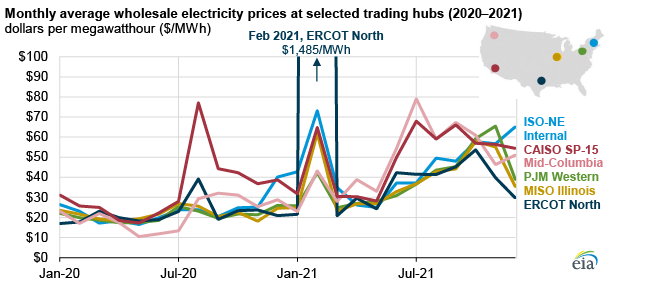

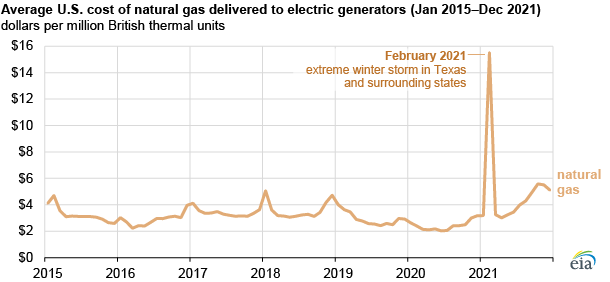

Average wholesale prices for electricity at major trading hubs in the United States were higher in 2021 than in 2020 as increasing costs for power generation fuels, especially natural gas, pushed electricity prices higher in the second half of 2021. Constraints on electricity supply as a result of cold weather in the central United States also created price spikes in February 2021.

Wholesale electricity prices were especially volatile last year in the Electric Reliability Council of Texas (ERCOT) market. A major winter storm in February led to significant energy disruptions in Texas. Extreme cold temperatures restricted the flow of natural gas for power generation, and many wind turbines froze. These supply constraints caused large increases in hourly electricity prices in the ERCOT day-ahead market. Between February 14 and February 19, hourly wholesale prices at the ERCOT North trading hub exceeded $6,000 per megawatthour (MWh) 70% of the time. For the month of February, the Texas wholesale electricity price averaged $1,485/MWh.

The cost of natural gas is a significant driver of electricity prices because it often acts as the marginal (highest cost) fuel of generating units that operators dispatch to supply electricity. Natural gas prices have remained relatively low in recent years; the cost of natural gas delivered to electric generators averaged $2.40 per million British thermal units (MMBtu) in 2020. However, natural gas prices trended higher over the last year. The delivered cost of natural gas to electricity generators grew from $3.19/MMBtu in January 2021 to an estimated $5.04/MMBtu in the fourth quarter of 2021.

Growing fuel costs in 2021 resulted in increased wholesale electricity prices in all regions. Average electricity prices during the second half of 2021 averaged $45/MWh at the Illinois hub in the Midcontinent ISO market (a 97% increase from second half of 2020) and $61/MWh at the SP15 hub in California CAISO market (a 37% increase).

Principal contributor: Tyler Hodge