US farmers facing supply-chain bottlenecks and a surging dollar are losing their competitive edge in the global market for soybeans to their biggest rival: Brazil.

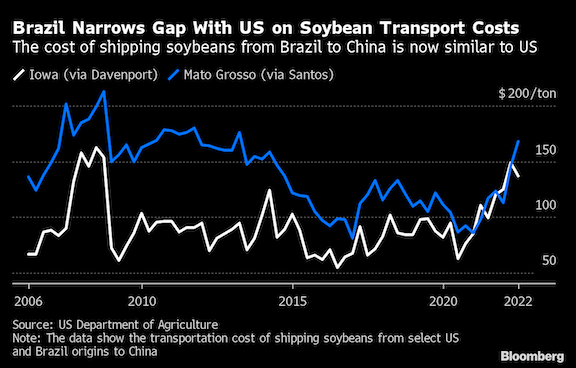

In many of the years through 2020, it was about twice as expensive for China -- the top importer -- to ship Brazilian rather than American soybeans. But logistics issues in the US, upgrades of the South American country’s ports and supply infrastructure, and a strong dollar have almost eliminated that gap, US Department of Agriculture data show.

While the US -- which vies with Brazil as the world’s biggest soybean producer -- races to remedy pandemic-era transport backlogs and kicks off a multi-billion-dollar plan to upgrade cranky infrastructure, Brazil is already starting to reap the fruits of more than 290 billion reais ($56.1 billion) the federal government has invested in roads and maritime gateways since 2008.

“Nothing stimulates more than competition -- and this is a fierce competition,” said Mike Steenhoek, the executive director for the Soy Transportation Coalition. “When you see that kind of improvement in other places, we need to increase investments in our country.”

Time is of the essence for the US, which lost about $10 billion in agricultural exports because of the pandemic-era supply-chain disruptions, according to an April paper by University of California at Davis professor Colin Carter, together with University of Connecticut assistant professor Sandro Steinbach, and doctoral student Xiting Zhuang.

Brazil, meanwhile, is seeing dividends from its investment -- the revamp of the so-called Northern Arc of ports along the Amazon River and northeastern Atlantic Ocean coast has slashed two days and 1,000 miles off the time and distance taken to get crops from midwestern farms to a ship -- about half of what it was before.

Over the last decade, corn and soy exports via the Northern Arc have surged almost sixfold, according to the National Confederation of Agriculture and Livestock.

Down south at Brazil’s busiest port -- Santos -- authorities are investing hundreds of million of dollars to upgrade total capacity by about half to 240 million tons annually in 2040, while the total amount of cargo moved by train will almost double to 86 million tons per year, said Bruno Stupello, the business development director at the gateway.

For Brazil to stay competitive, it will require that infrastructure grows more than production for the next few years, said Thiago Pera, an agricultural logistics specialist at the University of Sao Paulo.

That “will be a challenge given the production estimates for the upcoming years,” he said, referring to the record harvest predicted by the USDA for the 2023 season.

To be sure, the US federal infrastructure package passed in 2021 has promised big logistics investments, including $17 billion for ports and tens of billions more for rail and roads. At the same time, the country’s maritime hubs and their tenants plan to invest almost $33 billion annually by 2025.

While the US has supply-chain snarls to tackle, it remains an easier place to move products to ports relative to Brazil, Steenhoek of the Soy Transportation Coalition said.

And even with all the investment, only time will tell if Brazil will establish itself as a cheaper option, said Joana Colussi, an agricultural researcher at the University of Illinois in Urbana-Champaign.

“Despite recent advances, logistical challenges are likely to persist in Brazil in the coming years because of infrastructure deficits,” she said.

Although the investments have helped raise Brazil’s competitiveness, the weakness of the local currency relative to the dollar has also provided a boost.

The real has depreciated about 18% since the start of 2020 against the dollar, the biggest decline among 16 major currencies tracked by Bloomberg except the Japanese yen, which has slumped 23%.

“Brazil is more competitive for sure, but there is a huge currency effect,” the University of Sao Paulo’s Pera said. “If things stabilize again and the real gets stronger, that edge might be lost, so it is fundamental to keep improving our infrastructure with big projects.”

Ultimately, importers can be pickier in this situation, said Peter Friedmann, executive director of the Washington-based Agriculture Transportation Coalition.

“The hogs in China, they eat the soybeans that we ship over -- they don’t care if those are Brazilian soybeans or Minnesota soybeans,” he said.