basis in November 2020, and we expect them to average 9.5 Bcf/d and exceed natural gas imports by pipeline (8.9 Bcf/d) in 2021.

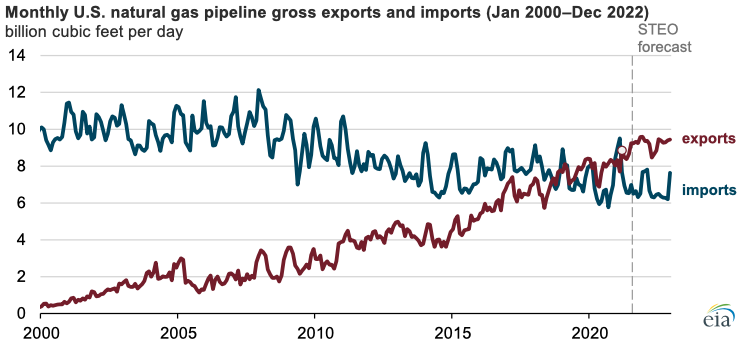

We expect U.S. imports of natural gas by pipeline and as LNG, combined, to increase by 6% compared with 2020, averaging 7.4 Bcf/d in 2021, before declining to 6.9 Bcf/d in 2022. Almost all U.S. natural gas imports enter the United States from Canada into midwestern and western demand markets. U.S. pipeline imports previously had been declining annually since 2008. However, we expect pipeline imports of natural gas to increase in 2021 because of relatively flat U.S. dry natural gas production and slightly higher U.S. natural gas consumption.

Natural gas exports by pipeline—almost all of which are sent to Mexico—began exceeding gross pipeline imports on an annual basis in 2019. In 2020, U.S. pipeline exports exceeded imports by 1.1 Bcf/d, and we expect this difference to increase to 1.7 Bcf/d in 2021 and 2.5 Bcf/d 2022.

Principal contributor: Kristen Tsai