Secretary of Commerce Gina Raimondo had a sobering message for US makers of chipmaking equipment this week: you’ll need to wait as long as nine months before Washington can reach an accord with US allies over strict new rules aimed at restricting China’s access to certain technologies.

The US is working on an agreement that would make companies in the Netherlands and Japan -- home to some of the biggest makers of chipmaking gear -- subject to limits on sales of such equipment to China. US companies are already bound by the export controls, which they say will cost them billions of dollars in revenue even as their main competitors in Europe and Japan face fewer limits on China sales.

Washington announced a new round of export control rules on Oct. 7 to limit China’s access to advanced chips and semiconductor-manufacturing equipment made with US technologies. Raimondo made the comments when she met representatives from equipment makers including Lam Research Corp. and KLA Corp., on Wednesday, said the people, who requested anonymity discussing a non-public interchange.

A spokeswoman for the US Department of Commerce declined to comment. Representatives of Lam Research and KLA did not immediately respond to requests for comments.

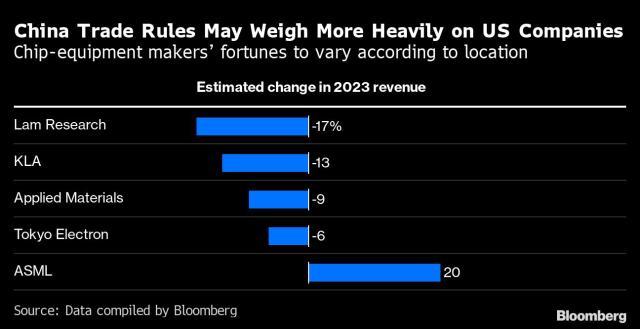

The global chip-production equipment market is dominated by US companies Lam, KLA, Applied Materials Inc., as well as ASML Holding NV in the Netherlands and Japan’s Tokyo Electron Ltd. Currently, the non-US suppliers have more latitude in doing business with China. For the US triumvirate, restrictions on what their overseas competitors can ship to China can’t come fast enough.

Applied Materials, Lam Research and KLA have warned investors that the new export control measures will cut into their revenue. The risk for them is that -- until the restrictions apply in a more even-handed way -- foreign peers will win market share in China, generating added revenue that in turn can be plowed into developing new products.

“I think there’s definitely a sense of disappointment that allies were not on board with this rule when it rolled out but a sense of urgency that they come on board soon to try and ensure that US companies don’t bleed out market share to their foreign competitors,” Jimmy Goodrich, vice president of global policy for the Semiconductor Industry Association, said in an online discussion hosted by the Washington International Trade Association.

“That doesn’t help the US government achieve the objective, it harms US industry, but more importantly it does not address the national security goals, because those entities of which the US government has concern over in China are still able to access that technology the US government does not want them to obtain,” Goodrich said.

“So on the multilateral front, that is a significant area where the private sector is watching that very closely for future developments,” he said.

While the overall market for chipmaking gear will shrink next year, according to estimates, analysts project that the three American companies will suffer steeper revenue declines than their Japanese counterpart.

Washington is now preparing to amp up pressure on allies to block chip gear sales to China. Senior US National Security Council official Tarun Chhabra and Under Secretary of Commerce for Industry and Security Alan Estevez are slated to travel to the Netherlands for discussions on China-chip curbs later this month, Bloomberg News has reported, although no deal is expected to come out of the talks.

Estevez said last week that he expects a deal with allies to be reached in the near term. He said he wants rules for American companies to be “fair with their competition across the globe, and it’s fair for their competition with each other,” adding that he and other officials such as National Security Advisor Jake Sullivan and Raimondo are talking to allies about the issue.