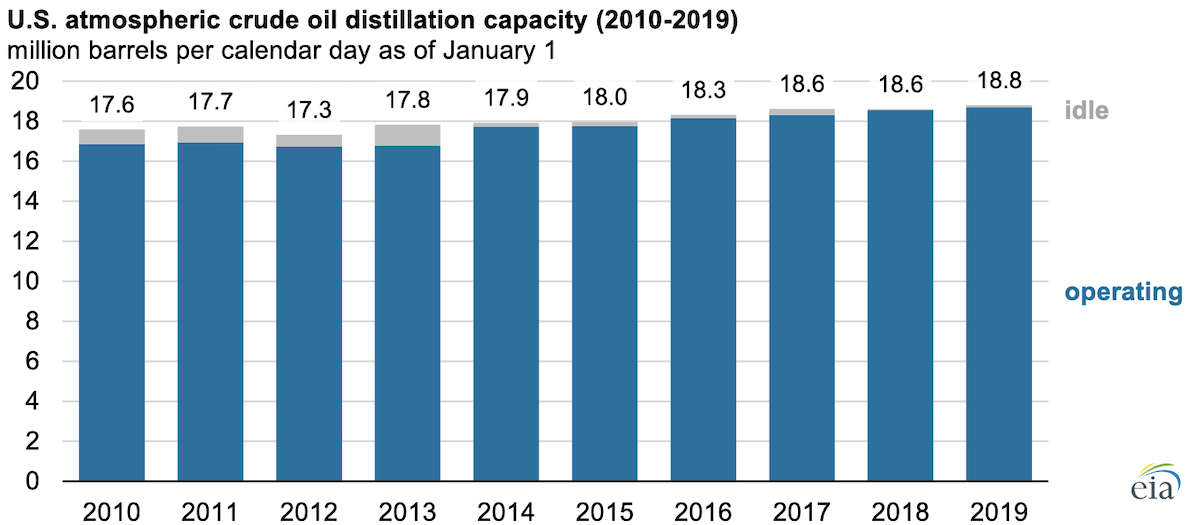

As of January 1, 2019, U.S. operable atmospheric crude oil distillation capacity was a record-high 18.8 million barrels per calendar day (b/cd), an increase of 1.1% since the beginning of 2018, according to EIA’s annual Refinery Capacity Report. The previous high of 18.6 million b/cd was set at the beginning of 1981. U.S. annual operable crude oil distillation unit (CDU) capacity has increased slightly in six of the past seven years. Operable capacity includes both idle and operating capacity.

Refinery capacity is measured in two ways: barrels per calendar day and barrels per stream day. Barrels per calendar day reflect the input that a distillation unit can process in a 24-hour period under usual operating conditions, taking into account both planned and unplanned maintenance.

The number of operable refineries remained at 135 on January 1, 2019; however, similar to last year’s report, four refineries previously considered separate in survey data were merged into two. Tesoro Refining & Marketing’s Carson and Wilmington plants (now owned by Marathon) in California combined operations, and the Par Hawaii and Island Energy Services plants in Kapolei, Hawaii, also merged.

Targa Resources started up a new condensate splitter in Channelview, Texas, in 2019 that was idle at the start of the year but began operating during the first quarter. Suncor Energy split its reporting of the Commerce City East and West plants in Colorado.

Marathon Petroleum Corporation acquired 10 refineries from Andeavor in 2018, making it the largest refiner in the United States. Marathon’s refineries collectively have an operable capacity of slightly more than 3.0 million b/cd, 16% of total U.S. refining capacity and about 800,000 b/cd more capacity than the second-largest refiner, Valero Energy Corporation.

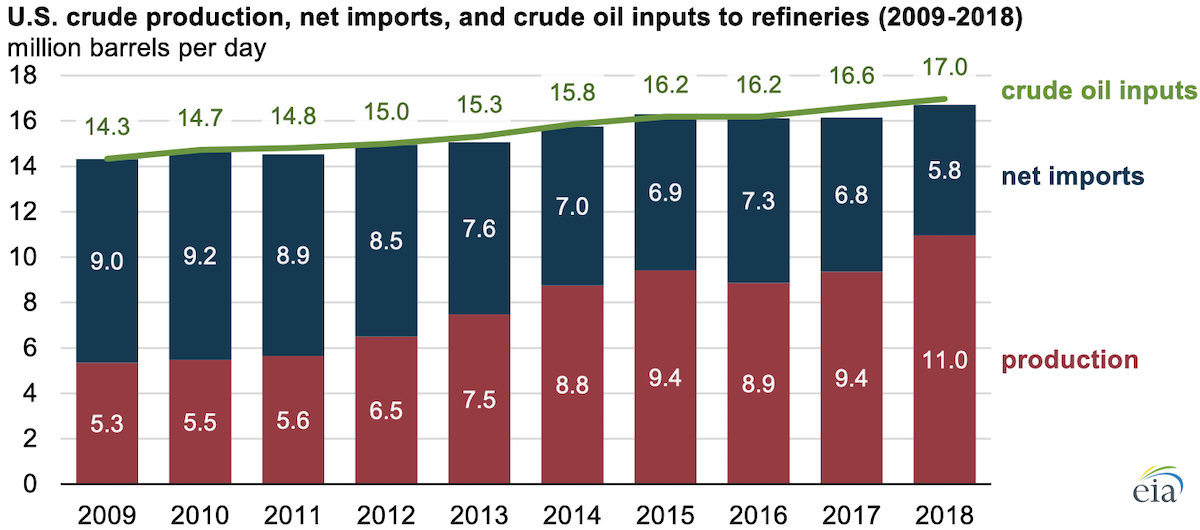

Refinery runs and crude oil production both continued at record levels in the United States in 2018. U.S. crude oil production, which averaged 11.0 million barrels per day (b/d) in 2018, has more than doubled since 2009. Crude oil inputs to refineries averaged 17.0 million b/d in 2018 compared with 14.3 million b/d in 2009.

Since 2009, operable refinery crude oil distillation capacity increased 1.2 million b/cd, and utilization rose from 83% in 2009 to 93% in 2018, resulting in the 2.6 million b/d increase in crude oil inputs. During the same period, U.S. crude oil imports decreased by 1.3 million b/d, and U.S. crude oil exports increased by 2.0 million b/d, leading to an overall decrease in net imports of 3.3 million b/d.

EIA’s Refinery Capacity Report also includes information on capacity expansions planned for 2019. Based on information reported to EIA in the most recent update, U.S. refining capacity will not expand significantly during 2019. A June 21 fire at the 335,000 b/cd capacity Philadelphia Energy Solutions refinery complex, the largest refinery on the East Coast, has resulted in its announced closure.

Further investment in U.S. refinery expansion projects depends on expectations about crude oil price spreads, the characteristics of the crude oils produced, product specifications, and the relative economic advantage of the U.S. refining fleet compared with refineries in the rest of the world.

Principal contributors: Julie Harris, Emily Sandys