The Black Sea—a major artery for the movement of commodities at the crossroads of Europe and Asia—is suddenly drawing the world’s attention as the conflict in Ukraine unfolds.

Half a dozen countries touch its shores, though it’s vital to many others beyond, for the trade of energy, steel and agricultural products.

Crude Exports

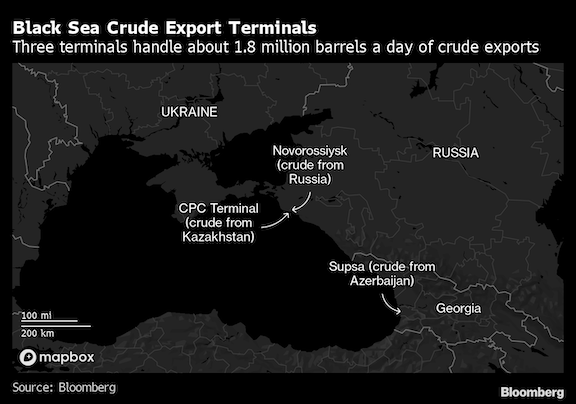

Crude is exported from three major oil terminals along the eastern coast of the Black Sea in Russia and Georgia.

Most of the crude at risk from a break in shipments from these facilities doesn’t originate in Russia, but comes from further afield. Kazakhstan’s exporters have the most to lose from any disruption to tanker traffic in the Black Sea.

The CPC terminal, located just to the north of the Russian port of Novorossiysk, handles about 1.3 million barrels a day of crude delivered by pipeline from Kazakhstan. The table below shows foreign ownership in major Kazakh oil grades shipped through the CPC pipeline:

The Novorossiysk oil terminal handles about 400,000 barrels a day of Russian crude, exported either as Urals or Siberian Light, with Urals accounting for about three-quarters of the total volume.

Supsa, further south in Georgia, is the end point of a pipeline carrying crude from Azerbaijan. The line carried about 31 million barrels, equivalent to 85,000 barrels a day, of crude in 2021, according to BP’s full-year results. But almost 90% of the project’s crude exports are piped to an export terminal on Turkey’s Mediterranean coast.

A small proportion of Azerbaijan’s crude exports, averaging about 1.5 million barrels a month and mostly loaded at Supsa, are shipped to Ukraine. Cargoes are discharged either at Odesa or at Pivdennyi where a pipeline runs across Ukraine to connect with the southern leg of the Druzhba pipeline from Russia.

Crude Imports

Romania and Bulgaria both import crude through terminals on their Black Sea coasts. About 200,000 barrels a day move from east to west across the Black Sea, while additional volumes are imported via the Bosphorus from the Mediterranean.

There is a regular trade in Urals crude from Novorossiysk to the refinery at Burgas in Bulgaria, which also takes occasional cargoes of Siberian Light and CPC Blend crude.

Romania imports a steady stream of both Urals and Siberian Light, as well as intermittent cargoes of CPC. The crude is either processed at the coastal refinery at Midia, or shipped along pipelines to inland plants from Constanta.

Refined Products Exports

Refined oil products are also exported from terminals along the Black Sea’s eastern shore. A pipeline from refineries on the Volga River carries Russian gasoil to Novorossiysk for export. That port also handles exports of fuel oil and naphtha. Further south, Tuapse ships refined products, including cargoes of gasoil, fuel oil, naphtha, vacuum gasoil and marine diesel oil.

Russia also operates a number of smaller oil-product terminals further north, including Taman and Kavkaz, both located close to the Kerch Strait that links the Black Sea to the Sea of Azov. Taman handles fuel oil, vacuum gasoil and LPG cargoes, as well as vegetable oils, grains, fertilizers and sulfur. There are sporadic shipments of refined products from Kavkaz. Several small terminals on the Sea of Azov also ship refined products.

In Georgia, Azerbaijan’s Socar owns a terminal at Kulevi from which it ships a range of refined products including diesel fuel and heavy fuel oils delivered by rail. Refined products are also shipped from Batumi, further south in Georgia.

The coastal refineries in Bulgaria and Romania are also sporadic shippers of refined products.

Agricultural Products

Ukraine and Russia together account for more than a quarter of global wheat exports, nearly a fifth of corn trade and the bulk of sunflower oil. Nearby Romania and Bulgaria have also become increasingly prominent crop shippers. Rich, fertile soils have helped Ukraine become the second-largest grain shipper.

Those products are then sent by truck, rail and barge to ports for shipment to Asia, Africa and the EU.

Ukraine’s southwestern ports of Odesa, Pivdennyi, Mykolayiv and Chornomorsk handle almost 80% of its grain exports, according to researcher UkrAgroConsult.

Shipments are now grinding to a halt, with Ukrainian ports shut and Russian grain deals on pause, according to an export union. Shipping from the Sea of Azov was suspended Thursday, stranding more than 150 vessels. The two countries have about 13.5 million tons of wheat and 16 million tons of corn left to ship this season, consultant SovEcon estimates.

Buyers like Indonesia and Tunisia are already considering alternative origins as far as Uruguay and India, as well as other European countries.

Iron and Steel

Ukraine’s steel makes up about a tenth of Europe’s imports, so any disruption to mills or shipments would tighten the continent’s already strained market and help keep prices high after they reached a record last year.

Key producers in Ukraine include Metinvest BV, which has facilities in the nation’s industrial heartland in the east, including sites by the Dnieper River and two major plants in Mariupol.

European heavyweight ArcelorMittal SA owns Ukraine’s biggest mill, in the central city of Kryvyi Rih. Ferrexpo Plc is the world’s third-biggest maker of iron ore pellets—a high-grade product used in steelmaking—and has all its operations in Ukraine. Seamless pipe maker Interpipe also has a plant in the east.

United Co. Rusal International PJSC runs an alumina plant in Mykolayiv, on the country’s southern coast. It opened in 1980 and has a 1.7 million-ton capacity, according to Rusal’s website.