Following a deadlock in OPEC+ negotiations at the July 2021 meeting, oil prices briefly rose above $75 per barrel at the prospect of the alliance keeping output stable from August onwards, with producers in theory honoring their commitment to the original deal until a new way forward is agreed. As global oil demand is set to grow significantly, such a development would lead to a production deficit and Rystad Energy examined whether or not US shale can rise to the occasion and fill the imminent supply gap.

During the busy summer season global demand for oil typically rises, and as countries loosen lockdowns and reopen, the demand push also increases the “call on OPEC+”, or the number of barrels the oil market would require from OPEC+ producers to be at a theoretical perfect equilibrium, meaning inventories neither draw nor build. For August, Rystad Energy forecasts that the global market needs an extra 1.6 million barrels per day (bpd) of supply to be at this theoretical equilibrium.

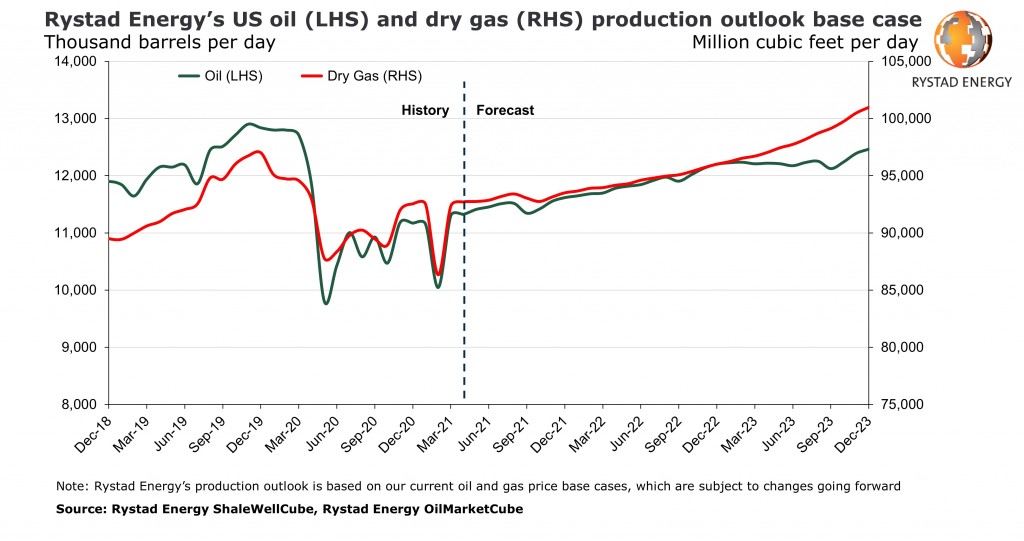

Rystad Energy data show that US crude oil output reached about 11.45 million bpd in June 2021. Despite the bullish conditions, it is only forecast to grow by 60,000 bpd to 11.51 million bpd in July, remaining at the same level in August. A dip is then expected in September and October to 11.34 million bpd and 11.41 million bpd, respectively. A constant, albeit slow growth trajectory will commence in November 2021, when crude output is expected to rise back to 11.55 million bpd, then closing the year with 11.62 million bpd in December. From January 2022 onwards output will continue to rise, breaking the 12 million bpd monthly average only from October that year.

Texas and New Mexico are expected to drive nearly all oil production growth from the second half of 2021 through 2023, while the rest of the country is set to remain in a maintenance mode, producing around 5.3 million bpd to 5.4 million bpd over the coming years.

Despite the continuous growth, US monthly output in 2022-2023 is not expected to match the record 12.9 million bpd achieved in 2019, as WTI prices are not forecast to remain at the current high levels. There is, however, some upside potential if volatility continues, and if the currently robust WTI price environment pushes into next year, our forecast could be subject to revisions.

A lot of 2021 crude output by public producers in the US is hedged at much lower price levels than in the $70s, meaning operators book a financial loss which partly offsets physical gains, ultimately disincentivizing extra production. However, below 40% of the total expected shale oil output in 2021 is hedged, meaning there are many operators that would be highly incentivized by higher WTI prices, especially private producers. For them, there could in theory be some upside to production if the higher prices are perceived as a structural change rather than short-term rebalancing.

Another reason the US supply response is muted is that in 2021 operators are remaining committed to capital discipline and on returning dividends to shareholders after the previous tough year.

Nevertheless, no major supply response is possible for both types of producers before the second quarter of 2022. The industry is still heavily relying on DUCs completion and to see a serious ramp up in fracking volumes operators would first need to increase drilling.

“Even if the US shale industry wanted to produce more, the time required from a price signal to a significant production impact is at least nine months, including the time it takes to make an investment decision, the months needed from spud to frac end, plus the last stage from frac end to peak production,” says Artem Abramov, head of Shale Research at Rystad Energy.

Natural gas and NGLs

On gas production, we are still calling for a gradual recovery towards the pre-Covid-19 peak, with nationwide dry gas output surpassing 96 billion cubic feet per day (Bcfd) by the end of 2022. We anticipate most growth in the second half of 2021 and 2022 will be driven by the Permian and Haynesville regions, while Appalachia has the potential to grow from 33-34 Bcfd towards 35 Bcfd in 2023, conditional on takeaway capacity expansion.

In 2021-2023, our current base case outlook suggests that associated gas from the Permian, Eagle Ford, Williston and Rockies will outperform the growth from the core gas regions Appalachia and Haynesville. Gas production from core oil regions is expected to account for 32.2% of the nation’s dry gas output in December 2023, up from 30.3% in December 2020. In turn, the contribution of the core gas regions to the nation’s total will increase from 49.0% to 50.2% in the same period.

When it comes to natural gas liquids (NGLs), Rystad Energy data show supply from wells located in the US rose to a new high of 5.62 million bpd in April 2021. The previous record of 5.54 million bpd was set in July 2020.