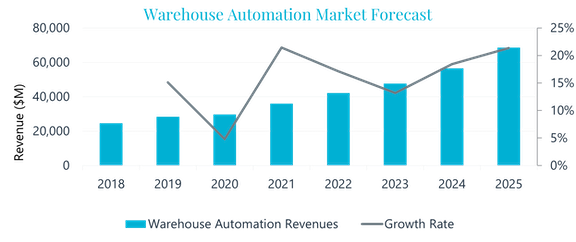

New research from Interact Analysis shows that the global warehouse automation market will grow from $29.6bn in 2020 to $69bn in 2025. The information has been released in the latest edition of the company’s global warehouse automation report.

Fixed automation such as AS/RS, conveyors and conveyor-based sorters will remain the most common form of automation for the foreseeable future, but there is a rapidly growing trend for warehouses to adopt more flexible mobile automation solutions.

Dematic and Honeywell Intelligrated continue to retain the greatest market share. Dematic leads the way, with 10% of the market and impressive revenue growth of 31% in 2020 (compared to 14% in 2019). Meanwhile, Honeywell Intelligrated grew by 13% in 2020. Interestingly, Knapp’s order intake grew by 55% in 2020 while their revenues decreased by 1% due to project delays caused by the pandemic.

Driven by China and Japan, APAC retains its title of having the largest market share for warehouse automation with a market size of $11bn in 2020. A significant proportion of growth within the Americas and EMEA markets is predicted to come from the general merchandise and grocery sectors. Interestingly, these sectors are less prominent in APAC, where they together account for 29% of the warehouse automation market (compared to 42% and 45% of EMEA and the Americas respectively).

Rueben Scriven, Senior Analyst at Interact Analysis says, “The general merchandise segment is the single largest segment in warehouse automation, and it is predicted to grow at a faster rate than the overall market, with revenues hitting $20bn by 2025. General merchandise is driven by companies such as JD.com, Amazon and Target, all of which have heavily benefited from the COVID-inspired e-commerce boost. By 2025, general merchandise will account for 28% of the market. However, the single fastest growing vertical market is grocery, which is projected to grow from 12% of the market in 2020 to 16% in 2025.”