U.S. exports of total petroleum products set a record high in 2018, reaching an annual average of 5.6 million barrels per day (b/d), an increase of 366,000 b/d from 2017 levels. The three largest petroleum product exports from the United States in 2018 were distillate, propane, and motor gasoline. U.S. exports of motor gasoline (including blending components) and propane reached record highs in 2018, and exports of distillate reached their second-highest volume on record, following the high set in 2017.

Total U.S. petroleum product exports set a record high in 2018 for the 16th consecutive year. From 2009 to 2013, distillate exports contributed the most to annual growth. However, from 2014 to 2018, exports of hydrocarbon gas liquids, which include propane, drove U.S. petroleum product export growth.

As U.S. crude oil production increased over the past decade, gross inputs into refineries also increased. Petroleum products can be used domestically, exported, or put into inventory. In 2018, record-high levels of U.S. crude oil production and refinery runs helped refiners export large volumes of petroleum products, even with high levels of domestic demand.

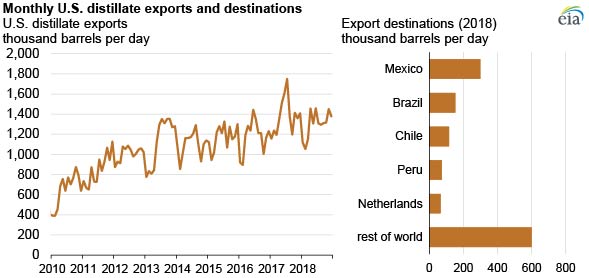

Mexico received an average of 298,000 b/d, or 23% of U.S. distillate exports, increasing 42,000 b/d from 2017. Mexico’s increasing exports were likely driven by the country’s refineries that continued to operate below capacity in 2018, as reported by trade press. Brazil received the second-largest share of distillate exported from the United States, averaging 151,000 b/d (12% of U.S. distillate exports), down by 57,000 b/d from 2017. Chile, Peru, and the Netherlands comprise the remainder of the top five recipients of U.S. distillate exports.

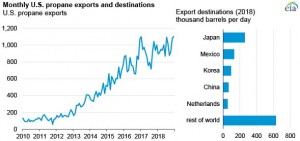

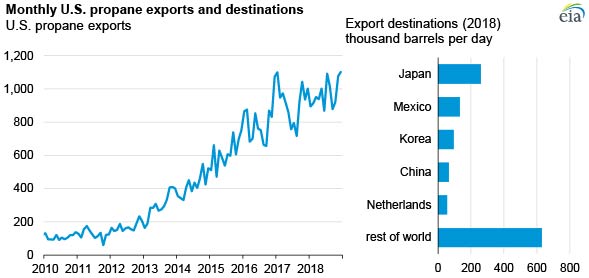

U.S. propane exports reached a record high of 972,000 b/d in 2018, surpassing the previous record of 914,000 b/d set in 2017. Propane exports in 2018 were greater than motor gasoline exports for the third consecutive year, and propane remained the second-largest U.S. petroleum product export. Unlike other U.S. petroleum product exports, which tend to stay in the Western Hemisphere, significant volumes of U.S. propane often reach Asian markets. Three of the top five destinations are in Asia. Propane is used in many Asian countries as a feedstock for producing ethylene and propylene, which are building blocks for chemical and plastic manufacturing.

Japan received the largest share of U.S. propane exports, more than 258,000 b/d (or 7%) of total U.S. propane exports, an increase of 48,000 b/d from 2017 volumes. Exports to Korea and the Netherlands increased by 25,000 b/d and 21,000 b/d, respectively. However, exports to China fell by 62,000 b/d, a 49% year-over-year decline. Mexico received the second-largest share of U.S. propane exports in 2018 at an average of 131,000 b/d, which was down 7,000 b/d from 2017 levels.

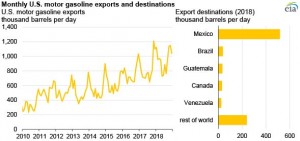

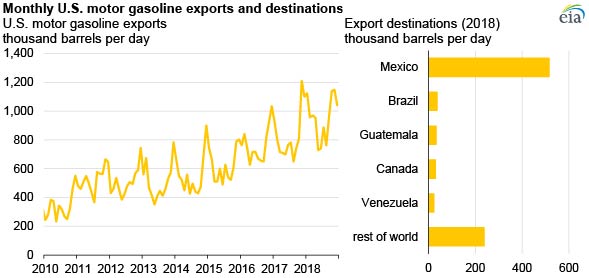

U.S. exports of motor gasoline (including blending components) reached 44 destinations in 2018 and set a record high of 951,000 b/d, up 126,000 b/d from 2017 levels. This increase in exports came despite high levels of domestic gasoline consumption, averaging 9.3 million b/d in 2018, only slightly lower than the record-high level set in 2017.

U.S. refiner and blender net production of finished motor gasoline increased more than 100,000 b/d to 10.1 million b/d in 2018, a record high, and helped contribute to the simultaneous high levels of domestic consumption and export volumes. The five largest shares of U.S. gasoline exports were all in the Americas. In 2018, Mexico received 529,000 b/d of U.S. gasoline exports, or 56% of total U.S. gasoline exports, which was 60,000 b/d more than in 2017. Exports to Canada increased by 25,000 b/d, to average 62,000 b/d, or 6% of U.S. gasoline exports in 2018.