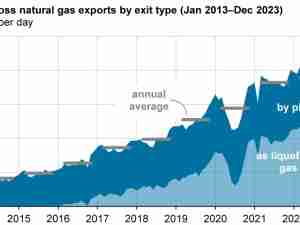

EIA reports U.S. crude stocks fall as imports dip; steep gasoline drawdown

By: Reuters | Aug 06 2014 at 11:06 AM

U.S. crude stocks fell last week as imports dipped, while lower refinery output contributed to a surprise sharp drop in gasoline and distillate inventories, data from the Energy Information Administration showed on Wednesday.

Crude inventories fell 1.8 million barrels in the week to Aug. 1, compared with analysts’ expectations for a decrease of 1.7 million barrels.

Crude stocks at the Cushing, Oklahoma, delivery hub rose 83,000 barrels and U.S. crude imports fell 181,000 barrels per day, the EIA said.

Gasoline stocks fell 4.4 million barrels, confounding analysts’ expectations in a Reuters poll for a 300,000-barrel gain.

Distillate stockpiles, which include diesel and heating oil, fell 1.8 million barrels, versus expectations for a 900,000-barrel increase.

Refinery crude runs fell 158,000 bpd or 1.1 percentage points to 92.4 percent of total capacity.

“The drawdowns in gasoline and distillate fuels are impressive and the further drawdown in crude oil inventories should combine to support the complex,” said John Kilduff, partner at Again Capital LLC in New York.

Oil prices briefly extended after the data, with U.S. crude climbing above $98 a barrel and Brent reaching an intraday high of $105.44 a barrel before retreating.

By 10:54 a.m. (1454 GMT), U.S. crude was up 50 cents at $97.88 and Brent up 65 cents at $105.26.

_A_-_28de80_-_38f408a0a1c601cdbf9fe70c9d30a28084a5da3d_lqip.jpg)