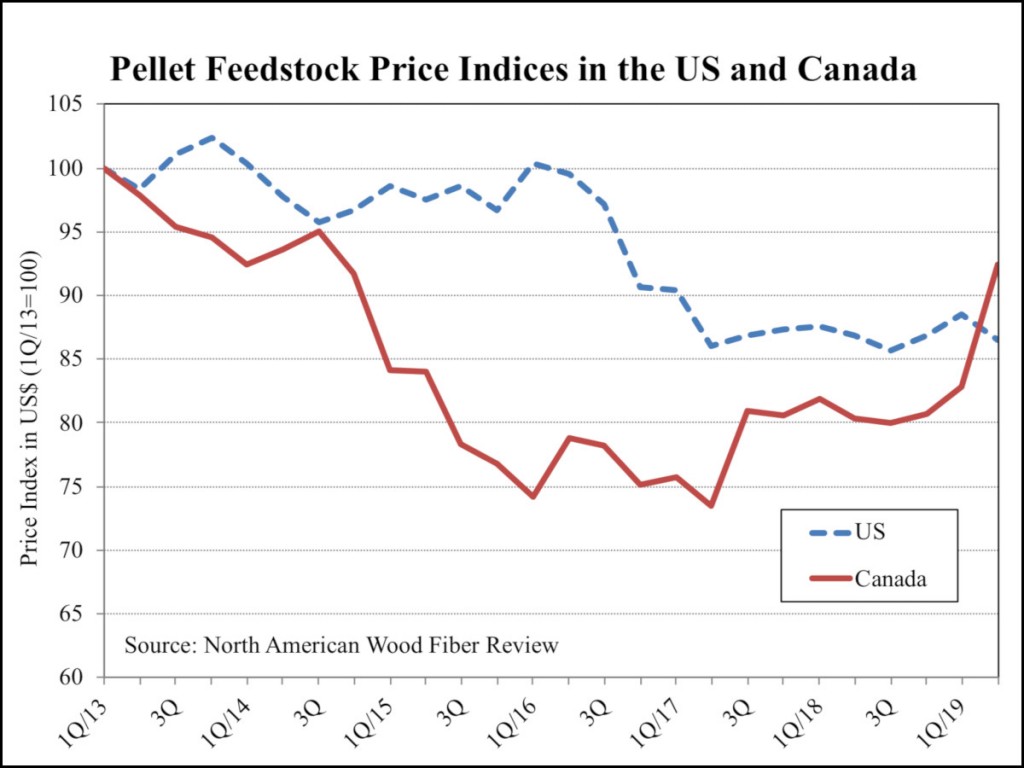

Wood fiber costs for US pellet manufacturers fell in the 2Q/19, while Canadian pellet producers experienced higher costs due to reduced supply of sawmill residues, reports the North American Wood Fiber Review

Many pellet manufacturers in North America have had to increase the usage of logs for their feedstock in 2019 because of reduced availability of lower-cost sawmill residues. This has resulted in higher total wood fiber costs and increases in the pellet feedstock price indices for both Canada and the US in the 1H/19, according to NAWFR.

Over the past five years, pellet producers in the US South have shifted their wood fiber mixes away from costlier logs and towards lower-cost wood chips and sawdust. This has led to a considerable reduction in the total wood fiber costs for the expanding industry sector (see chart).

The Pellet Feedstock Price Index for Canada (PFPI-Can) increased by almost 12% q- o-q in the 2Q/19. The substantial fiber price increases in Canada reflected the continuing change in fiber availability in British Columbia, where most of the Canadian pellet facilities are located. Due to the temporary and permanent closures of sawmills in British Columbia, supplies of sawdust and shavings have diminished. Although the increased volume of fiber from both forest biomass grinding and chipping is making up the difference, this material is significantly costlier than sawmill residuals.

The current higher price for exported pellets is allowing the British Columbia sector to handle the increase in fiber costs for now. However, it is likely that over the remainder of the year, fiber availability will become a concern, with the prospect of a higher PFPI-Can index in the coming winter season.